Tony

-

0

Posts -

0

Comments

-

-

-

-

Darren Sinden posted an update

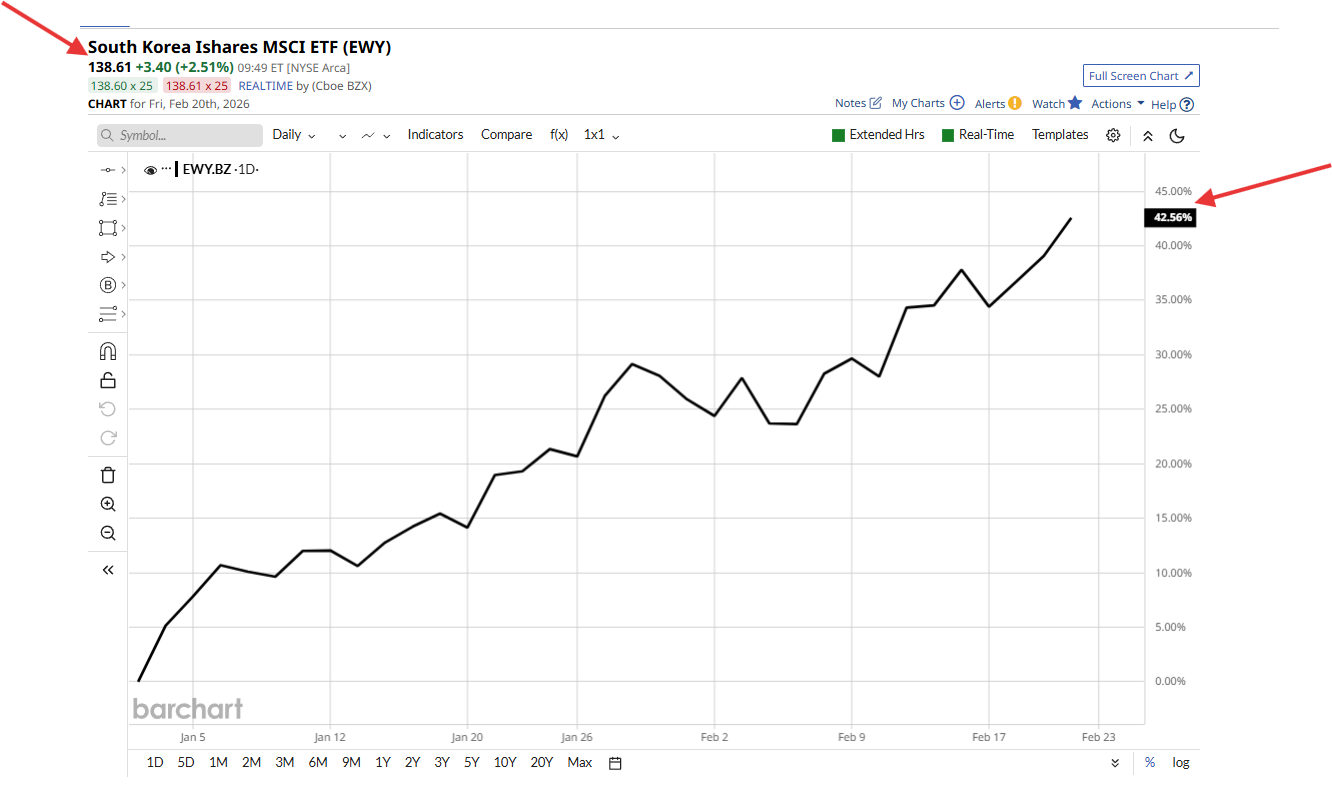

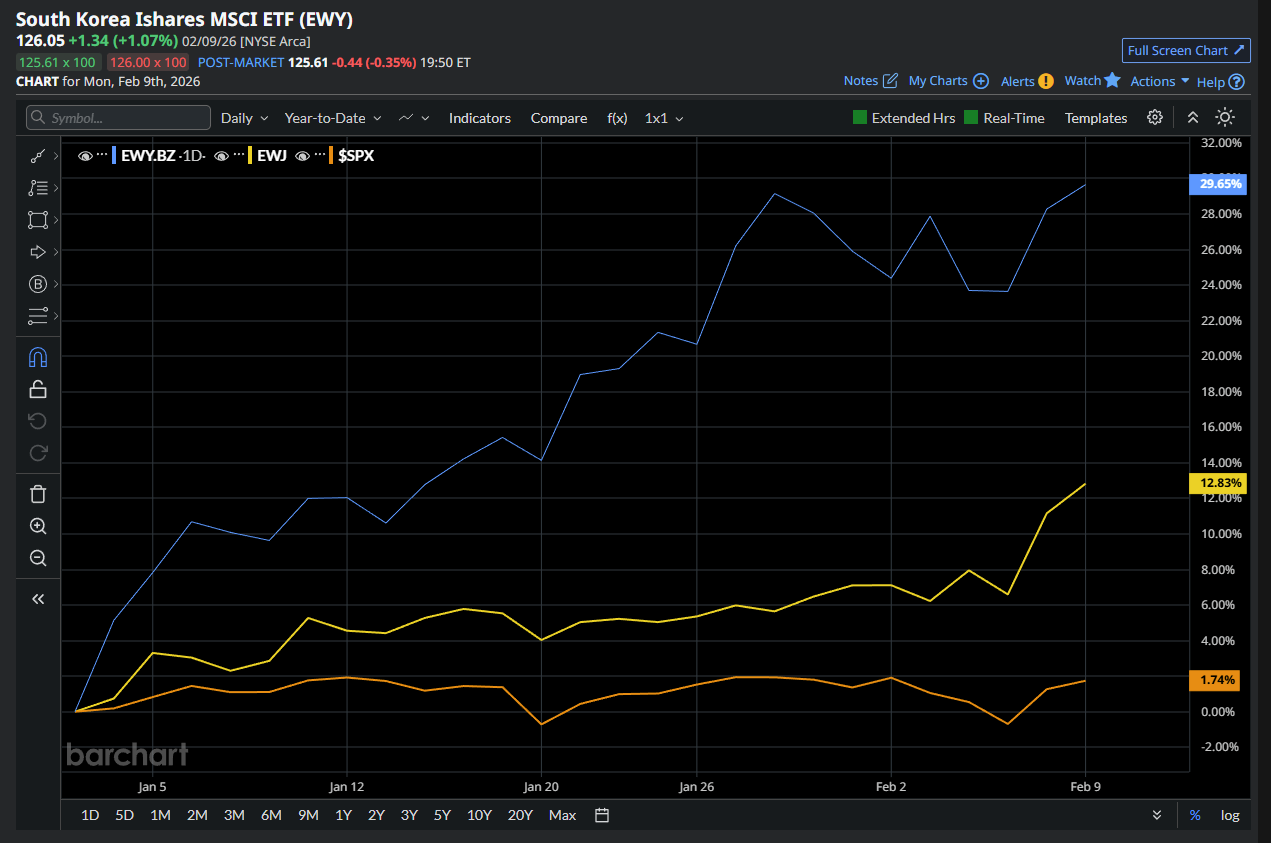

12 hours, 10 minutes agoI don’t know if you have checked EWY US the South Korea iShares MSCI ETF recently but you might be quite pleased if you do.

Because they are +3.59% today and by more than 25.0% over the last month .

You may recall that I tipped Korea to out perform the US S&P 500 in 2026 (see the link below).And though its early days we are of to a good…[Read more]

-

Darren Sinden posted an update

13 hours, 10 minutes agoAllied to those questions about sustainability and renewable energy, here is a link to a very interesting essay on the nature of a business and what it should strive to do ,and who it should try to please? From NYU Stern Business School Professor Aswath…[Read more]

