-

-

-

-

Good Money Guide posted an update

2 days, 18 hours agoIn this week’s market analysis, we look at what markets are set to rise and fall as crude oil price volatility increases: https://goodmoneyguide.com/analysis/another-taco-trade/

-

Jackson Wong posted an update

1 week, 1 day agoLloyds slips below 100p; watch to buy/add

Volatility in markets occasionally goes up significantly.

Why? This is because events – be it politically or military – happen unexpectedly. Traders often extrapolate recent market tranquility as the norm. These ‘unprobable’ events were attached with too low a probability. When they hit, the whole mar…[Read more]

-

Darren Sinden posted an update

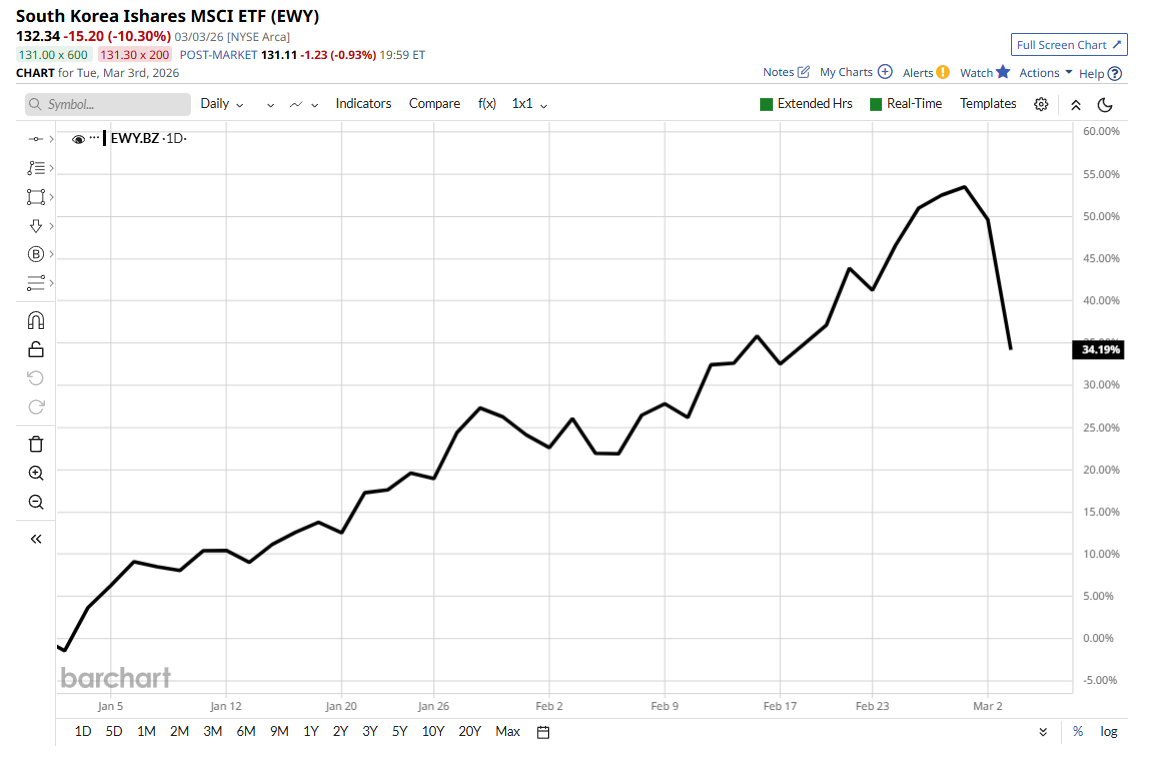

1 week, 1 day agoIf you want some more colour about my decision to change my mind on Korea for the near term at least, you need look no further than these headlines from news aggregators PiQ.

“The KOSPI just had its worst day in its entire 46-year history.

A 12% plunge on Wednesday, following a 7.2% drop on Tuesday, triggered circuit breakers and wiped out h…[Read more]

Reacted by Richard Berry -

-

Darren Sinden posted an update

1 week, 1 day agoJ M Keynes famously said when the facts change I change my opinion. What do you do sir ?

I think we have reached that point regarding Korea, there are just two many variables in the mix right now to justify holding on to an index position here.

The KOSPI/EWY ETF have both made double digit percentage gains in 2026.

It now seems prudent to bank…[Read more] -

Good Money Guide posted an update

1 week, 2 days agoIn this week’s market analysis sponsored by interactive investor, we ask whether investors should be “buying the dip” as war escalates in the Middle East.

