-

Darren Sinden posted an update

12 hours agoOutperformance that’s a word that keeps cropping up in my feeds most likely because that’s not what most people and their portfolios are doing right now .

Why is that ? Well put simply they have the wrong positions / exposure tracking the market through an ETFR like SPY, VOO or their European equivalents is a great plan until the stocks that drive performance aren’t performing any more. And that matters even more when the cap weightings dictate what moves the market.

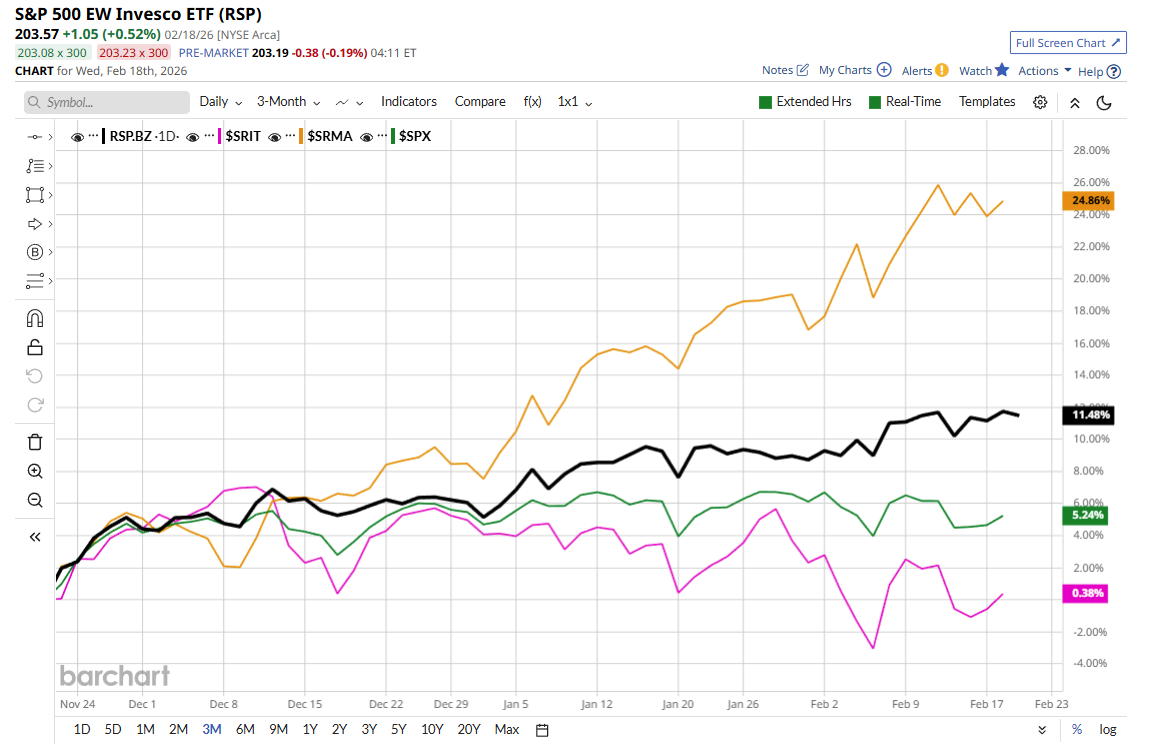

To put it another way if the top 10 US stocks aren’t plying ball the neither is your index tracker. You can see this at work below i the first of our charts that compares the equal weight S&P 500 ETF RSP with the Information technology sector the Cap weighted S&P 500 and the S&P 500 Materials sector.

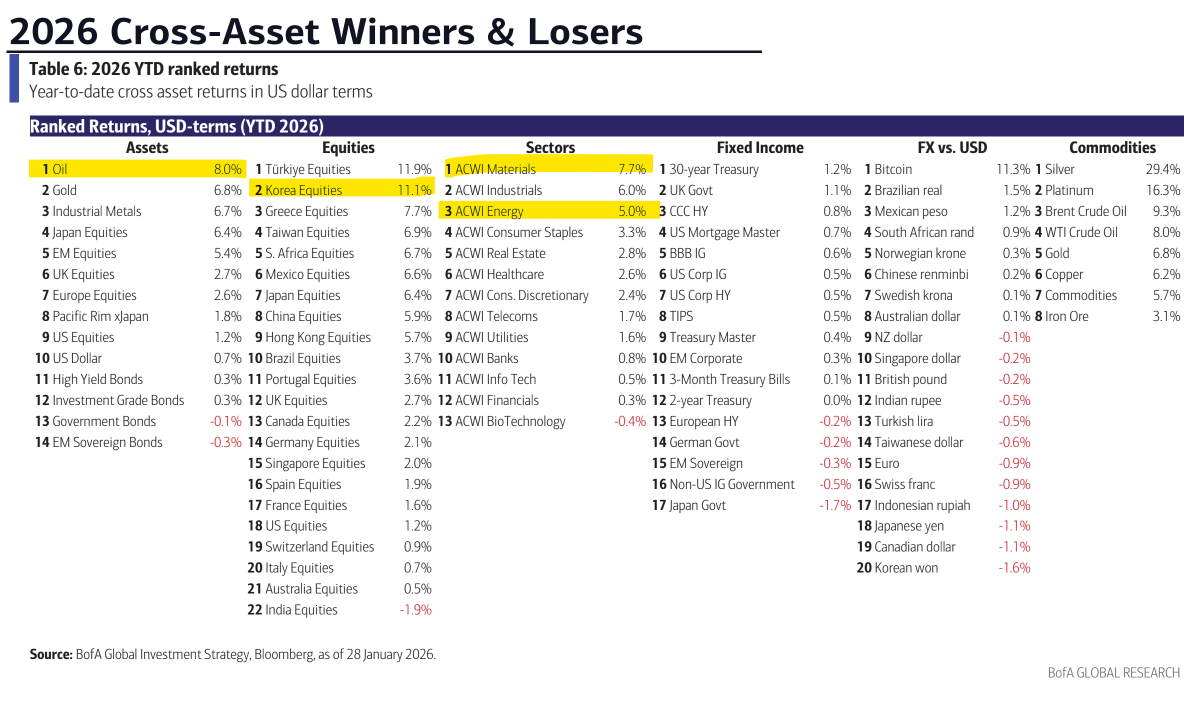

The table below courtesy of B of A shows what has been performing across asset classes in US $ terms in 2026 to date. This table is from Jan 30th but you get the idea I am sure.