-

Darren Sinden posted an update

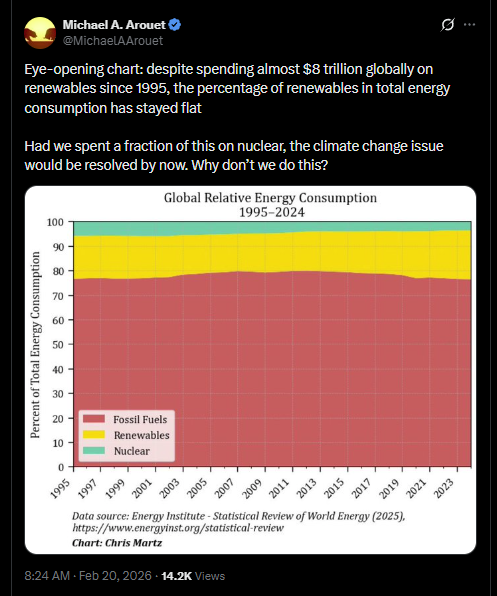

13 hours, 17 minutes agoHas the whole renewables energy and sustainability drive been just a sideshow and a colossal waste of time ? looking at his chart and associated comments its hard to think not .

-

Darren Sinden posted an update

16 hours, 48 minutes agoIts a tricky market for fund management companies right now.

At one end of the spectrum we have St James Place which has been disrupted by the emergence of tax and financial planning AI with the stock falling by as much as -13.39%, in a single session 9 days a ago.

At the the other end of the spectrum we have Schroder’s which is the…[Read more]

