Copper edges to fresh highs on supply fears

While gold and silver took a breather in the last few sessions, the commodity bull cycle continues to swing up. This time, copper is silently probing new all-time highs.

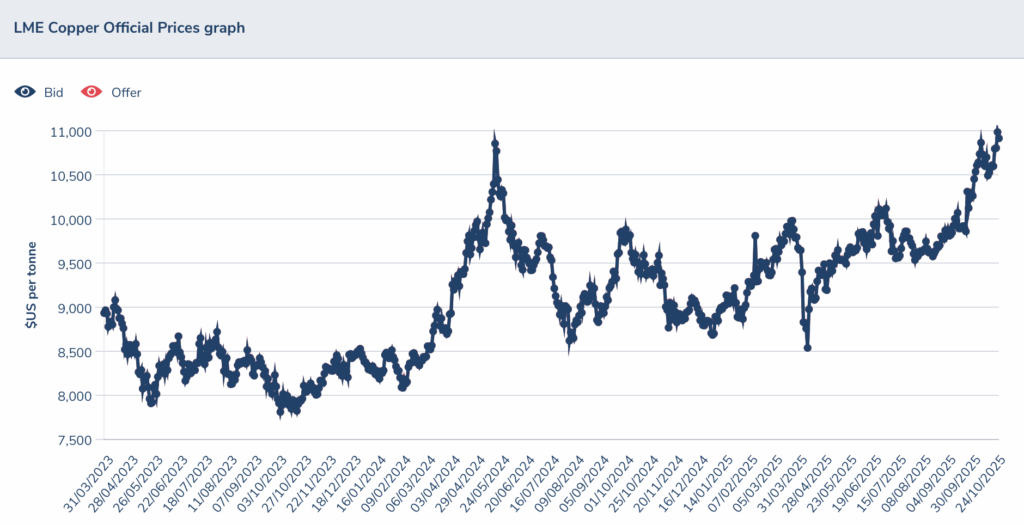

Spot copper prices from the London-based LME exchange are cracking the 2024 peak near the $11,000/tonne mark (see below).

Big copper bull runs don’t happen frequently. This one was an unexpected rally. Who, for example, could have predicted record copper prices this year amidst the ‘Liberation Day’ tariffs chaos back in April? Not many. But markets often behave in ways that confound expert judgements. Human emotion plays a part in fostering massive price swings; exogenous shocks another.

So, what is the red-hot “Doctor Copper” trying to tell us? For one, the demand for the industrial metal is seemingly solid. This indicates a relatively stable global economy which, contrary to many pessimistic forecasts, is more robust than expected. “Where,” asked Scott Bessent, US Treasury secretary, recently, “is the market risk?”

Two, there is ‘tightness’ in the copper supply. Commodity rallies are driven either by supply disruptions or demand shocks. In recent months, copper is experiencing some supply issues.

The Grasberg mine in Indonesia, one of the largest copper-gold mines in the world, encountered deadly mud slide in September that forced the owner, Freeport McMoRan (FCX), to declare force majeure. Glencore (UK:GLEN), in its 3Q report released on October 29, forecast a 17% drop in its copper production this year due to lower head grade.

For Antofagasta (UK:ANTO), the chilean-based copper miner, it expects full year copper production to be “at the lower end of the guidance range”.

In sum, all these supply developments are price-positive. With the demand for copper continuing to rise year-on-year, any small hiccup on the supply side will fuel a rapid rise in copper prices.

