What is gold at $5k trying to tell us?

Cast your mind back to the year 2021, when crypto, green economy and post-pandemic stocks were all the rage. Would you buy the metal, then trading at $1,800, over other assets? You might, but I suspected many didn’t.

At that time, gold was seen as an irrelevant and ‘boring’ investment. Traders were enamoured by the newly-discovered blockchain; while the entire investment community was focussed on exciting ‘stonks’ like GameStop (GME) or Riot (RIOT), which skyrocketed 20x in a matter of weeks.

Who, given the short-termism of markets, wants a metal that return 3% a year when the same investment in Tesla (TSLA) yielded 3% per day? As for silver back then, its investment proposition was even more unpalatable. Prices struggled even to hold on to $25.

But, the table has turned decisively. Many of those speculative stonks faded into oblivion during 2022-3; while gold and silver appreciated by multiples since.

What had changed in the past five years that totally shifted the investment landscape? Three key macro developments have channelled capital into gold:

- Quantitative easing (QE) increased substantially during 2020-2023

- Increased military conflicts around the world

- A paradigm shift in critical minerals investment

The ‘Era of Hard Assets’ has arrived

Gold at $5,000 is telling us one thing: The era of hard assets has arrived.

Its ongoing rally, broadly speaking, is the “payback” for the multi-trillion QEs pumped by global central banks during the pandemic.

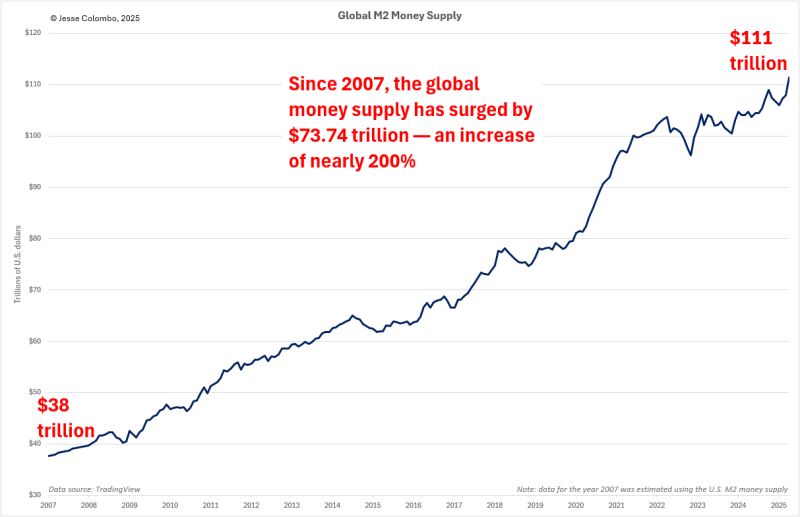

Look at the “Global M2 Money Supply” below. Oceans of money have flowed incessantly from the digital printers of the Fed, BoJ, ECB etc over the past six years.

When liquidity suddenly increased by the trillions, it had to go somewhere. First, it flowed into speculative securities and consumer spending. When the asset bubble imploded in 2022-3, liquidity went into ‘safer assets’ like large-cap stocks. Then, investors discovered the allure of gold, which broke out to all-time highs in early 2024.

Source: Jesse Columbo (linkedin)

What is the direct consequence of multiple QEs? Debasement of fiat currencies through inflation. Prices have increased markedly since 2020 and many households are suffering a sustained drop in purchasing power. When each dollar buys less and less goods, investors prefer hard assets.

Always remember this economic observation by Warren Buffett (2011 Berkshire shareholder letter):

…in the U.S…. the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire. It takes no less than $7 today to buy what $1 did at that time.

In other words, it is not that gold has appreciated massively, but the value of the dollar has declined precipitously. Two sides of the same economic coin.

The explosive rise in fiscal spending is another plus point for gold. Why hold debt securities when the risk of sovereign default is ever-present?

In the last 3 months of 2025, for example, the US paid $276 billion in interest payments alone. Sustainability is the concern here. The UK Truss debacle in 2022 reminds investors that the fiscal debt issue can easily blow up.