-

Darren Sinden posted an update

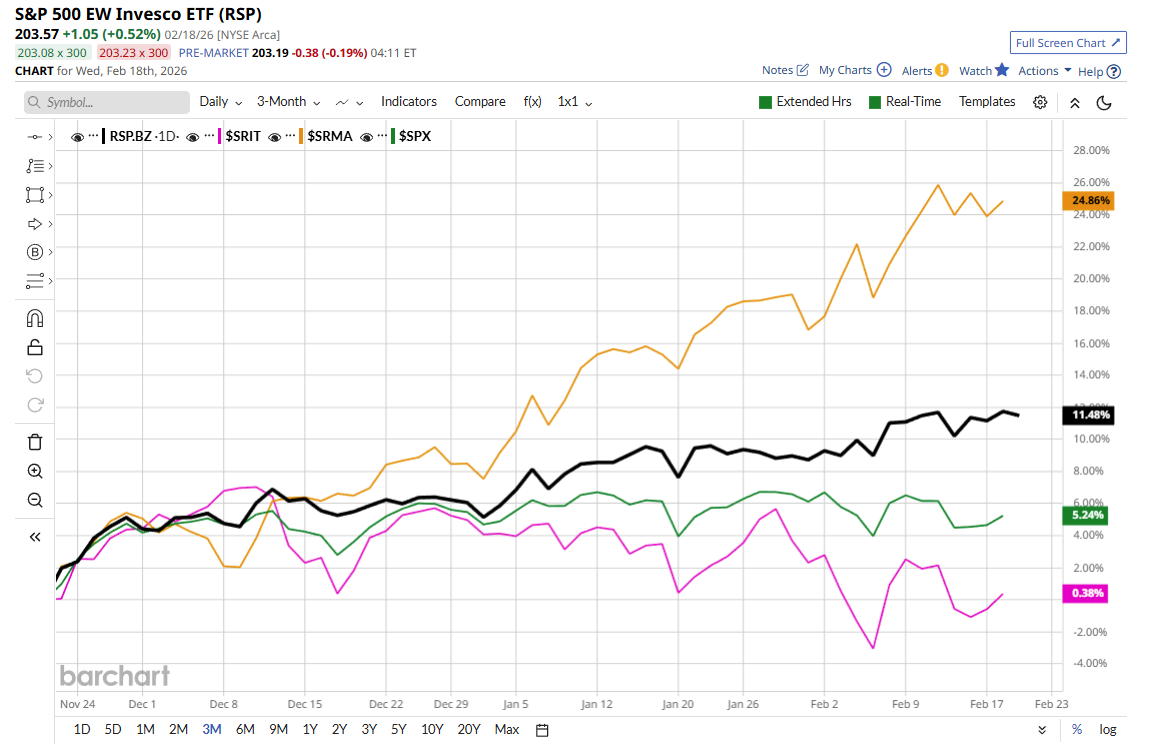

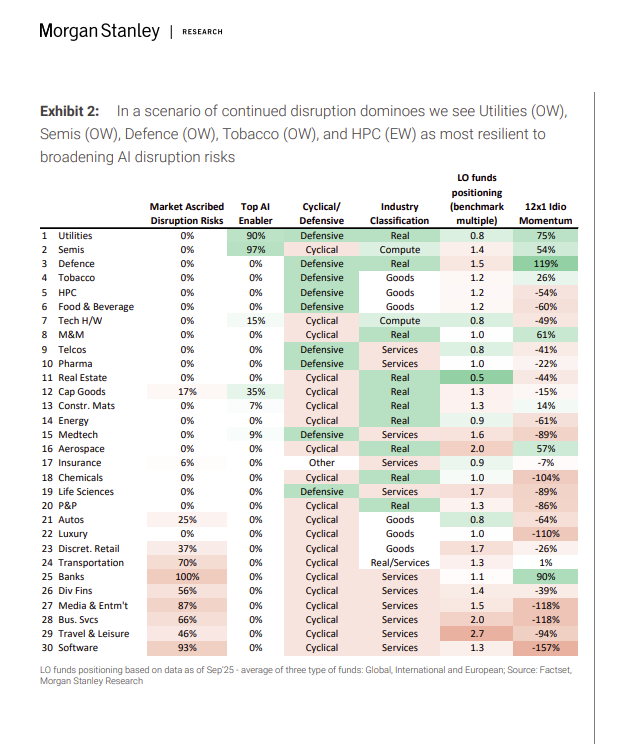

1 day, 17 hours agoOutperformance that’s a word that keeps cropping up in my feeds most likely because that’s not what most people and their portfolios are doing right now .

Why is that ? Well put simply they have the wrong positions / exposure tracking the market through an ETFR like SPY, VOO or their European equivalents is a great plan until the stocks that…[Read more]

-

Darren Sinden posted an update

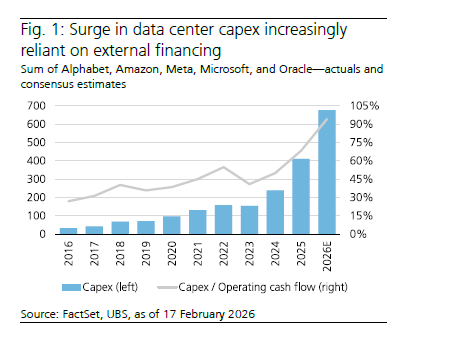

2 days, 18 hours agoUBS Wealth has downgraded the Communication Services sector today it follows a downgrade to the Information Technology sector by the money manager last week The wealth manager is concerned a bout the scale of AI and data centre related capex n the sectors which it reminds customers could consume most of the sector free cash flow leaving…[Read more]

-

Darren Sinden posted an update

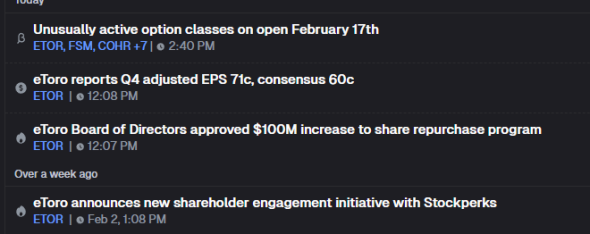

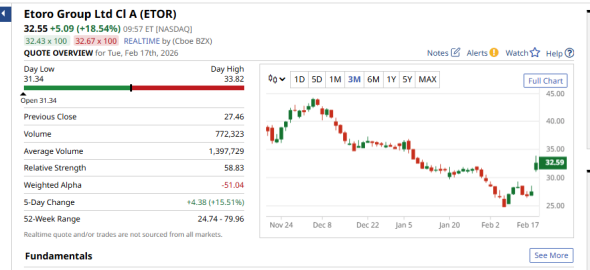

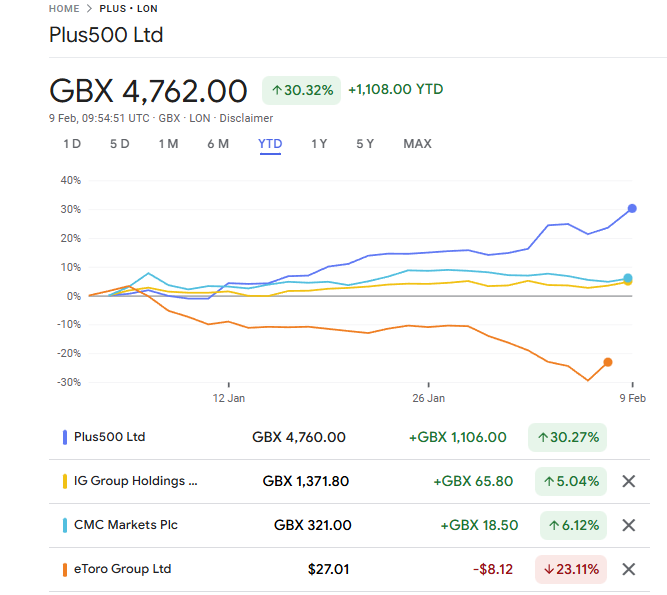

3 days, 12 hours agoMulti asset broker eToro ETOR US sees its stock rally by +18.0% today following better than expected earnings and news of an additional $100 million share buy back.

