A Happy New Year to all!

Not even a week into 2026, and seismic events are already unfolding at pace. The Maduro Extradition, Greenland threats, and ballistic action in gold and silver – all point to an exciting and dramatic year ahead.

I suppose it is customary to write one’s “Big Ideas” at the start of the year, summarising events and highlighting captivating and interesting trends. This week’s Macro is no different.

Without delay, here are my five potential stock trends to watch for in 2026.

1. Uranium equities to extend rally

Uranium has been a good sector theme to bet on since 2023. After a much-needed consolidation last year, the outlook is brightening again.

Let’s re-cap the pros of investing in U3O8:

- Nuclear fuel is a big energy component of the explosive demand coming from revolutionary AI technologies

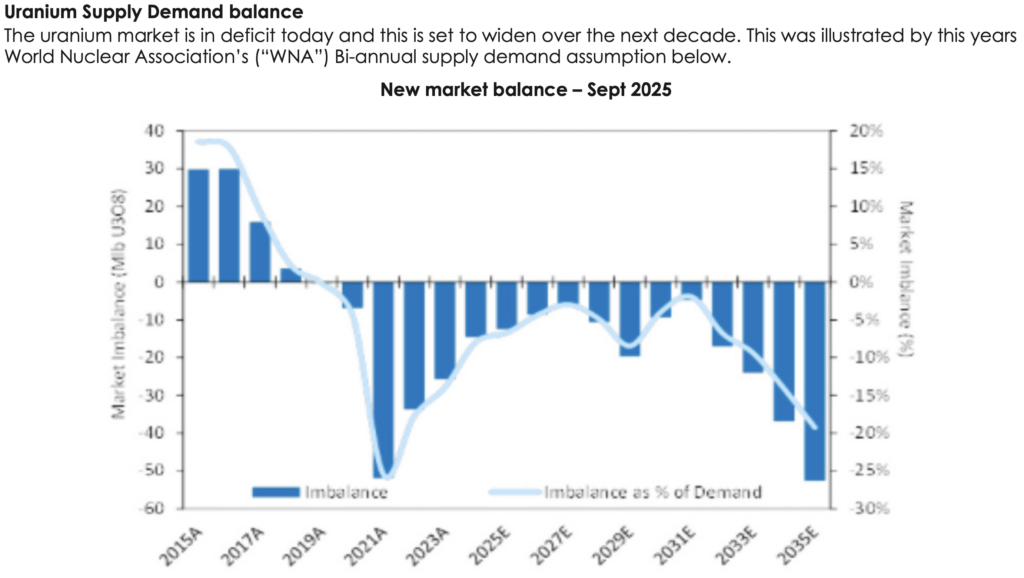

- The uranium market is in a deficit (see below) and according to the World Nuclear Association, the deficit will last for some years

- The development of nuclear-powered stations takes time

As such, all these bullish factors underpin a continuation of uranium equities’ advancement this year.

Point #2 is critical in my view, since it removes excess supply from the market continuously – a situation similar to the ongoing silver deficit. That monetary metal endured years of supply deficit before prices skyrocketed in 2025.

Source: GeigerCounter (LSE listed uranium fund, ticker: GCL)

As soon as 2026 arrives, many uranium stocks around the world are surging.

Take NexGen (US:NXE). The Canadian uranium miner breached the psychological $10 resistance and surged to record highs (see below). This appears to be a decisive breakout.

Paladin (ASX:PDN), the A$4.5 billion Australian uranium miner, also gapped up to suggest a base breakout. And if you flick through the charts of Cameco (CCO), Energy Fuels (TSX:EFR), Denison Mines (TSX: DML) – they all seem to convey the same message: We’re heading up. The first half of 2026 is thus looking great for this sector.

2. Financials to accelerate – then correct?

In my annual outlook for 2025, I highlighted the ongoing bull trend in financials, especially UK banks.

The sector has been benefitting from a number of sustained economic tailwinds, including:

- Steadily lower interest rates since late 2022 and a stable economy -> resulted in low default rates

- Sustained corporate profits

- Attractive shareholder returns (dividends, share buybacks)

In 2024, the UK Big Four banks (HSBA, NatWest, Barclays, Lloyds) raked in a combined £45 billion profit. This haul is likely to be higher for 2025. Hence the persistent rise in the share prices of all these British banks.