-

Darren Sinden posted an update

1 week, 2 days agoUBS upgrades IG Group IGG LN to buy this morning saying that :

“Upgrade to Buy We upgrade IG from Neutral to Buy, and raise our price target from 1250p to 1600p. IG should benefit from market volatility and trading activity, but is also self-helping with

revenue retention initiatives and new products. It is seeing positive momentum in…[Read more]1 CommentReacted by Richard Berry-

Richard Berryreplied 1 week, 2 days ago

Bought some the other day whilst testing out their new JISA. Bullish.

like like

like dislike

dislike

-

-

Jackson Wong posted an update

1 week, 6 days agoMcDonalds share hits fresh highs

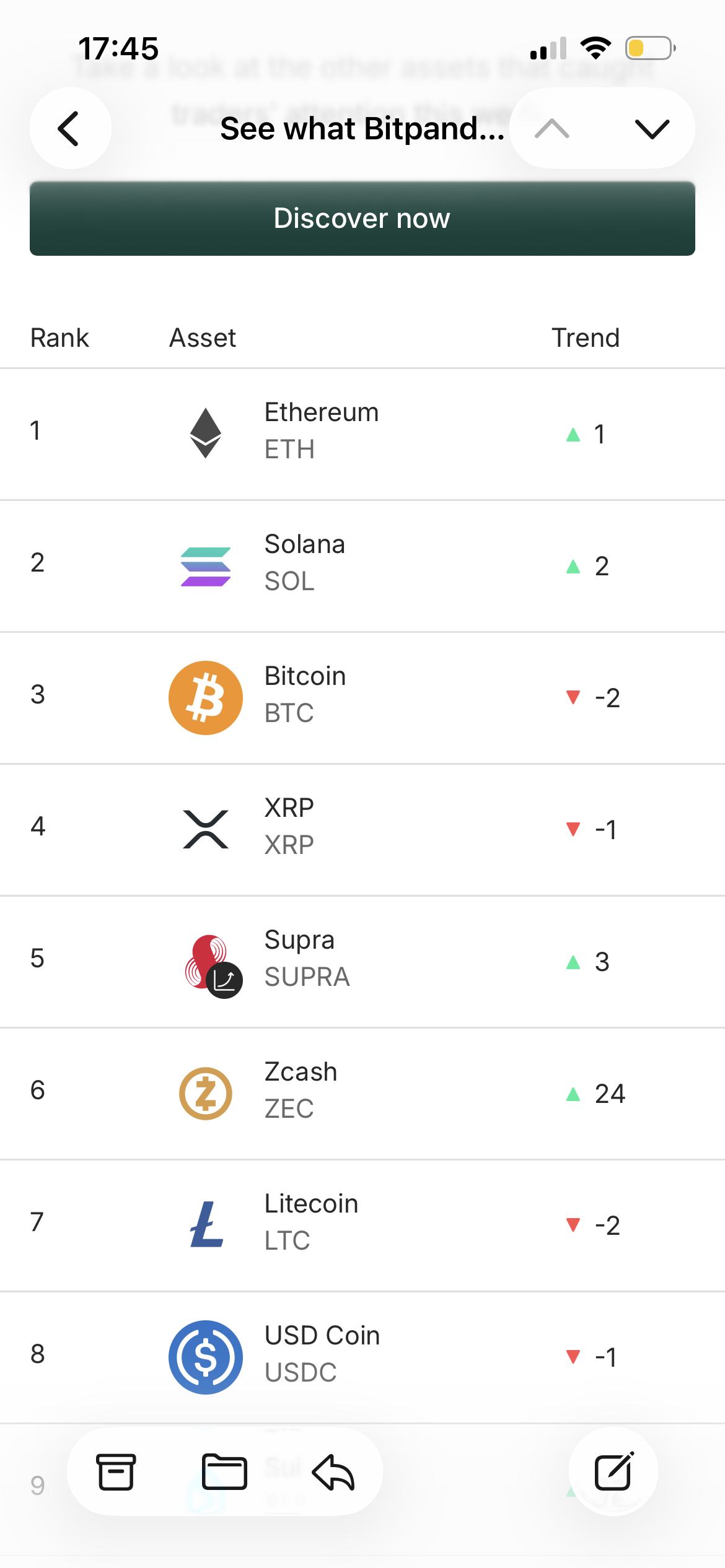

When other assets are not doing well, you can always turn to McDonalds (MCD).