Though the stock remains well below its June 2025 highs circa $79.96. a close above the 50 D MA found at $33.48 would be something for the bulls to hold on to.

Rivals Robinhood…[Read more]

-

Darren Sinden posted an update

3 days, 18 hours agoAt the same time we need to offer a counter balance and in that sprit I offer this piece by Andrew Orlowski a technology journalist writing in the Telegraph .

“AI isn’t magic. We’re just being taken for mugs”

I find myself som…[Read more]

-

Darren Sinden posted an update

3 days, 18 hours agoIf you are wondering what has caused this rotation in the market and why Software is suddenly a poison chalice then you should probably read this article by Matt Shumer

Which will set the scene and help to explain why AI agents may eat software’s lunch .

-

Darren Sinden posted an update

3 days, 19 hours agoThese are strange days in the markets make no mistake. Consider this comment on the S&P 500 by former market maker Noel Smith:

” The S&P is flat over the past month, but the average stock moved 10.8% — a dispersion spread at the 99th percentile over 30 years. ”

And this recent quote from market commentator Michael Batnick “Wild market. W…[Read more]

-

Darren Sinden posted an update

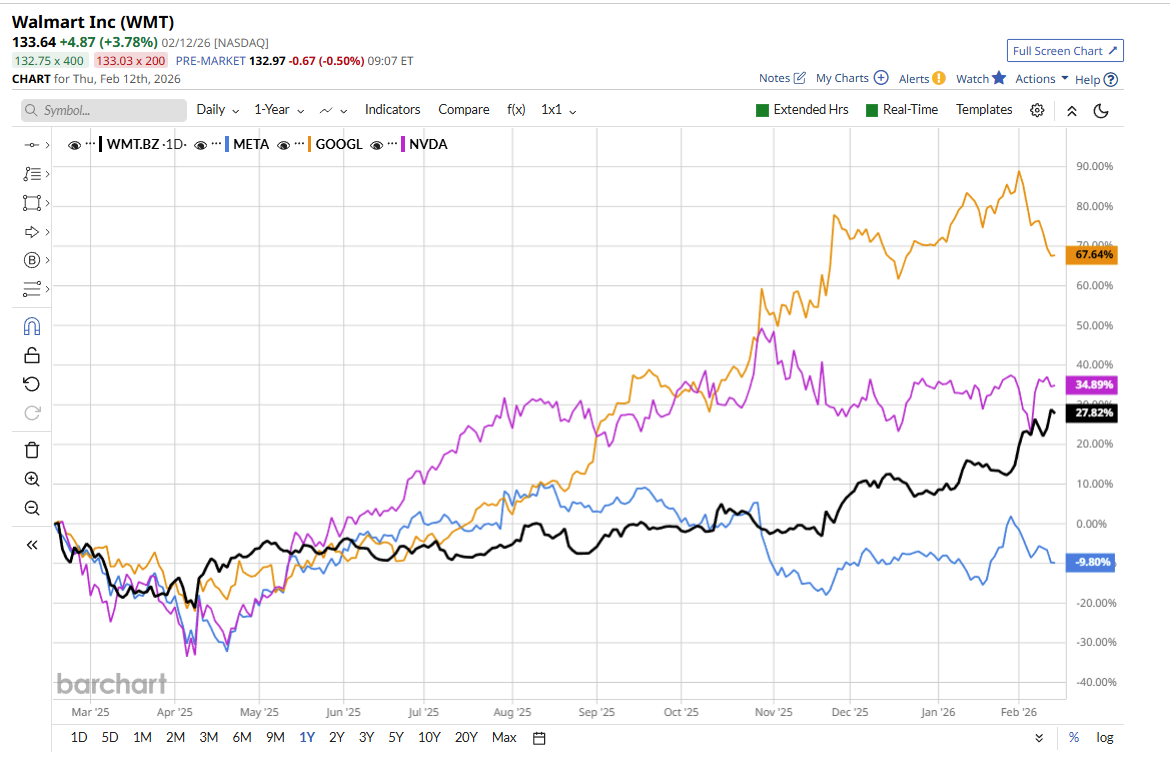

1 week agoWhich of these would you rather own right now? and for the long-term?

I am happy to stick with Walmart WMT US myself.

I picked them out 18 months or so ago and I am happy with how they have performed and their prospects going forward

-

Darren Sinden posted an update

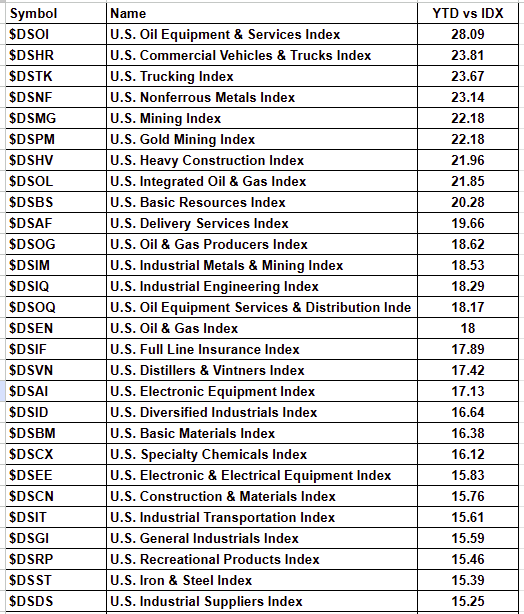

1 week agoThey day it will all change is not far away!