Source: LME (2025)

Large copper mines are increasingly expensive

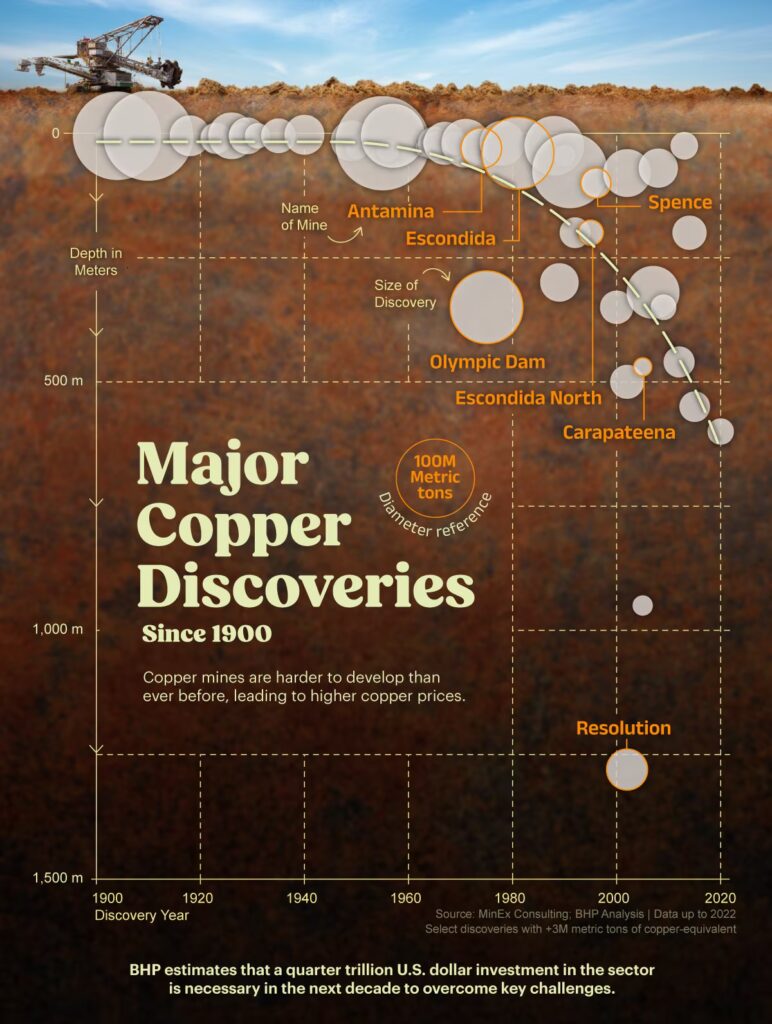

In addition, there are no major, easy-to-mine copper projects to be found these days. The biggest – and most economical – copper projects now were mostly discovered before the turn of the century. For example, one of the largest copper mines in the world – Escondida in Chile – was discovered in the eighties.

More importantly, recently found copper mines house not only smaller copper deposits, they are much deeper. This makes them much more expensive to develop.

To see this trend clearly, BHP handily provides some interesting info for us. The chart below tabulates the size of the copper mine (circle size) against the depth of it. Running along the horizontal axis at the bottom of the chart is the date of discovery of these mines.

As you can see, most large working copper mines were discovered in the last century. In recent years, geologists had to dig deeper – and deeper. These newly discovered large copper mines are between 250-500 meters below the surface. The Resolution Copper mine has deposits 1,250 meters underground! No more ‘low hanging fruits’ in copper mining.

Source: BHP (2024); See further insights on copper here.

Should we buy copper stocks now?

