-

-

-

-

Edward Sheldon replied to the topic Can any other index beat the US stock markets in 2026? in the forum Indices

1 hour, 28 minutes agoI don’t like to bet against the US market (the S&P 500 index). Because it has a fantastic long-term track record.

However, some indexes that could potentially beat the S&P 500 this year include:

* The S&P Equal Weight index: Late last year, investors started to rotate out of the technology sector and into other sectors such as Financials, H…[Read more]

-

Edward Sheldon replied to the topic Why has the eToro share price done so bady? in the forum US Stocks

2 hours, 52 minutes agoeToro shares have not performed well since the IPO. As I write this, they’re trading at $31 – about 40% below the IPO price of $52.

It’s hard to know exactly why the share price has tanked. I think it’s probably related to a few different factors including:

* Competition: eToro operates in a very competitive industry and it’s up against s…[Read more]

-

Jackson Wong replied to the topic Can any other index beat the US stock markets in 2026? in the forum Indices

12 hours, 43 minutes agoThe US stock market is in a league of its own.

At the time of writing, 12 out of the top 14 companies (by market cap) are American. Google (GOOG) is the latest tech company to hit the $4 trillion mark.

US Big Techs dominate many aspects of our daily lives, from social networking to shopping to tech gadgets. Their monopolistic platforms are…[Read more]

-

Darren Sinden posted an update

14 hours, 22 minutes agoBloomberg on Precious Metals

-

Here is an generated summary of the video:

Core message

Precious metals are seeing unusually steep, historically rare price moves, which can look overdone but are supported by real supply, policy, and demand drivers, so many investors remain bullish and some even talk about silver reaching levels like 100.Key drivers of the rally

Physical…[Read more]like like

like dislike

dislike

-

-

Jackson Wong replied to the topic Has Silver finally found its voice? in the forum Commodities

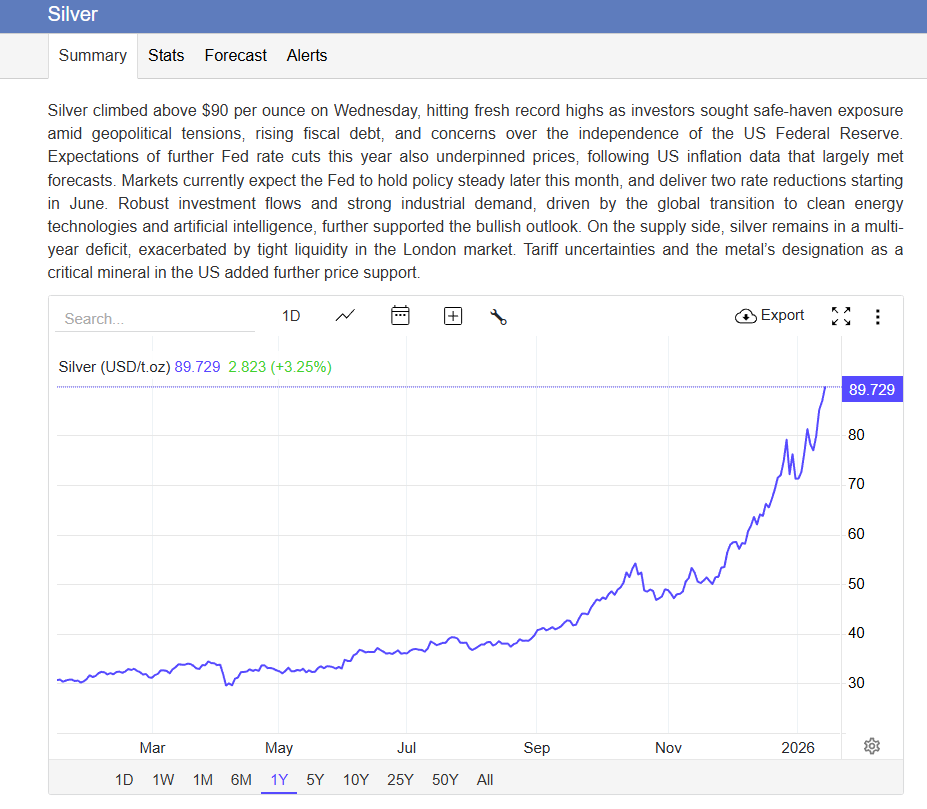

14 hours, 58 minutes agoWhen silver is on a roll, it is best to stay out of its way.

