Jackson Wong

-

21

Posts -

0

Comments

Many good points made by Sheldon and Darren.

Will FTSE 100 hit 10,000? Chances are high – but not 100 percent – that the UK large-cap index will hit that five-digit mark sometime next year.

The more important question, though, is this: Will it stay there?

Chartwise, the index is in a strong position. The upside breakout this year is the first decisive, upward move in decades.

When a financial instrument rallies to new price highs, further gains are likely. This is the well-known “momentum effect” in stock markets. Strength begets strength.

If FTSE 100 ends 2026 in the black, it will the be the sixth annual positive return since 2021. This is quite a remarkable run.

Will we see a pullback below 10K once the Footsie reaches that milestone? That is also a possibility. Profit taking, an economic slowdown, or a crash in the AI bubble in 2026 – are all negative factors that may tank UK stock prices over the next 12 months.

For now, the base case is that FTSE 100 will continue to drift upwards, to new highs, over the medium term. Whether the index can close with another blue candle is harder to say.

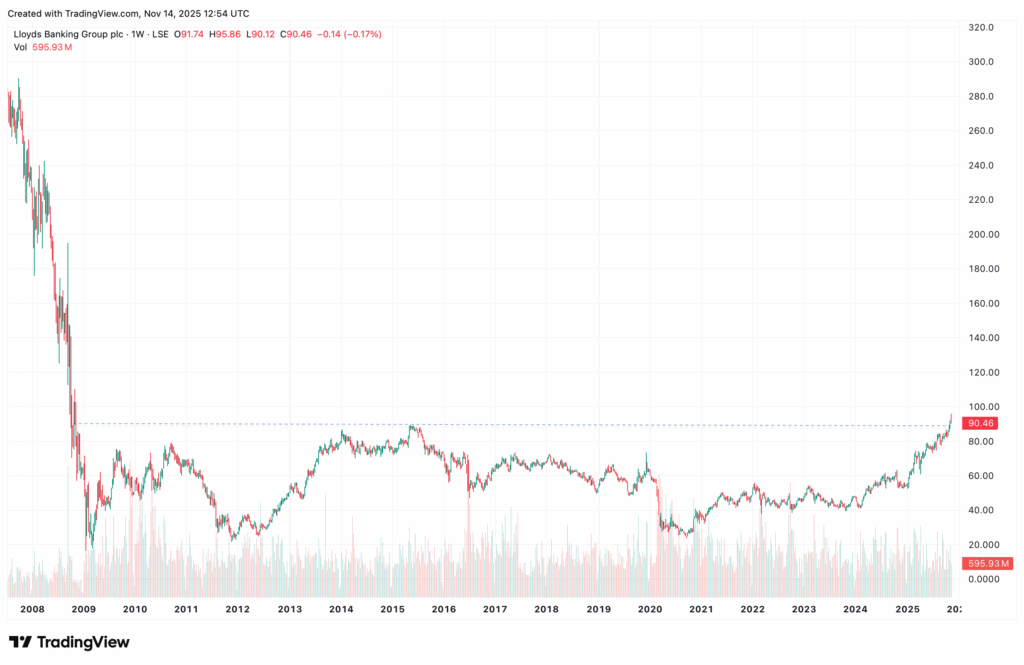

For all practical purposes, Lloyds’ share price has “reached” £1 this year.

A quick glance at its daily share price shows intra-day peaks this week of 96p (95.86p to be exact). Yes, we may not have traded at £1, but that’s close enough – close enough for many profit takers to slam in sell orders on the last trading day of the week (Friday 14 Nov) to lock in some profits. Jittery in the Wall Street is spreading; and risk appetite is waning for many previously red-hot sectors.

Of course, there could be another northerly spurt in the run-up to Christmas. But as we are only a few weeks to that holiday season, time is in short supply.

The next question is: Will Lloyds shares rally above £1 in 2026?

The past year and a half was an excellent period for bank shares. Barclays (BARC) jumped through 400p while NatWest (NWG) also cleared 500p. All three banks are now worth £50 billion or more. So Lloyds’ rally was not only an individual stock rally but an industry-wide advance.

If we take a longer view for Lloyds, it seems that its base pattern is just being explored to the upside. 90p for Lloyds is such a massive ceiling – a ceiling that dates back a decade earlier to 2015. Naturally Lloyds needs to consolidate around this level before making another attempt to trade above the magical £1.