-

Darren Sinden posted an update

12 hours, 2 minutes agoAnother good day for Plus500 shareholders as UK broker Cavendish rate the stock a buy, following upgraded guidance from the business. Which pointed to increasing revenues from its non-OTC activities. Which Plus500 called ” a key growth driver”. And which is said was “supported by positive momentum across global financial markets, as well as with strong operational results including launching prediction markets products for B2C customers and completing the acquisition of Mehta Equities in India.”

Cavendish maybe buyers of the stock but their price target is well below he current price. at £43.45 versus the £47.78 the are printing at as I type.

And with the stock up +30.0% year to date and plenty of volatility in the markets I fancy that the Cavendish target will prove to be too low.

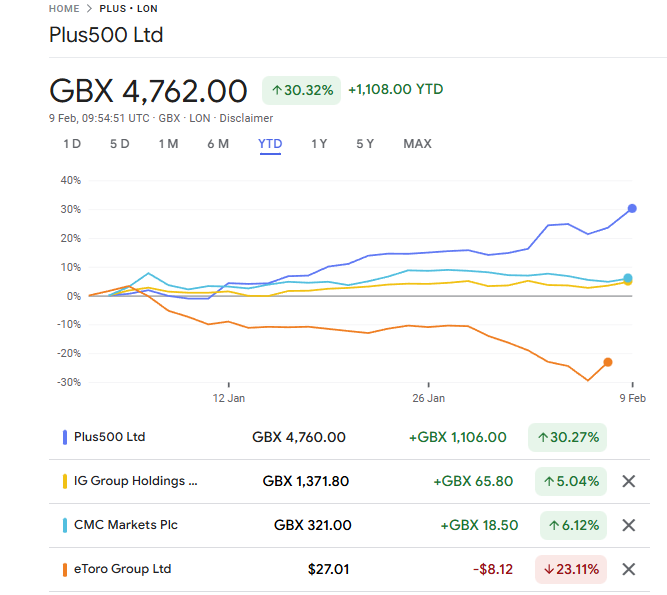

The chart below shows Plus500 versus the IG Group, CMC and eToro share prices. YTD.

-

There has got to be a really awesome 4 way trade there, I’d be a buyer Plus500, based on their sports sponsorship and them being one of the first to enter prediction markets in the UK. Not sure about eToro, I can’t help but feel they have peaked, but have a massive client base so I wouldn’t write them off – IG and CMC – overall long in the long run…

like like

like dislikeReacted by Darren Sinden

dislikeReacted by Darren Sinden -

-