The global fast-food company is positioned in all major cities. McDonald’s food quality and menu are famously standardised. Every Big Mac is the same in all stores; only prices differ (leading to the ‘The Big Mac Index’). In other…[Read more]

1 CommentReacted by Richard Berry-

Richard Berryreplied 1 week, 2 days ago

AI can’t replace the Big Mac!

like like

like dislike

dislike

-

-

Darren Sinden posted an update

2 weeks agoOne of Britain’s leading engineering and aerospace companies is up by 5.70% after reporting earnings and guidance that beat the market’s expectations. It gilded that lily with news of a £2.50 billion share buyback. The company said that based on its new, more bullish outlook, it now expects to hit its mid term guidance targets two years earl…[Read more]

-

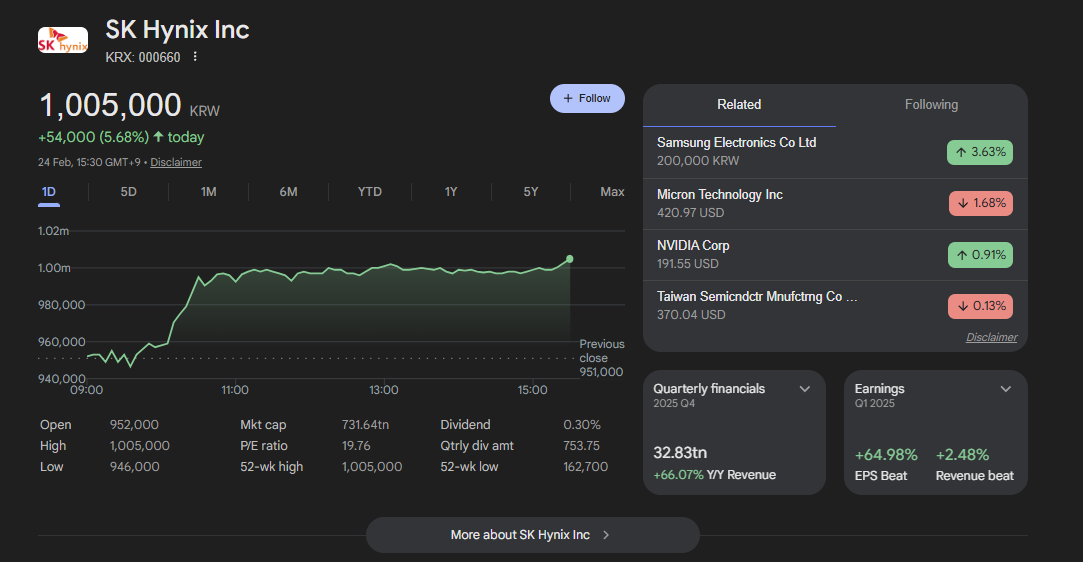

Darren Sinden posted an update