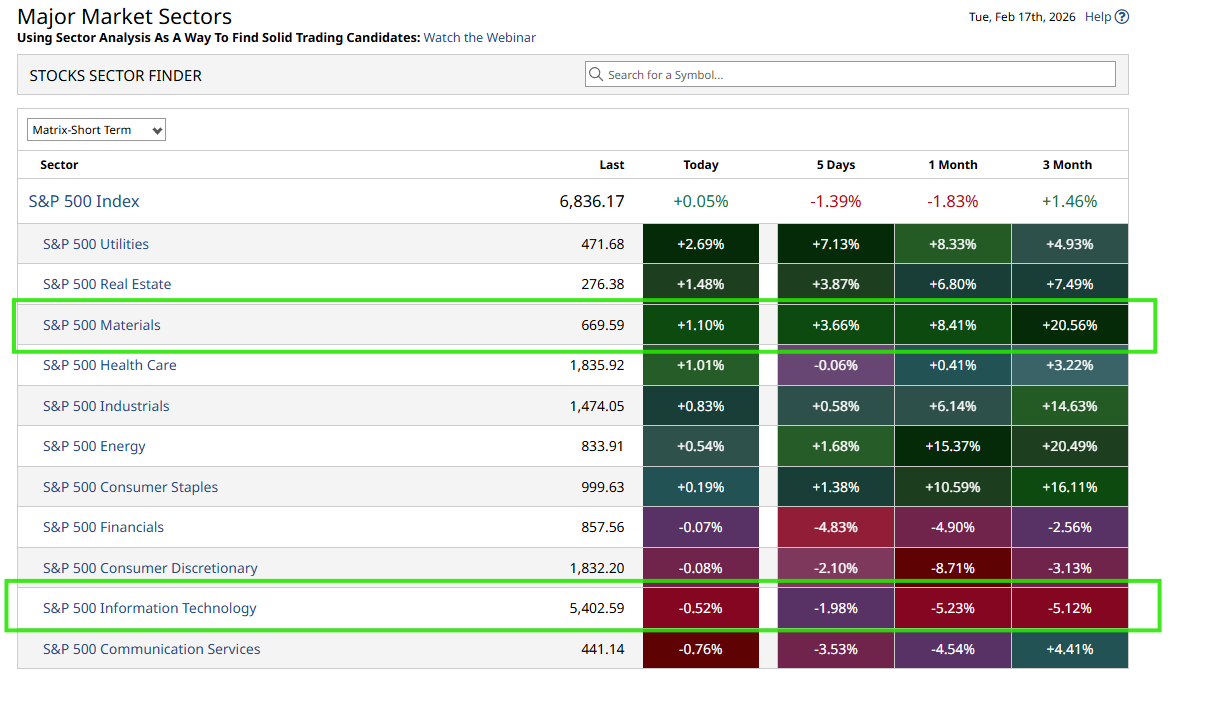

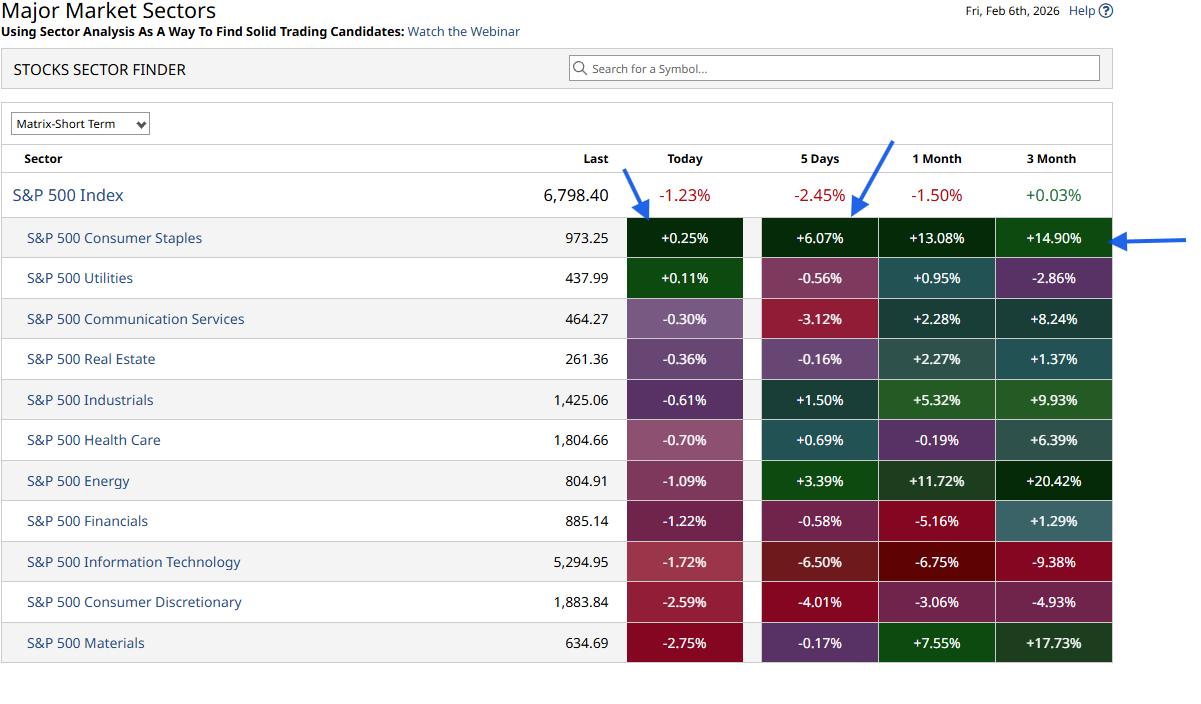

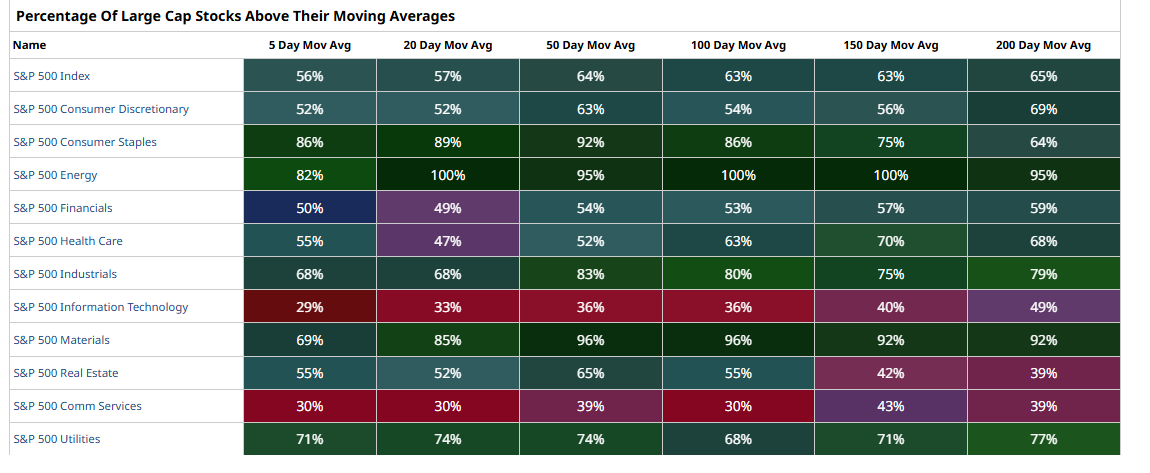

I spent a lot of yesterday looking at the sectors and industries that have outperformed the S&P 500 over the year to date what was very clear is that many of these outperforming groups have their roots in the old economy ( see table 1) rather than the new economies of software and technology.…[Read more]

-

Darren Sinden posted an update

1 week, 1 day agoThe shares of financial adviser St James ‘s Place sold off by -13.39% yesterday. The reason the emergence in the US of a new platform that will allow financial advisors to create bespoke tax efficient planning for their clients.

In other words Ai is helping to automate and speed up, and personalize the advisors job, and that wasn’t seen a…[Read more]

