- This topic has 3 replies, 4 voices, and was last updated 4 months, 1 week ago by mariiamdelgar.

Richard hi

I read your article on Met 1 and am interested in buying some shares.

Could you let me know if this is a good idea and also how much investment should be placed, in your experience?

I understand the future needs for metals for batteries etc, but just wanted to know if Met 1 were strong in the states.

Many thanks for your help

Hi, thanks for getting in touch – I’m afraid we can’t give direct investing advice as we don’t know your personal circumstances. However, as with all very small mining companies listed on AIM, I would not invest more than I was prepared to lose and view it as part of the very high-risk part of a portfolio. A bit like buying a long dated call option where if you’re right you’ll do well, but if not the investment will be worthless.

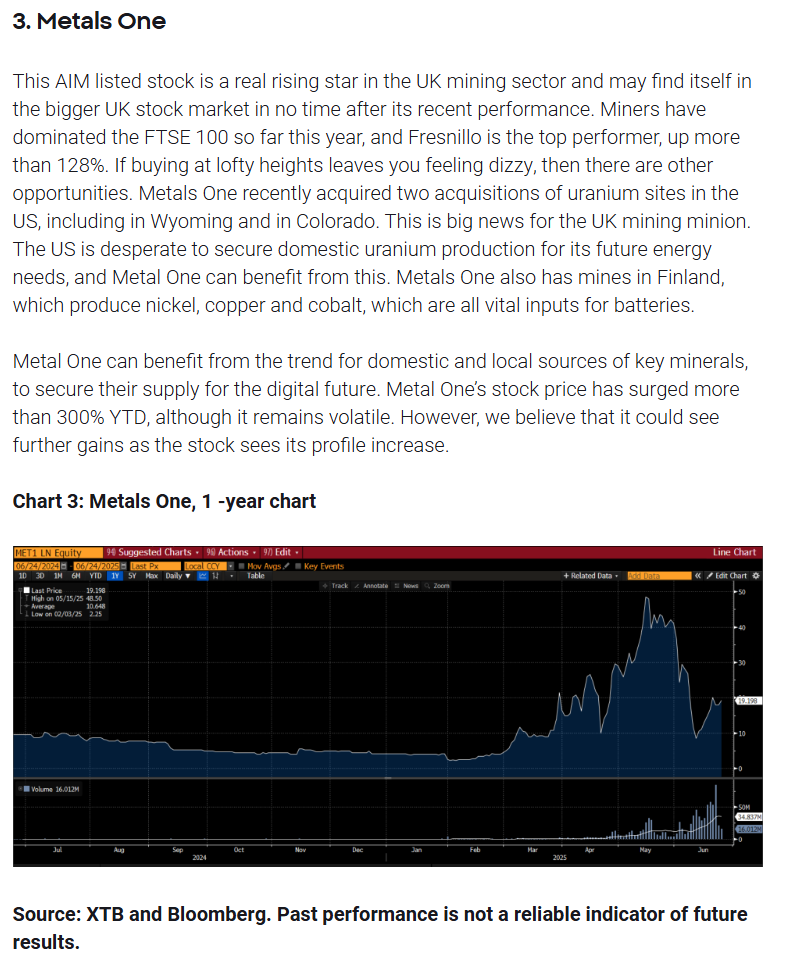

I did notice however that XTB have added this as one of their stocks to watch for the second half of 2025, so who knows, maybe there is some fundamental basis despite the pump and dump surrounding it.

A bit odd, as you can’t even buy it on XTB’s trading platform: https://www.xtb.com/en/education/top-5-stocks-to-watch-right-now

Metals One PLC (AIM: MET1) is a UK-listed exploration company focusing on critical minerals, including gold, uranium, and nickel, across projects in the U.S., Finland, and Norway. Despite a significant 52-week price increase of over 600%, the company faces challenges such as negative earnings, limited revenue, and a small workforce of just 8 employees.

📊 Key Financial Metrics

Market Capitalization: £26.3 million

Share Price: 3.20p (as of October 16, 2025)

Net Income: -£2.31 million

Earnings Per Share (EPS): -0.05

Return on Equity (ROE): -20.22%

Free Cash Flow: -£3.47 million

Net Cash: £2.73 million

52-Week Range: 0.176p – 55.00p

StockAnalysis

📉 Investment Considerations

Volatility: The stock has experienced significant price fluctuations, with a 52-week high of 55.00p and a low of 0.176p.

Technical Indicators: Analyses indicate a “Strong Sell” signal, with negative trends in moving averages and other technical indicators.

Investing.com

Financial Health: The company reports negative earnings and free cash flow, suggesting financial instability.

Thank you for reaching out regarding Metals One (AIM: MET1)

- You must be logged in to reply to this topic.

Invesdaq

Welcome to Invesdaq, a social network for investors.