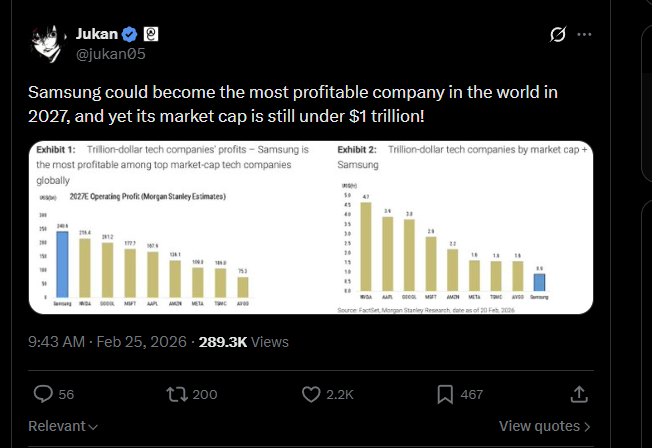

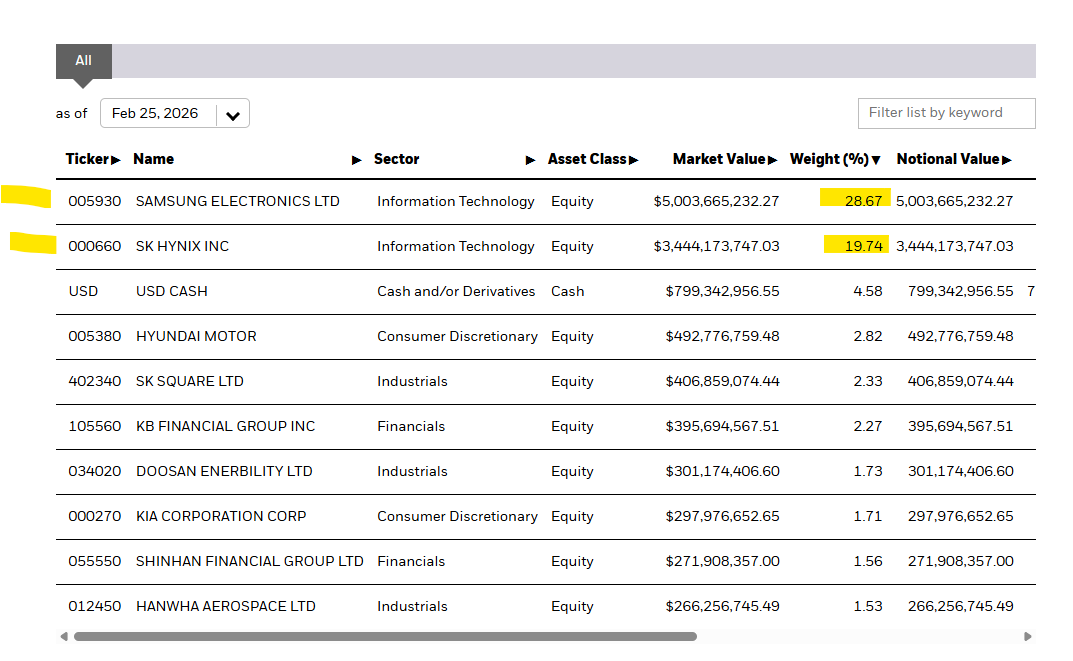

2 weeks agoSomebody asked me why I liked South Korea and have it as my top pick for 2026?

Well there are many reasons but without trying to get overly complicated, this tryptic of images below sets out the case:

Image One highlights the potential profitability of Samsung .

Image Two shows the weightings of Samsung and rival memory chip maker, SK…[Read more]

-

Jackson Wong posted an update

2 weeks agoRolls Royce jumped on excellent results and buybacks

Rolls Royce’s (RR.) growth results today continues to unpin its excellent recovery.

Over the past 5 years, Rolls Royce outperformed almost every other large cap stock in the UK. Prices rallied 20x from its 70p pandemic low. Investors who stayed steadfastly in the aerospace stock had reaped a…[Read more]

