-

Jackson Wong posted an update

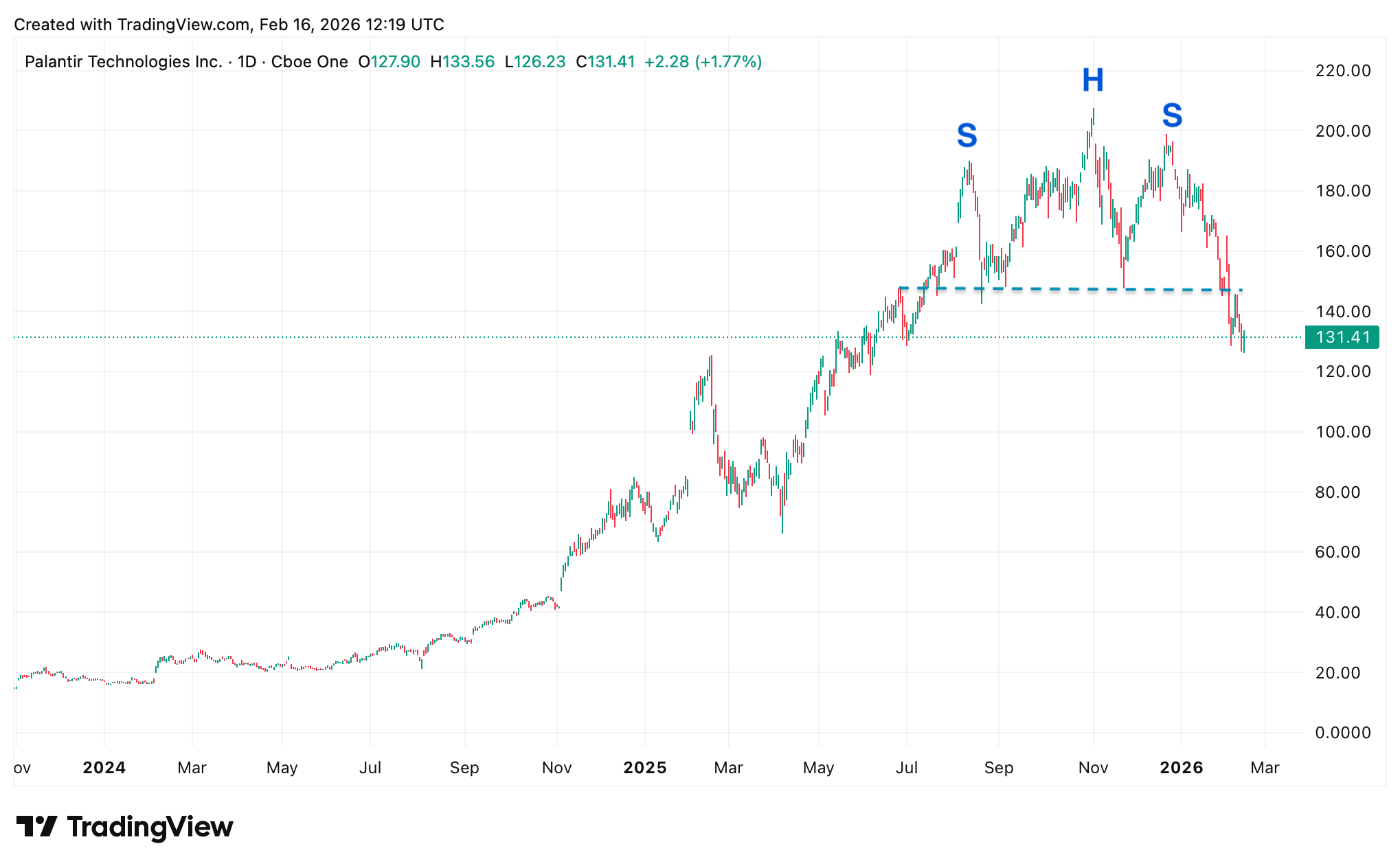

1 day, 11 hours agoPalantir completes a top formation?

Uncertainty is growing in financial markets.

Many long-running bull trends have collapsed (eg software stocks), while assets like gold and silver have regressed significantly from their recent peaks.

Meanwhile, a few red-hot Asian markets are near-term overbought (eg, Kospi and Nikkei 225).

In sum, it is hard to find compelling ‘bargains’ these days. Many sectors are under assault from the growing might of AI. Until the dust settles, investors are unlikely to return en masse to these battered stocks in the near term.

Perhaps it is under these uncertain circumstances that capital is flowing into defensive assets (eg US treasuries and staples stocks).

Even major tech players are struggling to hold onto their bull trends.

Take Palantir Technologies (PLTR), the $300+ billion data-cum-analytics company.

This tech company enjoyed one of the best rallies in the market during 2023-2025 as its income tripled. PLTR’s share prices gained 25x and brought massive riches to its shareholders.

However, if I look at its chart closely, a potential top appears to have been sketched out. The stock developed a reversal pattern akin to the famous ‘head-and-shoulders top’.

Recently, prices broke down beneath the ‘neckline’ and, following a retest of this support-turned-resistance, are now resuming the short-term downtrend.

The next area of support is noted at $100.

But the bulls will point out that this negative view is late, in that PLTR already shed 30-40% of its value since late December. That may be true.

But if a major AI-induced bear trend is developing in the coming quarters, any rebound here may be used as a selling opportunity.