Lloyds, for example, recently tested the psychological £1 for the first time since 2008 (see my daily market posts on Invesdaq.com).

The problem that I’m anticipating this year is that these uptrends may accelerate higher – which is never sustainable long term – and then lead to a medium-term setback.

Look at HSBC’s weekly chart below. Each phase of the rally is steeper than the one before. The angle of the latest breakout from 950p is far more vertical. When a stock trend behaves like this, prudence is probably a better idea than chasing the trend higher.

The fundamentals of the sector have not changed much, just that prices are running ahead. A reversion to the mean remains a core market behaviour.

As such I would probably eye to book some profits on a further run, and watch to re-enter on a consolidation.

3. Space Stocks: ‘To the Moon!’

Talks abound of multiple gigantic IPOs this year.

“SOA” – SpaceX, OpenAI and Anthropic are all eyeing a public exit for their founders, backers and managers. And all are valued at hundreds of billions.

The most exciting, naturally, is SpaceX. A new frontier always captures investor imagination. SpaceX is by far the leader in the industry and its public listing may happen in the second quarter (assuming steady markets). Already, hype is building about its $1 trillion valuation. Investors are crowding into the sector.

Look at the ARK Space and Defence Innovation ETF (ticker:ARKX, factsheet). The $445 million fund shot up to new highs consistently since July 2025. As market demand heats up, this fund will only grow in size and potentially extend the uptrend into 2026.

The top 10 holdings of this fund are mostly in a bull trend, too. You can check out their individual charts and see you want to participate in their uptrends.

In the UK, the Seraphim Space IT (ticker: SSIT) gained more than 50 percent in the past month. Investors here are attuned to the opportunities offered by the sector.

Source: ARKX

4. Developed Asia Stock Markets Affirming Cyclical Bull Trends

Casting our eyes to Asia now.

We all know that 2025 was a really good for Japan. The benchmark indices (Nikkei 225 and Topix) advanced to new long-term highs. A secular (economic) change is taking place in the country, to the point that the central Bank of Japan (BOJ) was able to normalise the ultra-low interest rates.

What is even more interesting is that the bullish sentiment is spreading to other Asian countries.

Take a quick glance at South Korea’s KOSPI Composite Index. The 900-member equity index extended the massive upside breakout (at 3,000) to record highs this year. Samsung and SK are two of the largest constituents of the index. With upward momentum this strong, reaching 5,000 this year should not be too difficult.

As you can see from KOSPI’s chart, the surge here is the steepest in decades! Is this, I wonder, the start of a secular rally akin to the breakout in Dow Jones back in 1982?

If you think that’s the only bull trend in Asia, jump over to Singapore. The Straits Times Index is also locked in a cyclical uptrend (see below). Bank shares there (eg DBS) are rising nicely.

In other words, exposure to the region is desirable. Economics 101 tells us that when a national stock market booms, the extraordinary wealth effect it produces can ripple throughout the entire economy for some time, which then reinforces the corporate fundamentals and subsequent growth trajectory.

In sum, 2026 could be a good year for these Asian economies.

Even China is looking decent, with some large-caps recovering from recent pullbacks (eg US:BABA).

