- This topic has 2 replies, 3 voices, and was last updated 3 days, 19 hours ago by Edward Sheldon.

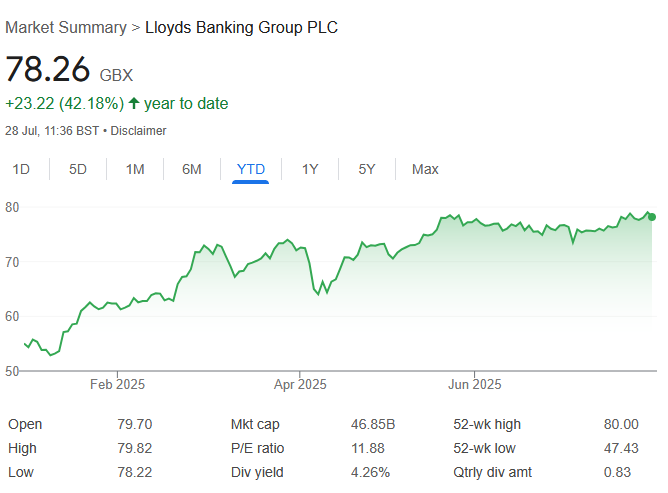

Lloyds (LLOY:LON) shares have been a great investment over the last five years. Believe it or not, they’re up about 200% over this timeframe – a return of around 25% per year. What about the next five years though? Can the share price keep rising or are we likely to see returns moderate?

Timing is key with bank stocks

Before we discuss the five-year outlook for Lloyds shares, it’s worth zooming in on their recent gains. Because the returns generated over the last five years are a little bit misleading.

You see, five years ago, a lot of stocks were heavily depressed due to the coronavirus pandemic (with the world on lockdown and the global economy facing major challenges, bank stocks like Lloyds were under pressure and trading very cheaply). As a result, five-year returns have been larger than usual.

If we look at 10-year returns from Lloyds shares, the numbers are not nearly as impressive. In fact, over the last 10 years, the share price has gone backwards.

This shows that with a stock like Lloyds – which is cyclical – timing is important. If you buy at the wrong time, returns can be underwhelming.

The outlook for Lloyds shares

Looking out over the next five years, it’s hard to know how Lloyds’ share price will perform. Ultimately, there are a lot of variables that could impact the shares.

One such variable is the UK economy. If the economy was to experience weakness, Lloyds shares could underperform. Right now, the bank is performing well (net income for H1 2025 was up 5% year on year to £8.9 billion) because credit conditions are relatively stable. If borrowers were to start defaulting on their loans as a result of economic weakness, however, I’d expect profits to deteriorate and the share price to move lower.

Another variable is UK interest rates. These could impact the bank stock in a few different ways. If rates came down slightly, it could be supportive for Lloyds as it may increase borrowing and refinancing activity. However, if rates were to fall significantly, it may limit the amount of net interest income (the difference between income generated from lending and the costs of borrowing) Lloyds is able to generate, putting pressure on profits.

Regulation is another factor worth mentioning. Banks like Lloyds tend to be targeted by financial regulators on a regular basis. For example, right now, Lloyds is in the spotlight due to the Financial Conduct Authority’s (FCA) investigation into motor finance mis-selling. Further investigations into the bank over the next five years could hurt the shares.

Of course, sentiment towards UK shares and bank stocks will also be important. This year, sentiment towards these areas of the market has been very strong, leading to significant share price gains across the banking sector. Looking ahead, however, sentiment may not remain as bullish. One reason sentiment has been strong this year is that investors have focused on diversifying away from the US market and tech shares.

Finally, investors need to think about FinTech disruption. Right now, FinTech companies are rapidly capturing market share from traditional banks like Lloyds. Digital banks, in particular, are having a lot of success. If this trend continues, it could have implications for Lloyds’ profitability.

My prediction for Lloyds’ share price

Put all this together and there’s a lot to think about when considering where Lloyds shares could go over the next five years. There are many different factors at play, so it’s hard to make an accurate share price forecast.

My own prediction – assuming no major economic downturn but relatively low economic growth in the UK – is that the shares will be trading somewhere between 70p and £1 in five years’ time. In other words, I see the potential for some gains, but I don’t expect the gains to be prolific.

This looks like a deceptively easy question on the face of it, after all the stock returned +80.65% over the last 12 months, according to data from Barchart.com.

However the more I dig into the question the more complex it becomes. And that’s because we have to look away from the performance data and ratios, and consider the bigger picture.

Lloyds is almost 100% exposed to the UK in revenue terms, true it enjoys significant market share in key sectors such as mortgage lending. However looking at the state of the UK housing market, and economy, that could just as easily be a poison chalice as much as a holy grail for the bank.

House building is slowing dramatically in the UK, that despite the Labour govts goal of building 1.50 million new homes in the current parliament.

The so called mansion tax and the initial proposal about levying IHT on large family farms shows that this government sees private property as potential cash cow.

And having drunk from the well once, it’s highly likely they will come back for another swig.

Income tax was of course introduced as a temporary measure to help fund the Napoleonic wars but 200 years (and more) later its still here.

And though, Rachel Reeves resisted the temptation to place additional surcharges on bank profits in November, will she be able to resist low hanging fruit like that in future?

The UK economy is currently flatlining in GDP terms. The jury is still out on inflation, and unemployment is on the rise. None of which will help decidedly shaky looking UK finances, and neither is it bullish for the domestic economy on which Lloyds relies.

Returning to Lloyds historic performance and key ratios: 5 year revenue growth at the bank come in at just +0.54% whilst dividend growth over that period is negative at -2.31%.

Provisions against motor finance compensation claims have dragged YoY and QoQ EPS growth into negative territory as well, though over 5-years earning have grown by almost +13.0% and the bank currently enjoys 20.0% profit margin.

Lloyds needs to grow its top line, because cost cutting and reductions in head count and high street branches, can only carry the bank so far. It seems unlikely that it could win significant market share without the demise of a competitor, and Santander’s recent purchase of TSB suggests that’s unlikely.

I think the best that Lloyds can hope for is the status quo and given that I would refer to own a UJK bank with overseas exposure such as Barclays.

I think some banks stocks could do well over the next five years. However, I find it hard to get excited about Lloyds – I reckon it may underperform its peers.

One downside to this bank is that it is predominantly UK focused. So, its fortunes are tied to the UK economy, which isn’t exactly firing on all cylinders at the moment.

For 2026, the IMF is projecting UK GDP growth of just 1.3% (versus global growth of 3.1%). UK growth may pick up in the coming years, but I don’t expect growth to be strong – we just don’t have the growth industries (e.g. technology).

Another downside to Lloyds is that it lacks the growth drivers other banks have. Barclays, for example, has a significant investment banking division. So, it can capitalise on IPOs. Other banks have large wealth management divisions so they can capitalise on rising equity markets.

With Lloyds, the story is mainly about UK mortgages. Ultimately, it’s a bit of a one-trick pony.

As for the valuation, the stock looks fully valued to me today. At present, Lloyds is trading on a P/E ratio of about 13 and a price to book value ratio of about 1.3.

So, I don’t think there’s a lot of scope for an upward valuation rerating in the near term. This could limit gains.

Overall, I’m not very bullish on Lloyds taking a five-year view. It could do well if the UK economy booms and it leverages technology to cut costs, however, in my view, there are better bank stocks to buy.

- You must be logged in to reply to this topic.

Invesdaq

Welcome to Invesdaq, a social network for investors.