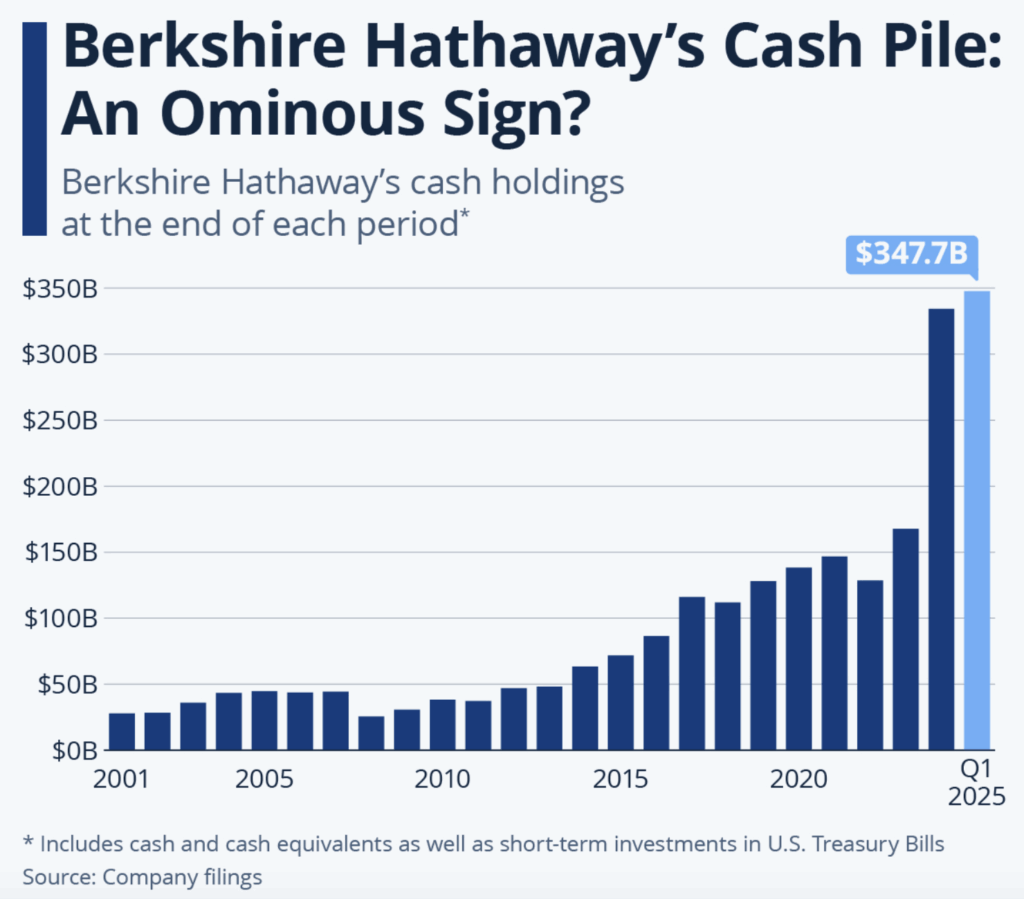

When asked, during the annual shareholder meeting in May, why Berkshire Hathaway (US:BRK.A) is holding so much cash and short-term Treasuries, Warren Buffett gave an answer that I think all investors should pay heed to (see YouTube video clip).

One problem with the investment business is that things don’t come along in an orderly fashion, and they never will. We have made a lot of money by not wanting to be fully invested at all times. Things get extraordinary attractive very occasionally….when we will be bombarded with offerings that we’ll be glad to have cash for.

But these fantastic opportunities, he stressed, are rare. Over time, chances of bagging these buying opportunities rise:

And it would be a lot more fun if it would happen tomorrow, but it’s very unlikely to happen tomorrow. But it’s not unlikely to happen in five years, and then the probabilities get higher as you go along.

According to its latest quarterly report, Warren Buffett’s holding company is sitting on cash and short-term Treasuries totalling almost $340 billion. In contrast, BRK.A’s equity investment is recorded at $268 billion. The fact that Berkshire’s highly liquid assets now surpass its equity investment by $70 billion is telling, and ought to tell you something about his estimation of “attractive” opportunities emerging in the next few years.

Source: statista.com

The other point that Buffett made is that market progression is never linear. It does so non-linearly. Five steps forward, three steps back, another two steps sideways and so on. Randomness permeates price movements all the time. Take Tesla (TSLA) as an example. Prices crashed 50 percent in 1Q this year, before rebounding 100 percent in the next six months. Stock markets are more volatile than you think.

Investment is all about betting intelligently, enhancing capital growth over the long term without suffering a complete blowout along the way. To finish first, as the old adage says, you must first finish the race. Longevity matters.

The last point is this: You don’t need to be fully invested at all times. Leave some cash around so that you can take advantage of any dips. ‘Buy the dip‘ can only be executed when an investor has liquid power at his or her disposal during a market correction.