-

Darren Sinden posted an update

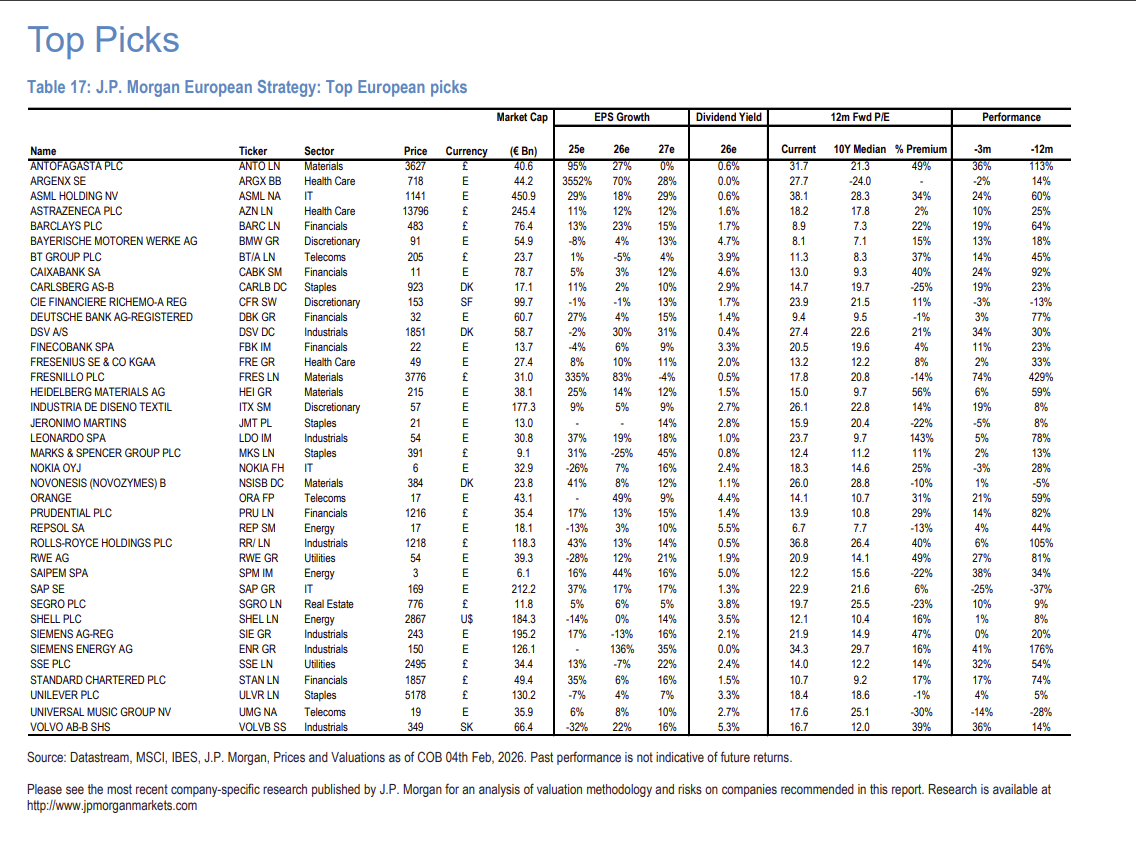

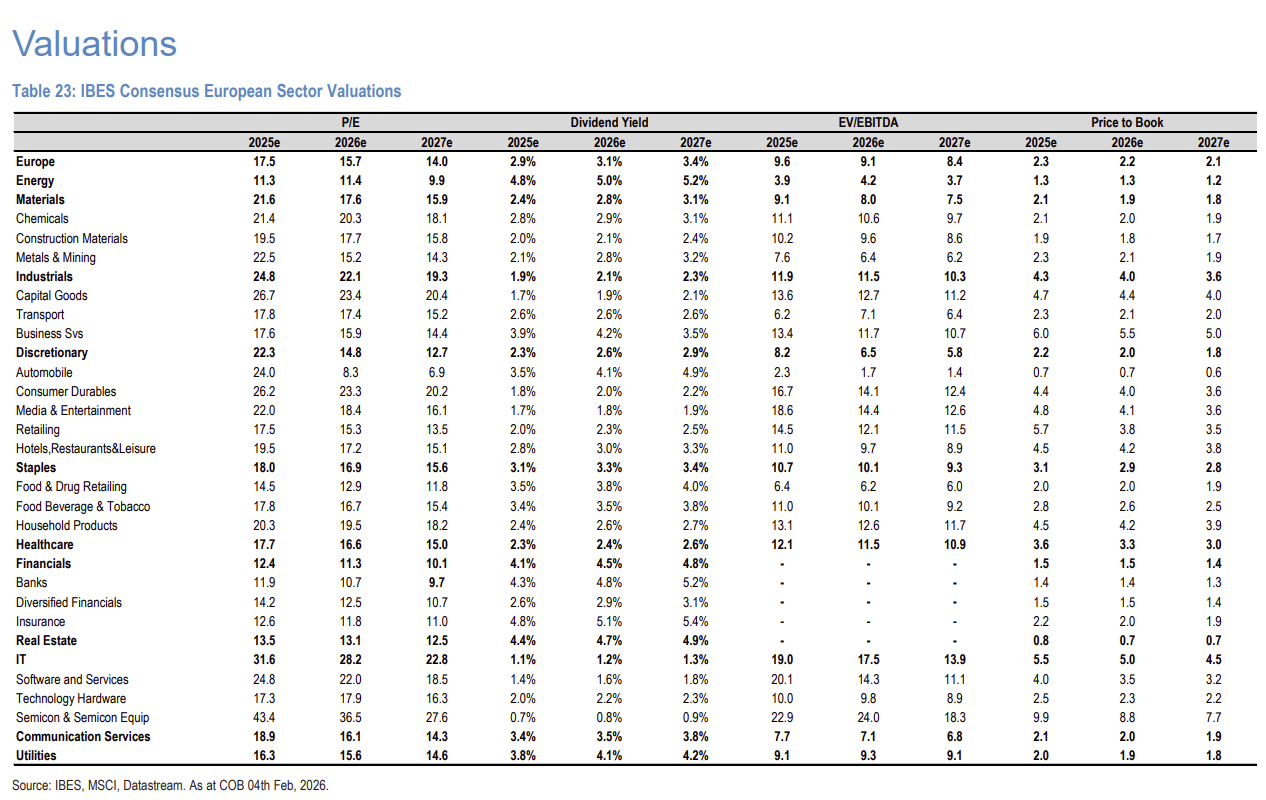

1 week, 3 days agoJP Morgan wrote on Equity Strategy yesterday and kindly published a list of their top European stock picks as they did so see below.

They also posted a very useful valuations framework for European Equity sectors, out to 2027. So there is plenty to get your teeth into here

-

Darren Sinden posted an update

1 week, 3 days agoThe action is in Asia once more.

US markets are unable to form a consensus right now when it comes to direction, and the most important narratives. Will AI eat