-

Jackson Wong posted an update

2 weeks, 1 day agoChinese Tech Boom

A year after the ‘DeepSeek’ moment, what has happened to the Chinese technology space? Plenty.

From chip-making to LLMs to robotics, the entire China technology chain is powering forward rapidly.

The weekly chart of Chinese chip-maker Cambricon Technologies (ticker: 688256) tells you broadly the sector’s upward trajectory. Now a near US$100-billion company, Cambricon’s stock rose almost 20-25x since late 2022. That’s enough to outpace many US tech stocks.

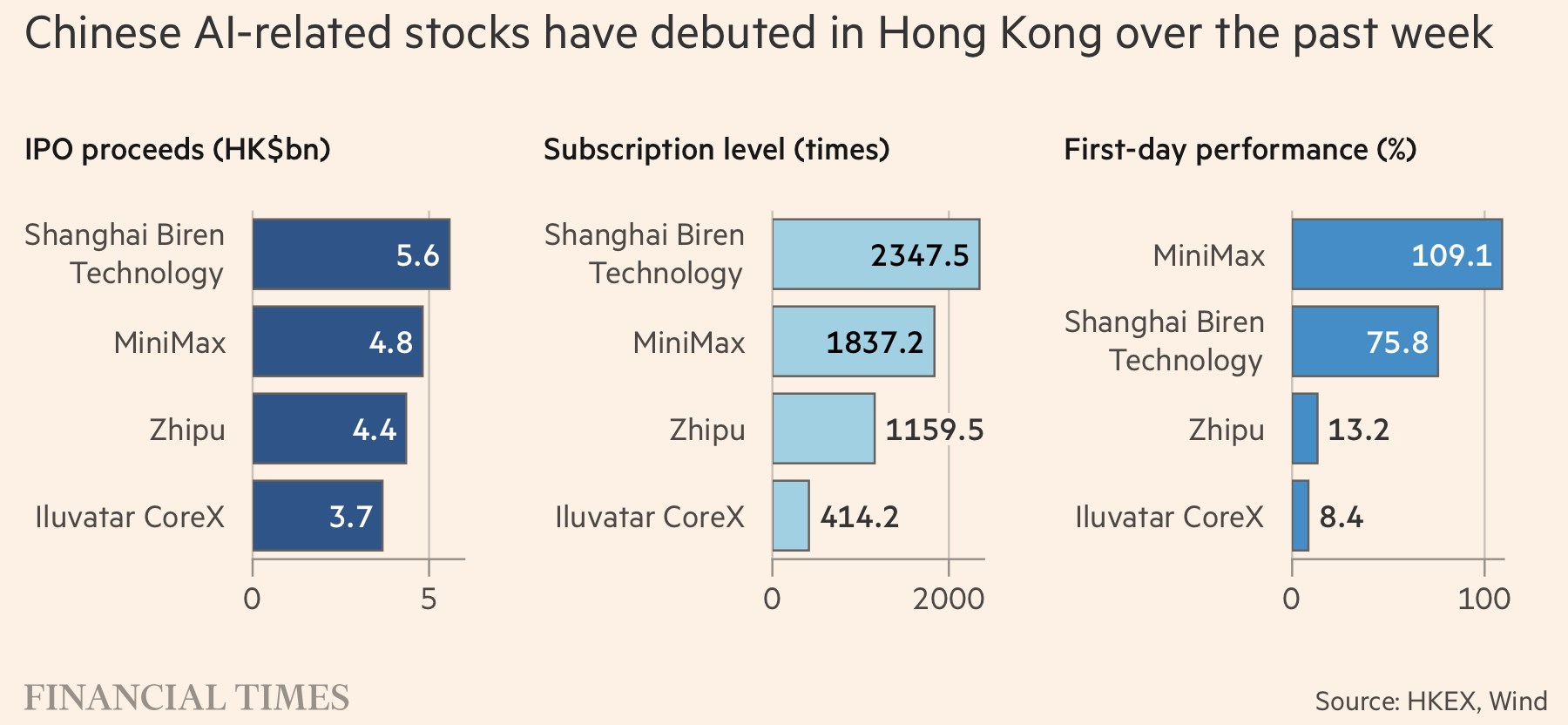

The pool of enlarging tech wealth is spawning many new tech companies. Barely a month into 2026, a few Chinese Large Language Models (LLMs) companies have listed in the HK stock exchange, garnering much attention and capital.

Minimax’s IPO (ticker:100), for example, was oversubscribed as it raised $619 million. Zhipu’s (ticker: 2513) debut generated more than $500 in new equity capital.

Their share prices rose sharply following the listing.[1]

The above trend tells us two things:

One, China is moving rapidly into the technology space. The number and breadth of these new tech companies is impressive. Soon, a self-sustaining Chinese ecosystem will form to rival that of Silicon Valley.

Two, Asian equity markets are doing well right now. We are seeing much enthusiasm for these new HK IPOs, enthusiasm that can only be sustained by investor confidence and capital availability.

Therefore, while Greenland-Trump furore is occupying headlines, other investment markets are continuing to power ahead. Thus, investors should not be too emotionally swayed by these macro currents.

[1] Chart 2 source: Financial Times (www.ft.com/content/a4fc6106-5a61-4a89-9400-c17c87fb1920, paywall)