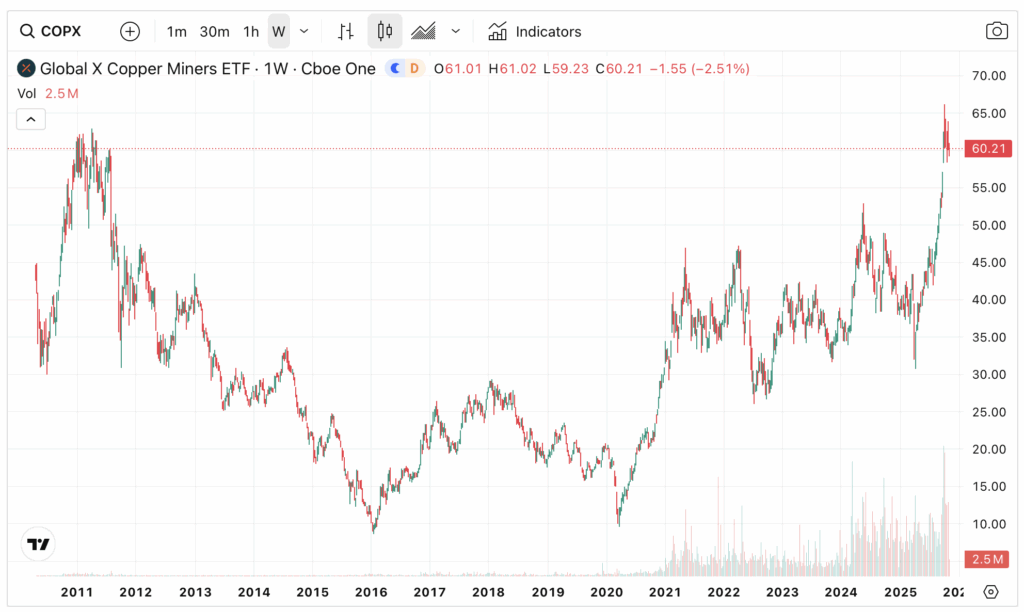

Unsurprisingly, copper miners surged as copper pricing heads north.

The $3.4 billion Global X Copper Miners ETF (COPX, factsheet) broke out in the summer and swiftly touched 14-year highs. As long as copper prices maintain its bullish trajectory, COPX may extend the upward trend into the new year (see below).

In the UK, Antofagasta is a pure play copper stock. Prices recently surged to record highs. The near-term upside target for the Chilean-based company is at the round number £30.

However, should we buy copper miners now? Here are the pros and cons:

Pros

- Long-term upward demand trend for the metal (green economy requires plenty of copper)

- Large copper deposits increasing rare and difficult to operate (reduces the probability of overwhelming supply)

- Bullish copper prices

Cons

- Shares of copper miners up significantly in 2025 and are overbought medium term

- Global economy may slowdown (reduces demand for copper)

- Mine accidents, closures and depletion impact earnings (eg Grasberg)

Other Critical Commodities Also Advanced

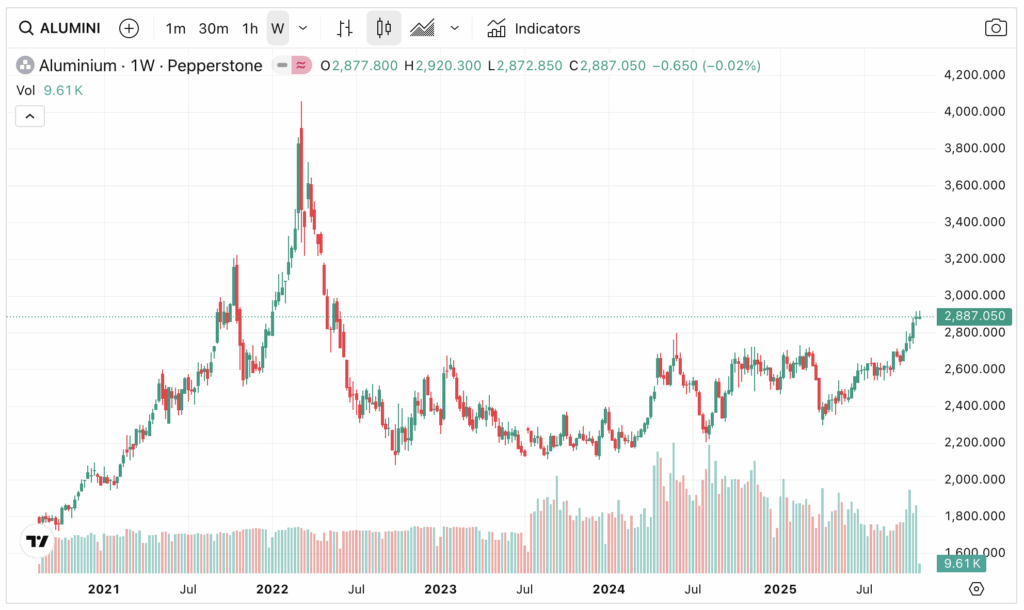

Copper aside, a few other metals have developed interesting bullish trends.