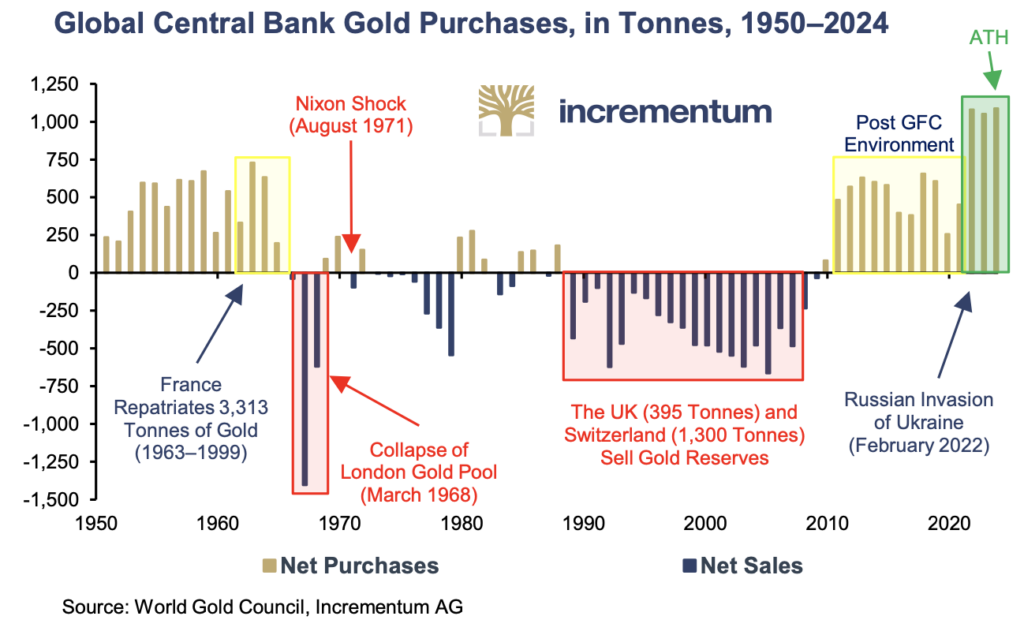

Another catalyst to hold gold is the increase in military conflicts around the world. These events have increased the uneasiness of investors and directly contributed to higher demand for haven assets (eg gold and Swiss Francs). Even central banks are hedging their bets by buying vast quantities of the metal since 2021.

Source: Incrementum (In Gold We Trust, 2025) – an excellent report on gold

Meanwhile, the ever-louder drumbeat of war also increases demand for industrial and critical metals.

Unfortunately, many suppliers of these critical raw materials have placed restrictions on exports (eg, China). Due to national security concerns (as many of these elements are essential to military assets), overcoming the supply bottleneck has become imperative.

A new paradigm in metal commodity exploration, investment, and refining is thus underway. Gold and other precious metals are enjoying strong returns amidst this sector-wide metal commodity boom.

Are Gold and silver too expensive to buy?

The key question is whether we should still buy gold at $5,000 and silver at $100.

To be fair, if you’re only thinking about joining the party now, you’re a little late. There is no other way to put it.

Silver has rocketed 3x-4x in six months. Chasing it at triple-digit levels means: a) investment risk has increased substantially, b) the position is subjected to higher price volatility.

Look at Silver’s daily price chart below. While prices are climbing rapidly, intra-day corrections are widening. Prices can plunge deeply in a matter of hours.

Of course, the ‘blow off’ top seen in many commodities rallies may still lie ahead for silver. But I suspect that climactic phase is not that far away. If you’re going to bet on silver now, perhaps do it on a lower-than-usual position size to account for the hyper price swings. Risk management is absolutely essential when chasing parabolic trends.

Silver’s final peak may zoom past very quickly, in time frames measured in hours rather than days.

As for gold, its peak will likely coincide (roughly) with silver. However, gold is a slower-moving beast. And it is a monetary asset. Central banks may use price setbacks to increase their gold holdings. I suspect gold’s current ‘boom-bust’ cycle may unfold differently to past cycles.

Back to the question: Are these precious metals too expensive to chase?

When measured to their recent prices, yes these metals may look expensive. But if we factor in constant fiat debasements, unsustainable debt stacking, and widening military conflicts, gold and silver remain somewhat desirable over the long term. They give investors some peace of mind that few other assets can provide: the protection of capital in a turbulent world.