-

Jackson Wong posted an update

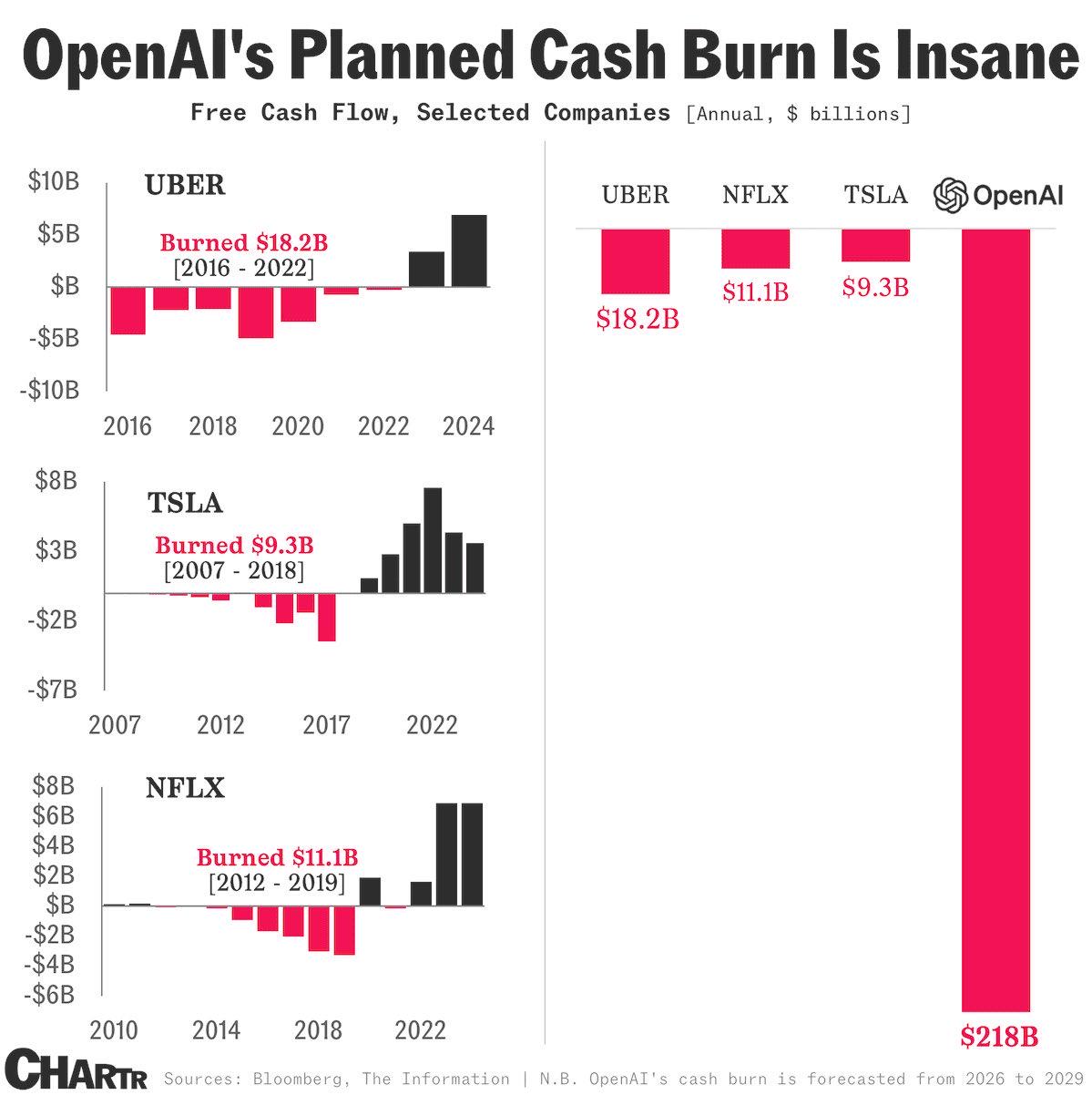

2 weeks, 1 day agoOpenAI’s to invest a record amount

While scouting Reddit’s famous r/WallStreetBets, one chart caught my eye.

That’s the figure comparing OpenAI’s cash burn to other famous platform companies during their growth phase.

Over a period of 36 months, UBER cumulatively sunk more than $18.9 billion while TSLA’s investment totalled almost $10 billion…[Read more]

1 CommentReacted by Darren Sinden-

Darren Sindenreplied 2 weeks, 1 day ago

Musical chairs is fun until the tunes stop, and then everyone scampers for a seat at the same time.