5. Building Blocks of Modern Economies: Metals and Minerals

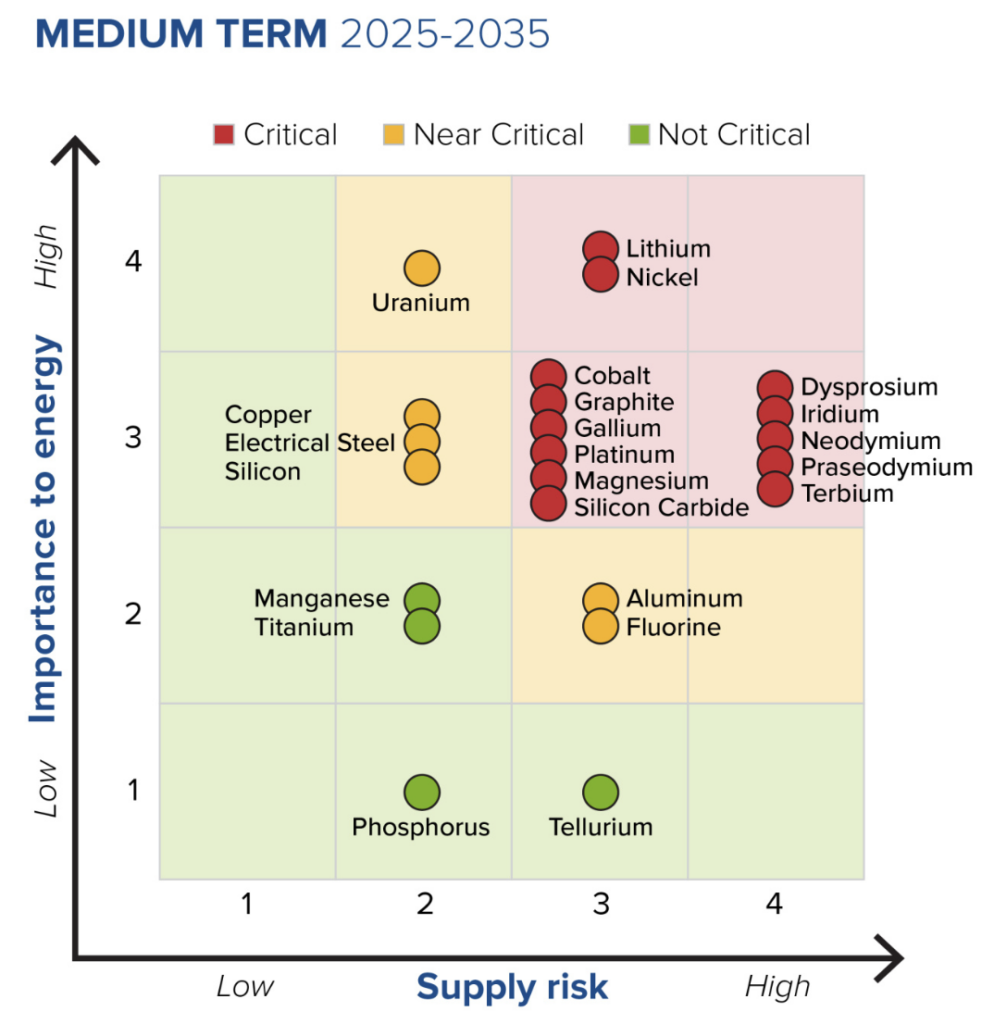

Critical minerals form the backbone of modern economies.

From copper to lithium to rare earths, these minerals are crucial. Last year saw a decisive revival of the sector as the US administration moved to reduce the choke points in the sector.

According to the US government, there are now 60 critical minerals essential to the American economy (see the full list here). The government strives to ensure that the smooth supply of these commodities.

Interestingly, the US energy department also ranks the importance of some these minerals according to the following matrix:

Source: US gov (energy.gov/cmm/what-are-critical-materials-and-critical-minerals, Aug 2025)

Therefore, the ongoing investment in the sector will persist into 2026.

Yes, the sector overheated in the 3Q last year, which led to a deep consolidation. But the case for the industry remains almost unchanged. Finding the mines, mapping the location, building processing plants, gathering sufficient funding, and shipping the final products to manufacturers is a long process. Building this supply chain takes time.

MP Materials (US:MP) jumped 5x last year before consolidating. Lynas (ASX:LYC), the Australian rare-earth miner, also slumped in 2H before finding tentative support.

Therefore, a case can be made for buying these stocks after a deep sell-off, betting a rebound later this year.

Another sub-sector to look at is Copper. This industrial metal is listed as “critical” by US govt and prices have been rising steadily throughout 2025.

With supply growth fairly limited, the trend here appears cyclically bullish. Copper miners, proxied by this Global X Copper Miners (US:COPX), are trading near their multi-year highs. One example is Antofagasta (LSE:ANTO) in the UK.

The last chart I would like to show is Lithium, a key component for batteries. Lithium prices have been sliding for some years. But it appears the bottom has been reached.

The portfolio of Lithium miners, tracked by Global X Lithium and Battery ETF (US:LIT), rebounded from the multi-year lows in the middle of last year. The bounce was sustained and broke the entrenched downtrend decisively.

A further revival in 2026 is a distinct possibility. Watch to buy on setbacks.