-

Jackson Wong posted an update

3 weeks, 4 days agoTime to exit property listing platforms?

One recent news article (“Zillow shares are getting crushed. Here’s why.”, CNBC, December 16) caught my eye attention.[1]

The reason is that Google (US:GOOG), the search monopoly giant, is muscling in real estate listing. Starting late 2025, Google has been testing the waters by inserting some property listings in its search results.

Coupled with other data the company possesses, such as maps, Google’s foray into the property transactional process is starting to attract attention.

Currently, Zillow (US: Z) is the largest property listing platform in America. But if a $4 trillion Big Tech is taking aim at its business, its management and investors will feel the heat quite soon. Zillow’s shares are down 15 percent over the past 12 months.

Back in the UK, the business threat that Zillow is facing is applicable to the UK property listing platform Rightmove (UK:RMV).

The £4 billion company saw its share price tumble last month as it downgraded its 2026 profit growth to 3-5%. The firm is planning to increase investments in its AI capability to keep up with the competition. Hence the lower profit outlook. The market disliked this and RMV’s share price plunged 12 percent that day.

If Google were to intensify its property listing presence here in the UK, Rightmove will face an even stiffer business landscape.

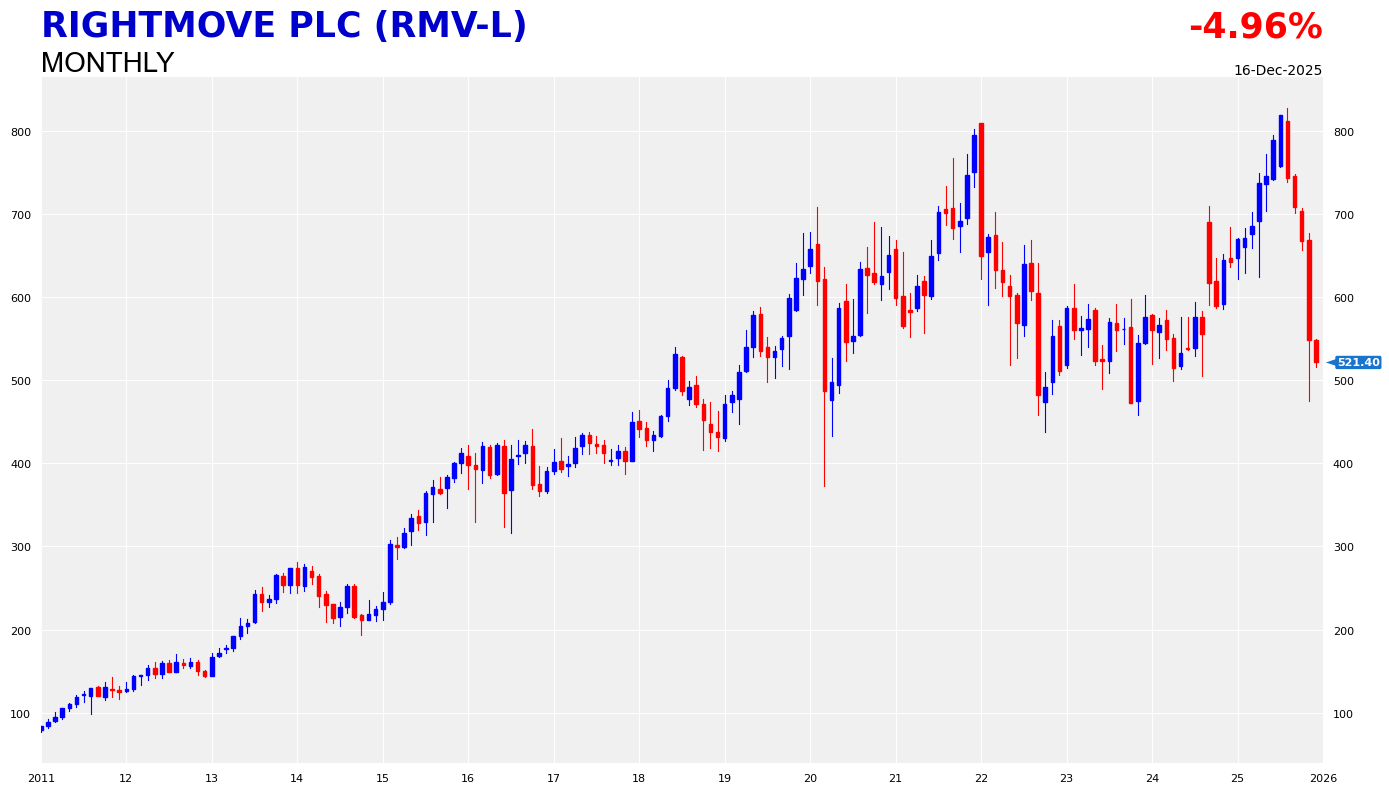

Chartwise, it seems Rightmove has completed a major ‘double top’ formation near 800p. Prices have plunged by a third in just a month. A further slide in market sentiment may drag prices below 500p.

Long-term shareholders of Rightmove, however, may think current downtrend is just an aberration. Prices may rebound back to the 800p+ peak in due time. After all, Rightmove’s revenue is still growing, as are its profits. That’s true.

But stock markets are forward looking. The fact that Rightmove has failed to appreciate much since 2019 (6 years ago) is worrying. The market is sensing a deep threat.

Therefore, one has to draw a line somewhere. Stops to protect some positions are recommended in case prices slide further. You can always buy them back when sentiment improves.

[1] https://www.cnbc.com/2025/12/15/zillow-shares-are-getting-crushed-heres-why.html