- This topic has 2 replies, 2 voices, and was last updated 1 month, 1 week ago by Jackson Wong.

For many long years, Silver was the forgotten cousin of gold – has it now found it’s voice…

When gold powered to new all-time highs back in 2024, silver was found languishing beneath $30 an ounce. That’s nearly $20 beneath its 1980 highs nearly half a century ago.

In other words, silver was trading – using inflation-adjusted pricing – at levels far beneath its “real” price.

No longer. Silver has surged and surged in recent months. Its price and relative performances easily outpaced that of gold’s.

From $40, silver promptly doubled in one quick sprint. The breakout at $50 was decisive. The upward acceleration to the record $83 was wild – and unexpected.

Prices peaked in the last trading session before Christmas, before tumbling this week down to $70.

Given this climactic price action, everyone wonders: Is silver’s rally over?

CME, the US commodity futures exchange, has this week raised silver’s margin requirements, in order to temper speculative activities. Higher margins mean traders need to stump up more cash to open – and hold – silver positions. This echos the margin hikes back in 2011 when silver skyrocketed to $50 before crashing down.[1]

This time, however, could be different.

For one, from Jan 2026 China is placing a ‘permit-only’ restriction on refined silver exports. For your information, China/HK are the largest silver exporting entities. When the largest supplier of the refined metal decides to restrict its flow, users will immediately stockpile.

Two, silver has been running annual ‘deficits’ since 2020. This means the more silver are being used than produced. In turn, this means excess silver supply in the market was gradually absorbed.

Remember that silver is an industrial metal widely applied in the green economy (eg solar). Given silver’s steep price appreciation, even Elon Musk is now worried. He recently warned on X (27 Dec): “This is not good. Silver is needed in many industrial processes.”

This means that silver’s recent margin hikes may have less impact in containing its bull market. Silver’s fundamentals are strong and end users will demand the metal regardless of the margins raised.

Uncertainties around future silver availability is also pushing many silver future holders to request the physical metal instead of accepting cash settlements. This may lead to a scramble to buy physical silver in order to deliver the future contracts.

In conclusion, the only determining factor in predicting financial prices is still supply and demand. When demand is high and rising, and supply constant, prices go up. As simple as that.

The only economic cure to reduce demand and increase supply? Higher prices, far higher prices.

Imagine silver trades at triple digits. Every silver miner will be incentivised to dig the metal out of the ground to supply the market. For now, I suspect we’re not there yet.

That said, the risk-reward in chasing silver now is obviously not as good as before. Price volatility is high; downside risk is swelling. Some exposure adjustments may be needed to balance the portfolio.

[1] https://www.cmegroup.com/notices/clearing/2025/25-393.html

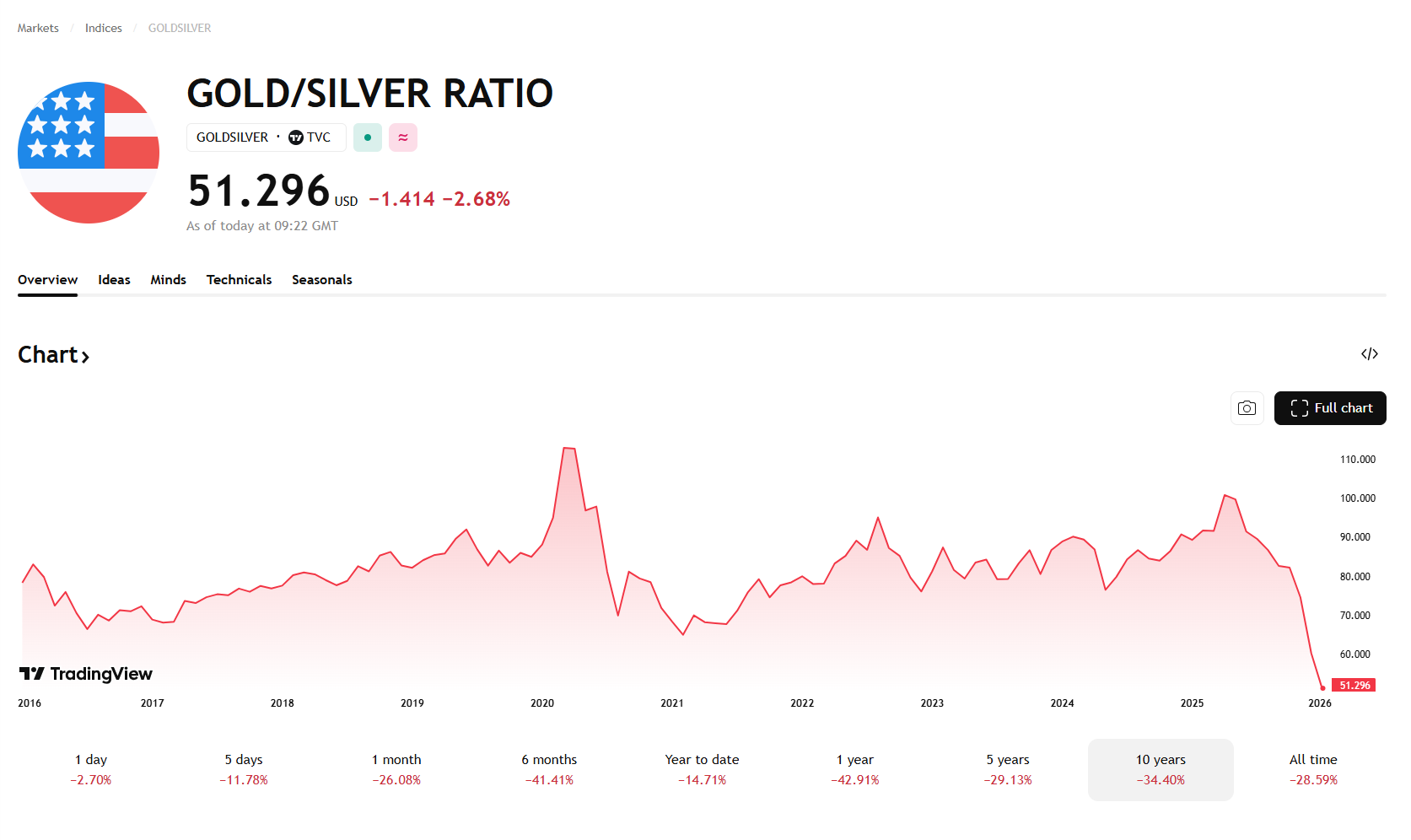

The Gold Versus Silver ratio is at its lowest in 10 years, based on the fact that Silver is largely correlated to gold – albeit much more volatile. Is there an argument for buying into this as a pairs trade?

When silver is on a roll, it is best to stay out of its way.

The metal has a habit of churning around aimlessly for a long time until prices march resolutely northwards.

Has silver reached the the climactic end? I’m not so sure.

To bet on the spread narrowing (long gold; short silver) is a bet on gold outperforming silver.

This may well happen in the future.

But in the meantime, one may need to guard against a further widening of the spread.

The relative trade could sink into a loss first before recovering. This consideration needs to be ironed out before initiating the spread trade.

- You must be logged in to reply to this topic.

Invesdaq

Welcome to Invesdaq, a social network for investors.