The metal has a habit of churning around aimlessly for a long time until prices march resolutely northwards.

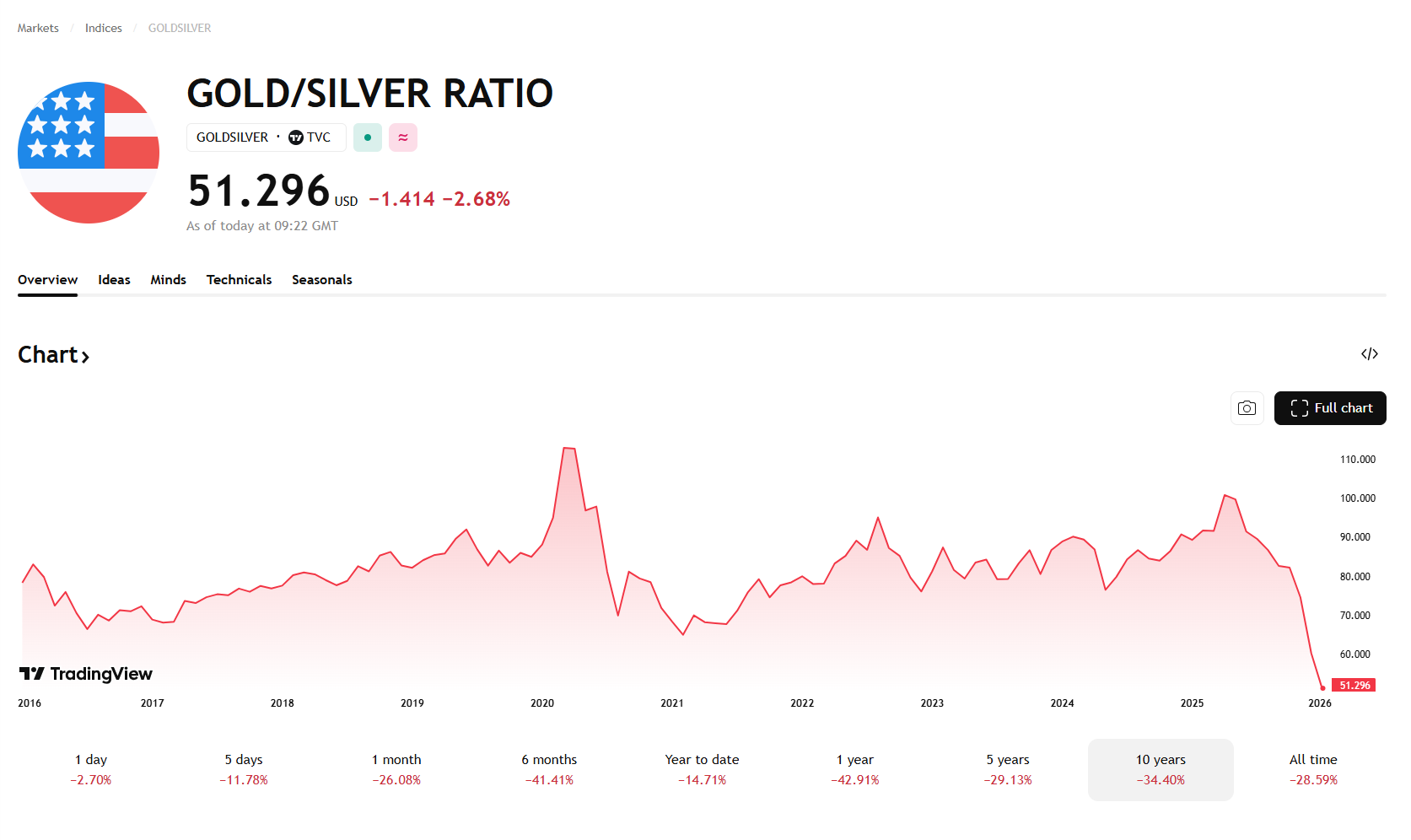

Has silver reached the the climactic end? I’m not so sure.

To bet on the spread narrowing (long gold; short silver) is a bet on gold outperforming silver.