software? Or will its gargantuan Capex requirements bankrupt the Mag 7 and Co before it reaches singularity?

South Korea and Japan, or at least their equity indices seen…[Read more]

-

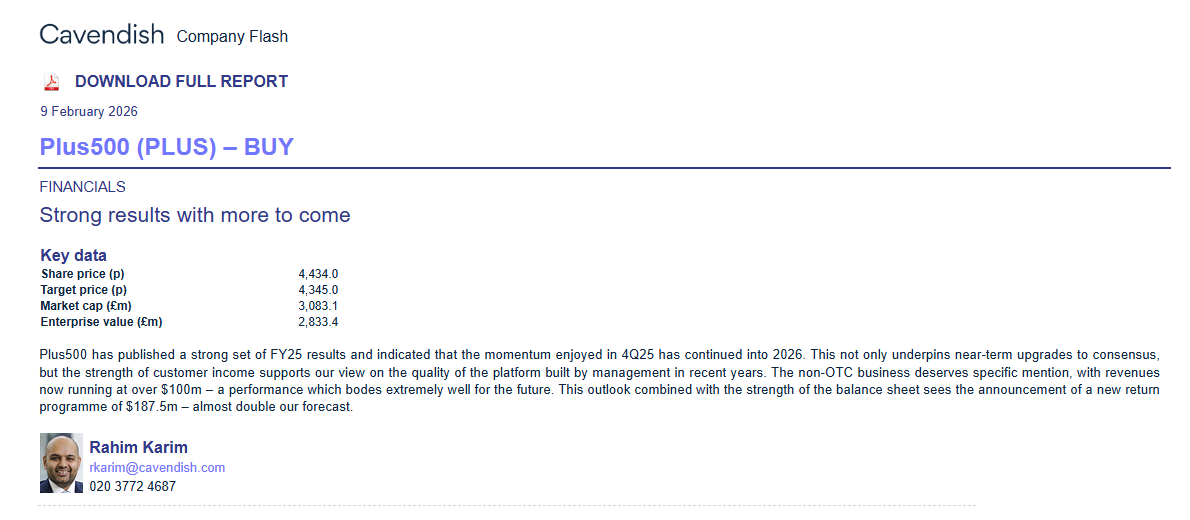

Darren Sinden posted an update

1 week, 4 days agoAnother good day for Plus500 shareholders as UK broker Cavendish rate the stock a buy, following upgraded guidance from the business. Which pointed to increasing revenues from its non-OTC activities. Which Plus500 called ” a key growth driver”. And which is said was “supported by positive momentum across global financial markets, as well as…[Read more]

