-

Darren Sinden posted an update

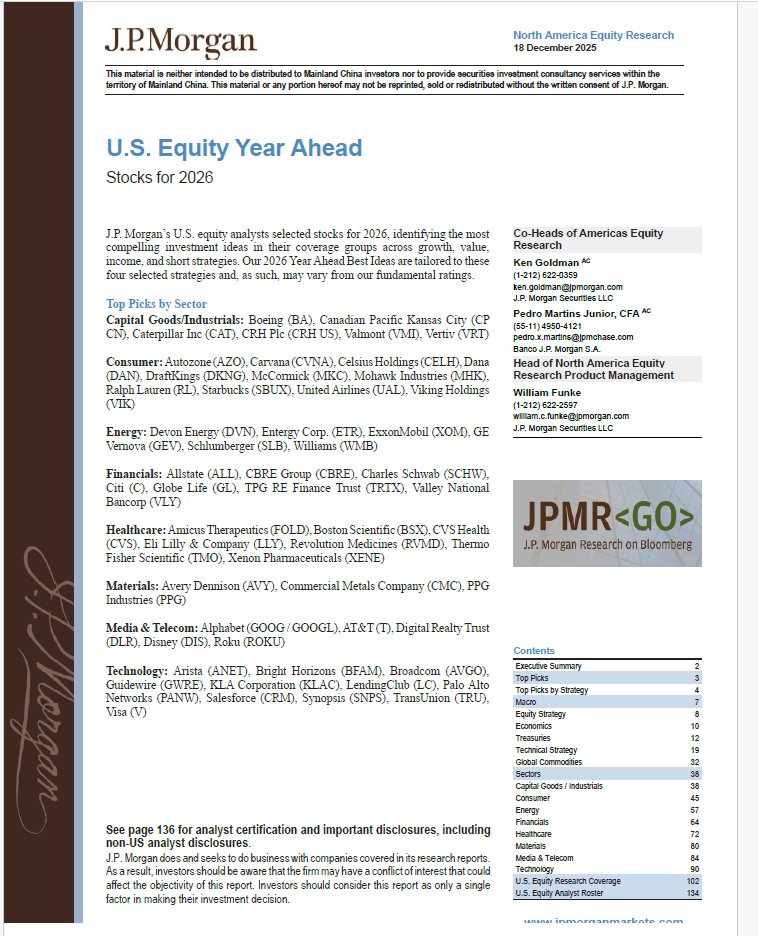

3 weeks, 2 days agoJP Morgan may not be publishing any more morning notes in the UK until Jan 5th 2026, but its US team has published an outlook for stocks in 2026.

Which includes a list of preferred stock in each sector a snapshot of which can be seen below.

The reports extends to 134 pages however the executive is as follows:

“!J.P. Morgan’s 2026 U.S. Equity Year Ahead report highlights sector-specific

opportunities and risks amid a K-shaped, AI-driven economy.Institutional investors should focus on companies with secular growth drivers, robust balance sheets, and exposure to transformative trends like data centre expansion and infrastructure

investment.While select sectors look poised for outperformance, others face headwinds

from macro uncertainty, regulatory shifts, and cyclical slowdowns.”The bank also look at sentiment:

“Sentiment Analysis: Overall sentiment is constructive but selective, with “growth,”

“AI,” “margin,” “demand,” and “infrastructure” as the top five terms. Technology,

Industrials, and select Financials should be positively impacted by secular trends and

capital investment.Conversely, Consumer Staples, Homebuilders, and some Energy

names could face negative sentiment due to margin pressures, regulatory

uncertainty, and cyclical demand risks.”