This may well happen in…[Read more] -

Darren Sinden replied to the topic Can any other index beat the US stock markets in 2026? in the forum Indices

15 hours, 16 minutes agoUS markets didn’t perform particularly well in 2025 for example, over the last 12 months the S&P 500 was up by +16.92%. However, the Spanish Ibex 35 posted gains of almost +50.0% in that 12 month period and several smaller European indices did even better. Slovenia’s SBITOP Index is up 5+4.0% over the last year, but even that is knocked into a…[Read more]

-

bearlybullish started the topic Why has the eToro share price done so bady? in the forum US Stocks

15 hours, 36 minutes agoThere was a time when eToro had everything going for it – riding the crypto and personal investing wave through COVID, international expansion and being plastered all over social media. But since it’s IPO performance has been dire, and now reports of layoffs in Israel. Why has the share price done so badly, considering the performance of brands…[Read more]

-

Richard Berry replied to the topic Has Silver finally found its voice? in the forum Commodities

16 hours, 35 minutes agoThe Gold Versus Silver ratio is at its lowest in 10 years, based on the fact that Silver is largely correlated to gold – albeit much more volatile. Is there an argument for buying into this as a pairs trade?

-

Richard Berry started the topic Can any other index beat the US stock markets in 2026? in the forum Indices

17 hours, 7 minutes ago43% of investors surveyed by CMC Markets expect the US to be the strongest-performing market in 2026, comfortably ahead of the Far East ex-Japan (26%) and Japan (11%). Europe has just 10% backing continental markets to outperform.

Sentiment towards the UK market is looking pretty bruised. On a scale of one to ten, investors rated the UK’s 2026 t…[Read more]

-

Darren Sinden posted an update

17 hours, 27 minutes agoSilver is up again overnight trading above $90.00 per troy ounce. The metal has gained almost +40.0% in a month.

One of the most straightforward ways to play Silver as a UK retail trader is Fresnillo FRES LN, one of the worlds largest silver miners, with extensive operations in Mexico.

Fresnillo have rallied by just over +34.0% in the last…[Read more]

-

Jackson Wong wrote a new post

1 day, 6 hours agoThe Biggest Investment Risks For 2026

“No one,” says an old market adage “rings the bell at the top.” A stock market may well peak on […]

-

Darren Sinden posted an update

1 day, 11 hours agoAlbemarle ALB US have traded higher again in the pre market today. Nothing earth shattering but they are up by +3.0% just ahead of the open and they have traded at $174.14. A a new two year high.

The three year high is up at $293.01, so there is a lot of work to do before we get anywhere near that.

However, if you shoot for the stars…[Read more]

-

Darren Sindenreplied 1 day, 11 hours ago

ALB US $176.00 trading as I type up by almost +10.0% in a week 🙂

like like

like dislike

dislike

-

-

Darren Sinden posted an update

2 days, 10 hours agoI mentioned Vistra Energy VST US last week see here https://invesdaq.com/members/fatdaz/activity/416/

The stock faded into the close on Friday, however its up +5.35% today and right now it has the makings of a bullish engulfing pattern on the daily candle chart.

It’s not the strongest signal, but if posted , it does suggest that the bulls are…[Read more]

-

Darren Sindenreplied 2 days, 10 hours ago

I note that 4 Brokers including BofA and UBS have raised their price targets in the name today as well .

like like

like dislike

dislike

-

-

Darren Sinden posted an update

2 days, 10 hours agoFreeport Mcmoran are up again today though they haven’t printed above the 10 year high posted on Friday at $58.63 nevertheless they have registered a +32.0% gain since I first mentioned them here in early December.

I have added a chart that tracks the percentage change in the share from then, to today, below.

-

Darren Sinden posted an update

2 days, 11 hours agoI recently highlighted the upside potential of Albemarle ALB US the worlds largest lithium refiner

see https://invesdaq.com/members/fatdaz/activity/390/.Albemarle are called up +4.67% in the pre market today and have traded at $168.83 $10.00 above the level they were when I mentioned them a week a go. As you can see that move takes the stock…[Read more]

-

Good Money Guide posted an update

2 days, 13 hours ago“I can’t afford to lose this money – what’s the safest option?”

That was the question from a reader with £20,000 to save for two years. We break down the safest places to grow cash, beat inflation where possible, and avoid unnecessary risk. -

Darren Sinden posted an update

2 days, 13 hours agoYou couldn’t describe the start of 2026 as uneventful, protest in Iran appeared to be gaining momentum over the weekend and the US DOJ instigated a criminal investigation against the Federal Reserve Chair Jay Powell.

US markets are trading lower ahead of the open, with CFDs on the S&P 500 showing a – 0.54% drop as I type .