like like

like dislike

dislike

-

-

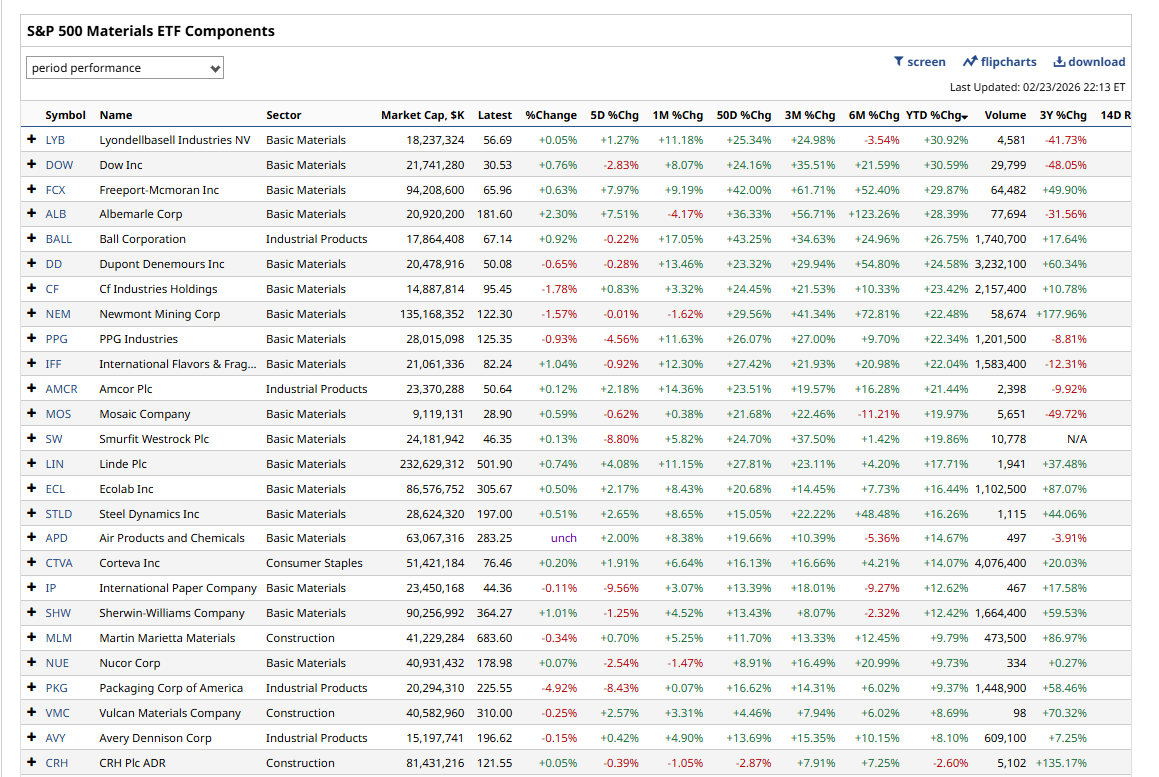

Darren Sinden posted an update

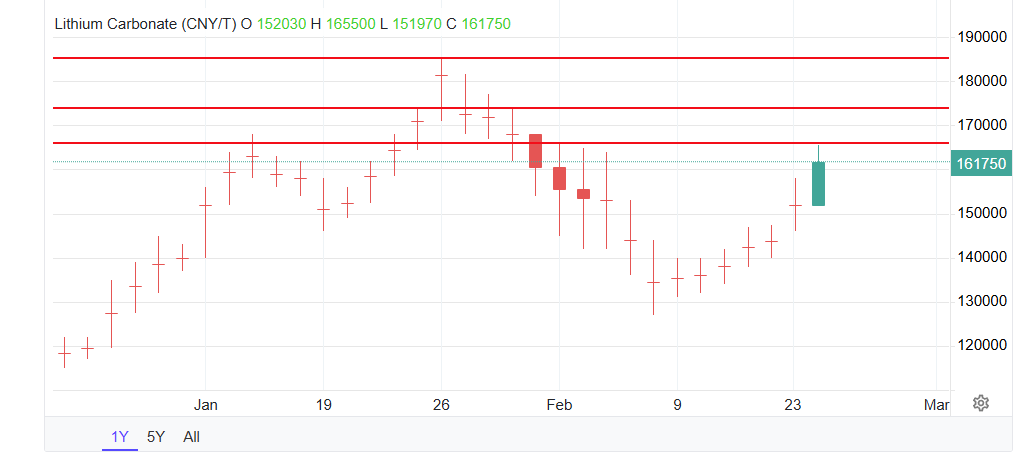

2 weeks, 1 day agoAlbemarle Corp ALB US added +5.24% on the regular session yesterday and are up by another +5.23% in the US pre market this morning.

As lithium prices continue to rally see the charts below .

Albemarle was very much a momentum stock prior to Xmas and into the New Year, and its posted 3 new ,5-day highs in the last week, when its gained…[Read more]

-

Good Money Guide posted an update

2 weeks, 2 days agoIndian IT stocks have enjoyed a multi-year outsourcing bull run.

But AI could disintermediate large parts of the traditional services model.

Are Tata Consultancy Services, Infosys, HCL Tech and Tech Mahindra facing a cyclical dip, or structural disruption?

-

Darren Sinden posted an update

2 weeks, 2 days agoCan’t help but notice that Albemarle ALB US have sprung back to life in the last 24 hours as Lithium prices rally by +5.74% . Both the stock and the commodity are well below recent highs, but the signs of life are encouraging and I am inclined to watch them closely from here.