Aluminium, for example, rallied to multi-year highs in the second half of this year. Prices broke through the major ceiling at 2,700, forming what is known as a ‘base breakout’. Supported by such a long sideways trend, a rally above $3,000 is possible in this cycle.

But that’s not all. Remember, these are industrial metals that are abundant and not subjected to steep export barriers.

When one country commands a dominant supply position in some of these essential commodities and decides to impose such barriers, the resulting price action can be explosive.

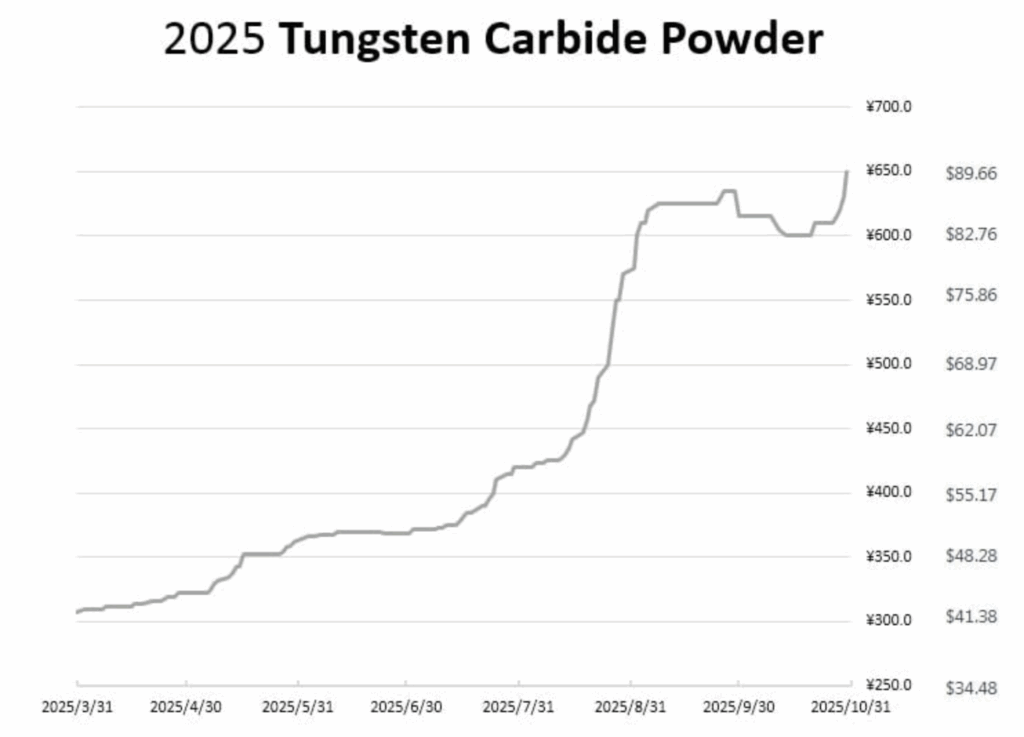

One prime example is Tungsten (periodic symbol: W). The largest producer is China (>70% of world production). The element is used in many industries.

Since February 2025, China has been tightening exports of the commodity. The consequence? Surging prices (up 100 percent in six months, see below).

Source: yatechmaterials.com

As a result, investors have been bidding up shares of miners of these critical minerals constantly throughout the year. Companies like Lynas (AUS:LYC), MP Materials (US:MP) and US Antimony (US:UAMY) saw 5-10x increase in their market values.

The problem is, these rallies have gone parabolic and bubbly. Since the US-China deal struck last week, most critical miners have dropped sharply from their Sept-Oct peaks. MP Materials, for example, has corrected 45 percent in a month (see below).

Is now a good time to buy, after a major setback? This depends on your investment horizon. Easing your way into the sector is a possibility since nobody knows how long the current sector consolidation will last. Another risk is that government policy may change direction out of the blue.

Given the volatility of the sector, correct position sizing (relative to your portfolio) is important.