-

Richard Berryreplied 1 week, 4 days ago

There has got to be a really awesome 4 way trade there, I’d be a buyer Plus500, based on their sports sponsorship and them being one of the first to enter prediction markets in the UK. Not sure about eToro, I can’t help but feel they have peaked, but have a massive client base so I wouldn’t write them off – IG and CMC – overall long in the long run…

like like

like dislikeReacted by Darren Sinden

dislikeReacted by Darren Sinden -

-

-

Darren Sinden posted an update

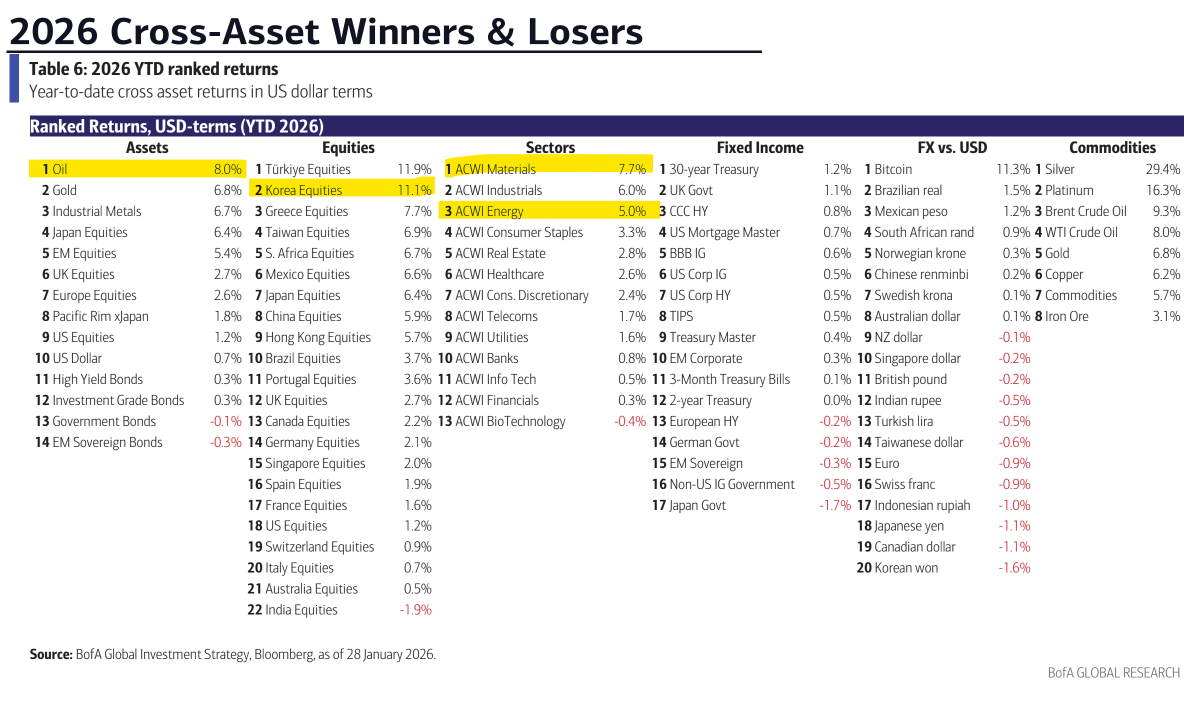

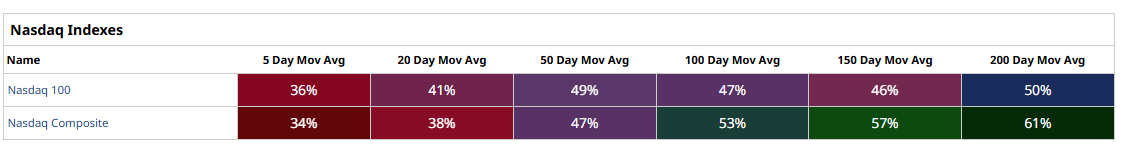

2 weeks agoIts been a difficult couple of days for equity investors, particularly if you are exposed to technology stocks and given the weighting of the Mag 7, on a global basis, that’s pretty much everybody.

In times like this I find it useful to look at things from a top down perspective, tables like those shown below are helpful in this…[Read more]

-

Darren Sinden posted an update

2 weeks, 1 day agoTwo days ago I suggested that Unilever ULVR LN (or UNA NA), might benefit from the strength in US Consumer Staples.

see https://invesdaq.com/members/fatdaz/activity/515/.

The chart below shows the percentage change in both listings of Unilever, over two days.

And by my math they are up +4.0% that may not sound much but its more than…[Read more]

-

Darren Sinden replied to the topic Where Will The PayPal Stock Price Be in 1 Year? in the forum US Stocks

2 weeks, 2 days agoI think the 5-year chart of PayPal Holdings tells you what you need to know about the stock and its prospects.

Back in July 2021 they were trading around $311.00 per share. Yesterday they closed at $41.70, down by -20.31% the biggest one day fall in the name for 4-years, as the company missed Wall Street’s forecast for Q4 2025 earnings, and…[Read more]

-

Darren Sinden posted an update

2 weeks, 3 days agoBack in December 2024 I wrote this article for the Good Money Guide, which looked the potential for AI to change the fortunes of Walmart WMT US .

Walmart is still in transition, but has hit a $1.0 trillion market cap today, trading as high as…[Read more]

1 CommentReacted by Richard Berry-

Richard Berryreplied 2 weeks, 2 days ago

I remember that one! goes to show that AI is having an impact on everything: https://goodmoneyguide.com/analysis/can-a-transition-towards-an-ai-future-boost-walmarts-stock-price/

like like

like dislikeReacted by Darren Sinden

dislikeReacted by Darren Sinden -

-