-

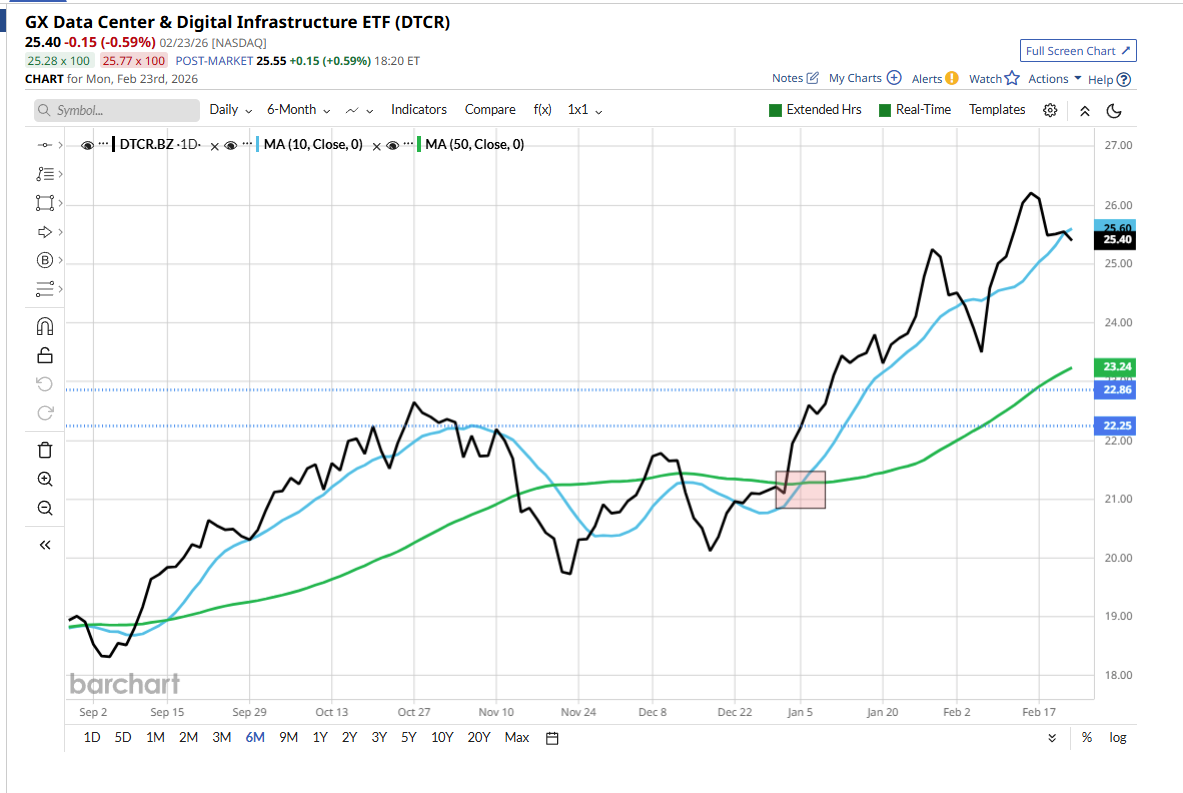

Darren Sinden posted an update

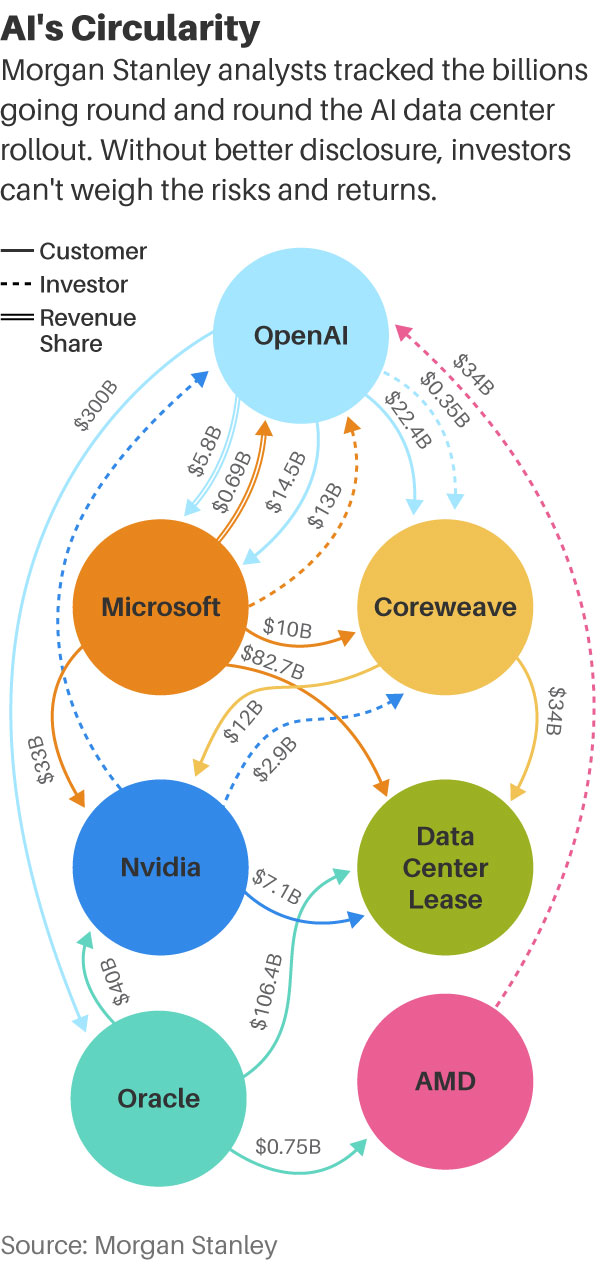

2 weeks, 2 days agoYou might have thought that in the midst of a reignited trade war (?) and a crisis of conscious about AI and the future of software, that the data centre frenzy might pause for breath, but not a bit of it.

In fact, analysts at Citi have “refreshed ” their Global Data Centre Industry Model to include recent earnings data, and reports from…[Read more]