So, is the market about to present ‘attractive’ opportunities?

Last Friday, many US equity indices developed a scary-looking candlestick. The precipitating factor of the latest sell-off is another squabble between Trump and China. Nasdaq 100 lost nearly 3.5 percent and closed at 3-week low.

But, to investors’ relief, there was no further downside follow-through on Monday. It appears Friday’s sell-off was just some ‘profit taking’. But is it?

Technical Pattern to Repeat?

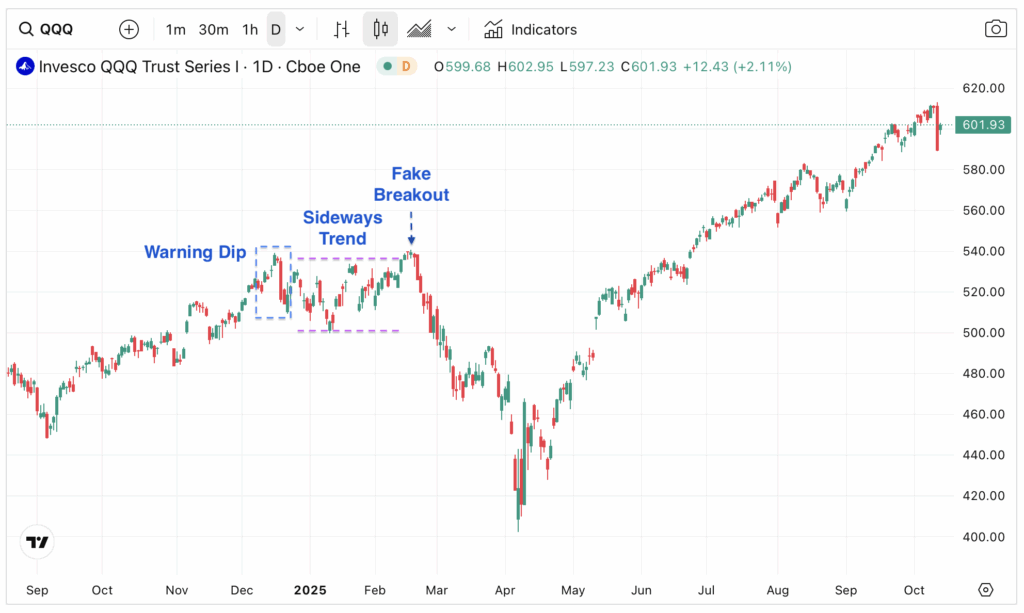

Poring over some key charts over the weekend, I did notice a chart pattern that may provide a potential roadmap for US indices in the next few weeks. Take, for example, the Nasdaq 100 Index ETF’s (QQQ) behaviour a year ago.

Prior to its massive selloff in April, the index was already struggling for some time.

First there was a sharp warning dip in December 2024 from record highs. Then, the index entered into a multi-week sideways consolidation, with lower dips and sharp bounces. Lastly, prices made a gentle push to new highs (540) which failed to reassert strongly. A correction then set in, and lasted until 400 – a 26 percent decline (see below).

I suspect this three-step technical pattern may repeat.

For a start, the index generated a ‘warning dip’ last week, again from new all-time highs. Then, no downside follow-through in the next session. This suggests a potential sideways trend for a few weeks. And lastly, who can say that the index will not surge to another record high again?

Of course, the index may repeat the chart pattern exactly like this. QQQ may suddenly jump higher, or drop sharply, due to unexpected macro developments.

Still, the “warning dip–sideways action–fake high” pattern is my base case for the time being, until other technical developments override this. And remember, if there is a correction, only investors with spare liquidity on the sideline can take advantage, as Warren Buffett reminded us.