Crude oil prices…[Read more]

-

Jackson Wong posted an update

2 days, 14 hours agoGold and silver soar to fresh highs on Fed investigation

Important events are continuing to unfold frenetically over the weekend.

The most shocking, however, was the criminal investigation of the US central bank. In particular, the US Justice Department is examining whether an indictment can be charged against the Fed chairman, Jerome Powell,…[Read more]

-

Darren Sinden posted an update

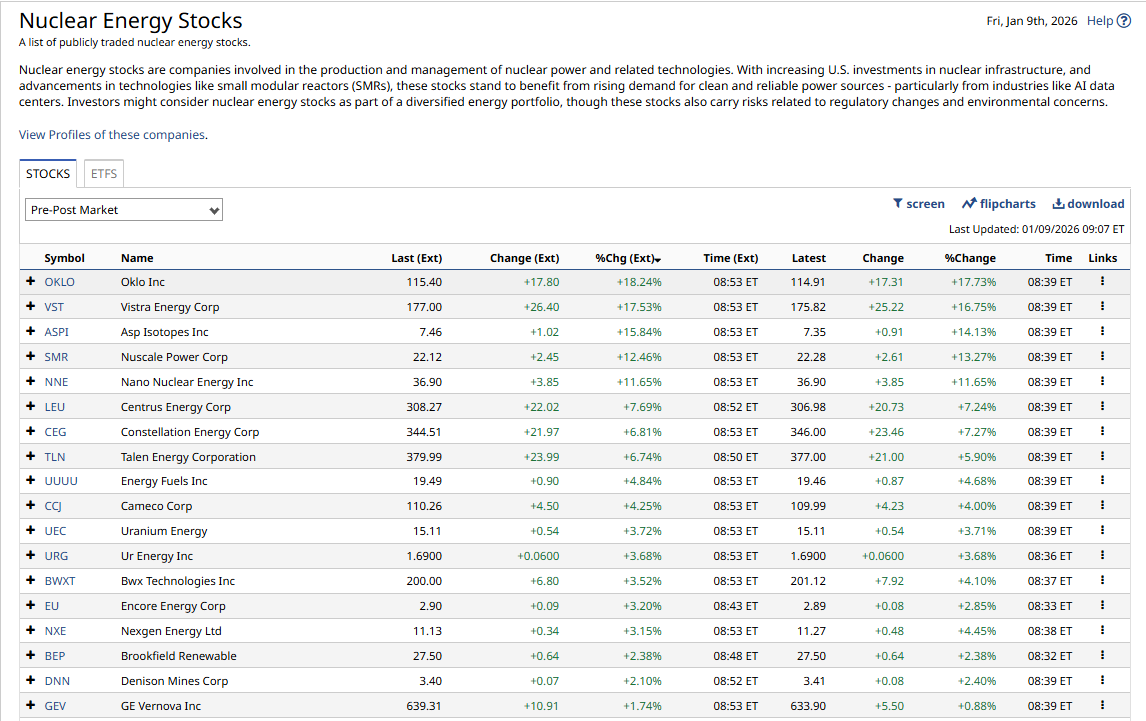

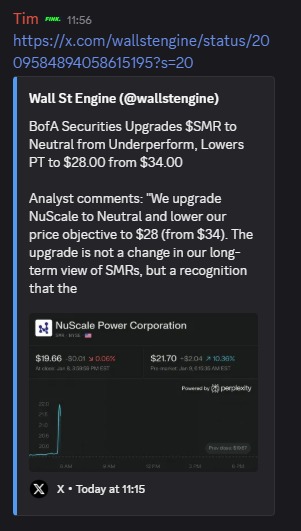

5 days, 11 hours agoNuclear stocks are to the fore in the US pre market as Meta Platforms META signs deals with OKLO OKLO and Vistra Energy VST the stocks are either side of +18.0% higher and the news has boosted other names among nuclear energy and uranium stocks.

URA US the GX Uranium ETF is up by +5.5% pre market

Stifel Canada wrote on Uranium stocks…[Read more]

-

Michael Hewson (MCH Market Insights) posted an update

5 days, 12 hours agoSimilarly Sainsburys posted a solid set of Q3 numbers yet you wouldn’t know it judging by the market reaction which has seen the shares fall sharply.

Let’s look at the numbers.

Q3 sales were up by 3.9% with Christmas sales up by 3.3%.Grocery sales were a standout performer with 5.4% during Q3 and 5.1% in the 6 weeks to 3rd January.

The…[Read more]