-

Jackson Wong posted an update

10 hours, 26 minutes agoTime to take a look at US Treasuries?

Market recap

– Bitcoin tanking. In yesterday’s post, I highlighted that $70k may be not the ultimate support that everyone was looking for. Indeed, Bitcoin smashed that level with relative ease and touched lows $60k in a bout of panic selling. But Bitcoin’s steep decline is now quite oversold. I anticipate a sharp rebound to unwind these oversold technicals. Former support, however, may be turning into resistance.

– US Mag-8 extended sell-off. The key concern is heavy capex spending. Amazon, for example, plunged nearly 10 percent on Thursday after revealing $200 billion capex on tech infrastructure. The issues are twofold: One, can the tech companies fund these spending adequately? Two, can they recoup sufficient returns from these ever-rising bills? The market suspects the ‘Law of Diminishing Returns’ is at work here: The more they spend, the lower the returns. This leaves one tech standing – Apple. So far the company has not spent much capex. Its 2025 expenditure came at a tiny $12.7 billion. As such, Apple’s share price has surged relative to its tech peers, and it may soon return to the world’s largest stock.

– Gold & Silver slumped. Silver, in particular plunged all the way to $65 in the early hours of Friday trading, before rebounding back above $70. Price volatility of the sector remains high. Talks of ‘collateral death spiral’ abound, as the price correlation between precious metals and Bitcoin increased in recent days. This means that a fall in one asset is precipitating a selling of another asset. Whether all of the leveraged positions have been flushed out remains to be seen.

Earlier this week, I (and Darren, too) highlighted a gentle sector rotation into ‘defensive’ sectors, such as consumer staples. This remains the case. Unilever (ULVR) extends its uptrend despite the jittery market.

This leaves one interesting question: What about US Treasury bonds?

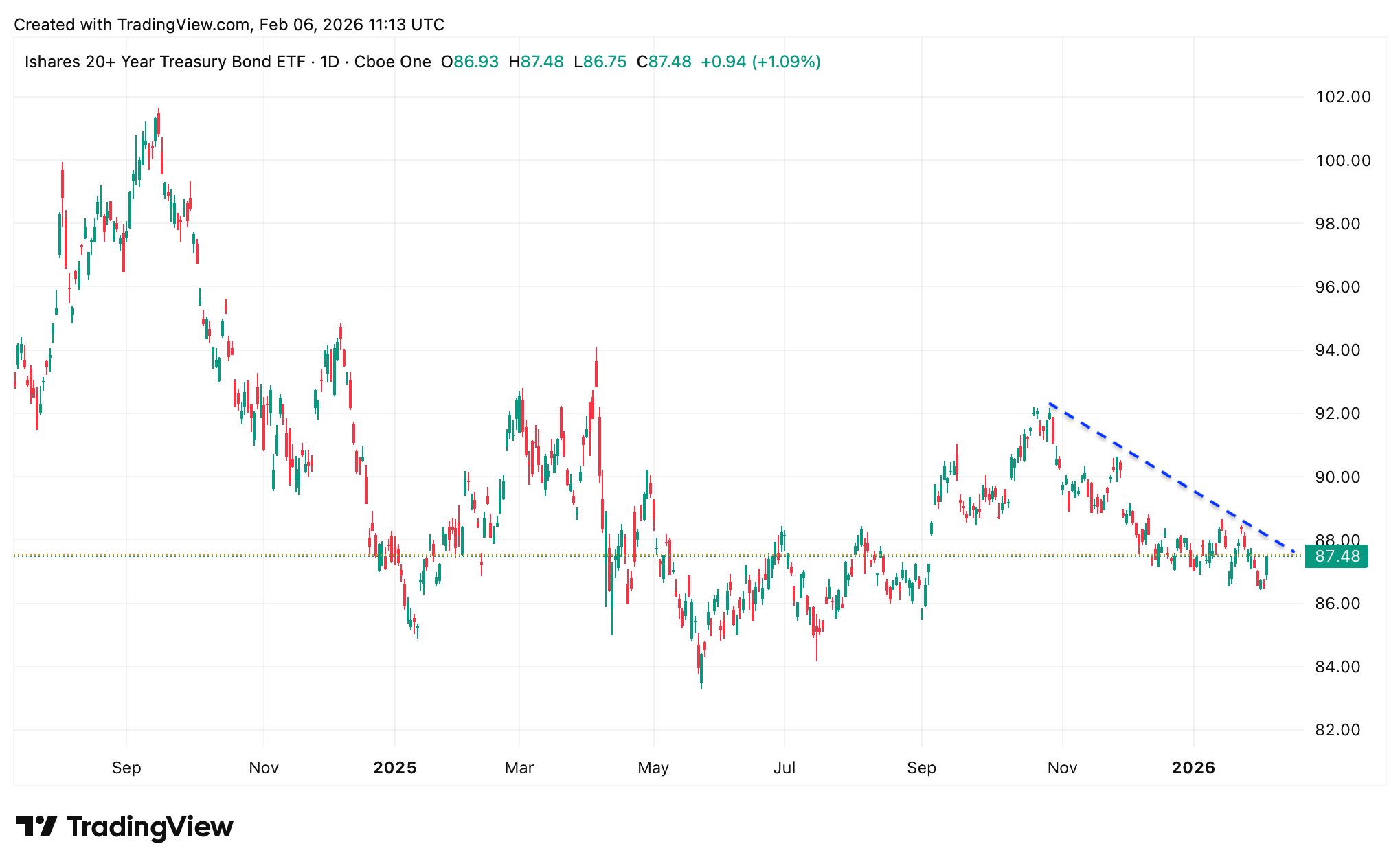

We know that this asset class came under pressure in recent months due to a rise in risk sentiment, political infighting, and inflation expectations.

But now the new Fed chair has been selected. And it seems the market likes the choice. No more ‘indiscriminate’ rate cuts on the table. Will this be enough to attract investors back to US Treasuries?

Technically, I am seeing a potential test of the gentle downtrend, a trend in place since late October.

Support has emerged at around 86.0 to pause the decline. Any further under-performing macro data – particularly unemployment – may push prices north of the downtrend resistance.