Investors Are Starting To Focus On Quality

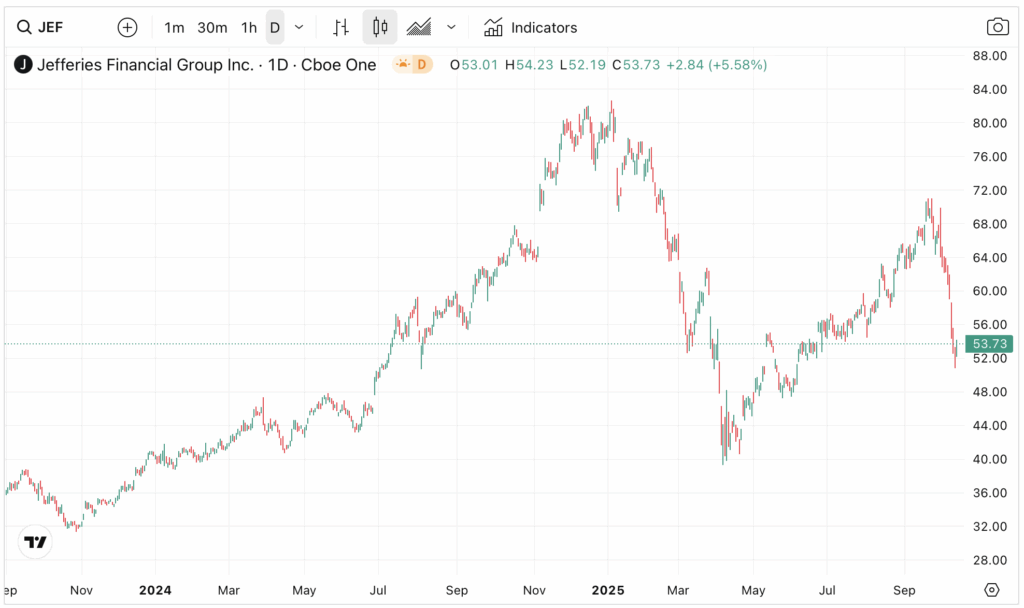

First Brand’s bankruptcy in 3Q was an unexpected credit event. The Chapter 11 ensnares a few financial names, such as Jefferies (JEF). As market speculates on its credit losses, the first thing investors did was to flee the scene. JEF’s share price tanked from $70 to $50 in a matter of days (see below).

Another credit event – Tricolour’s Chapter 7 – also caused Fifth Third Bancorp (FITB) investors to dump some holdings. According to Barrons’, the weekly financial newspaper, the financial institution is said to face some $200 million in credit losses. FITB’s share uptrend was stopped in its tracks.

While the US auto loan sector is neither the largest nor the riskiest, these credit losses are a wake-up call for many institutional investors. They pondered: Are these events a ‘one-off’ or a harbinger of more events to come?

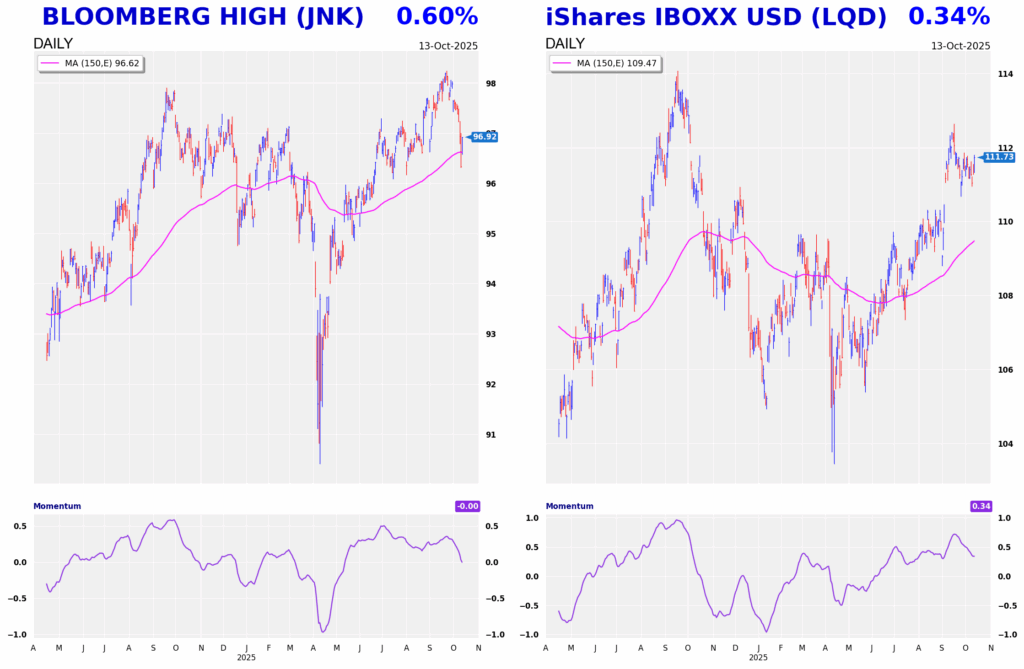

Investors aren’t sure. So to offset this uncertainty, they are shifting back from risk. This is reflected from the performance of different type of bond securities.

For example, in recent weeks, junk bonds have underperformed the better credit names. The disparity in price performance between JNK (junk bonds) and LQD (higher credit) since August is widening

The former is heading down and breaching long-term trend line; while the latter is stayed firm within a bullish trajectory (see below).

This subtle rotation into quality credit securities is mild and masked by the euphoric trends in precious metals and AI. Perhaps credit investors are starting to believe that bearing higher risk will not yield higher returns. Protecting investment capital rises in priority, over chasing the last penny on the table.

And this ties in with Warren Buffett’s keen market observation that I highlighted at the beginning. A market correction may not happen tomorrow, but over time risks start to build up. Eventually, something breaks. As credit investors position themselves for a worsening in repayments, equity investors should also look at quality names, allocate some cash, and wait patiently.