-

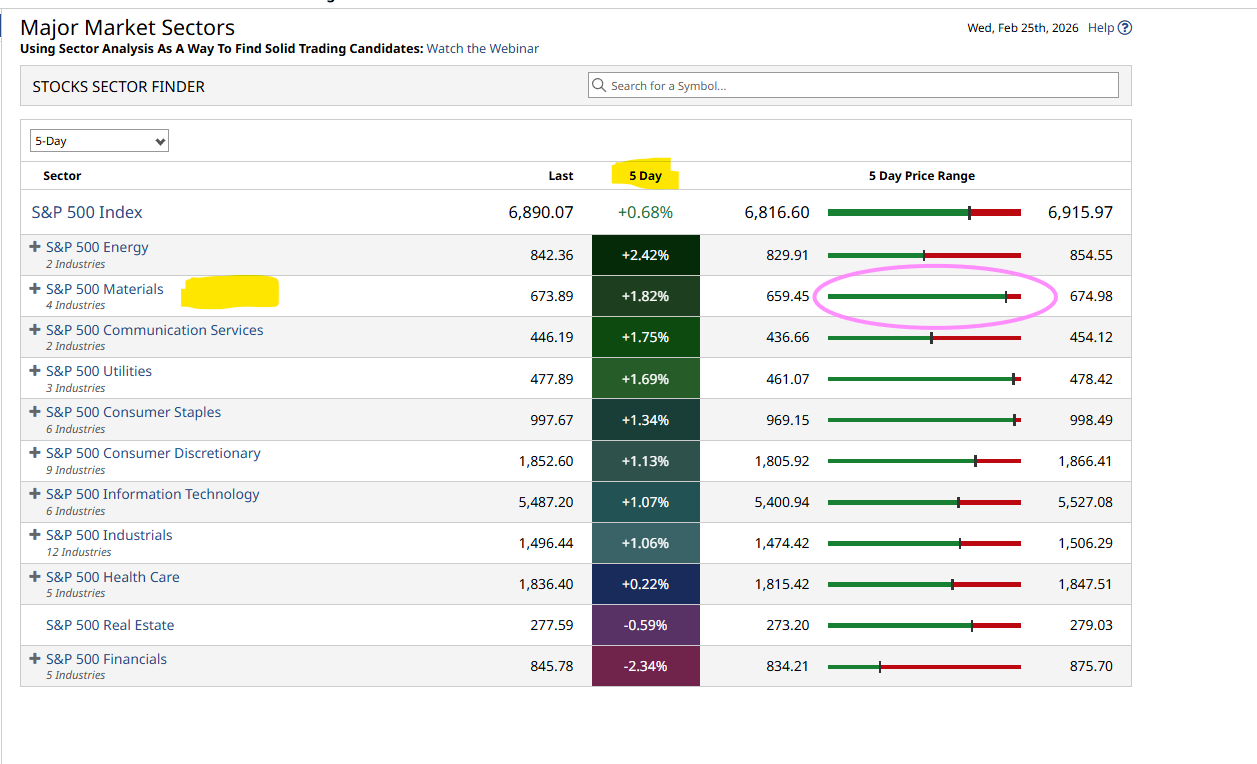

Jackson Wong posted an update

2 weeks, 3 days agoFTSE 100’s accelerated uptrend to pause?

In today’s The Telegraph business section (Feb 23), one prominent headline screamed: “Britain is biggest loser from Trump’s new tariffs”.

Last week, the Trump administration was dealt a significant blow after the US Supreme Court rejected its Liberation Day tariff plan. Not backing down, the US president…[Read more]