Edward Sheldon

-

0

Posts -

0

Comments

-

-

-

-

Edward Sheldon replied to the topic Thoughts on Filtronic in the forum UK Shares

3 weeks, 1 day agoI think this UK stock has a lot of potential. Because the company serves two high-growth markets – space and defence.

On the space side, the company is winning huge deals with SpaceX. Last year, for example, it landed a contract with the space firm worth $62.5 million. This is to provide gallium nitride (GaN) E-band products (chips designed to p…[Read more]

-

Edward Sheldon replied to the topic Where Will The PayPal Stock Price Be in 1 Year? in the forum US Stocks

3 weeks, 4 days agoI used to own this stock. Luckily, I got out around 80 bucks.

Looking ahead, it’s hard to know where it goes from here.

The stock does look cheap after its recent fall. Non-GAAP earnings per share (EPS) for 2025 came in at $5.31, so the trailing price-to-earnings (P/E) ratio is only about eight right now.

But it’s hard to see the stock get…[Read more]

-

Edward Sheldon replied to the topic How high will the S&P get this year? in the forum Indices

1 month agoThere are lots of reasons to be bullish on the S&P 500 index right now.

For a start, the tech companies at the top of the index look poised for another year of strong growth. Nvidia, for example, is expected to see 54% revenue growth over the next year.

Secondly, the index is broadening out. Today, the S&P 500 is no longer only about tech – l…[Read more]

-

Edward Sheldon replied to the topic Can any other index beat the US stock markets in 2026? in the forum Indices

1 month, 2 weeks agoI don’t like to bet against the US market (the S&P 500 index). Because it has a fantastic long-term track record.

However, some indexes that could potentially beat the S&P 500 this year include:

* The S&P Equal Weight index: Late last year, investors started to rotate out of the technology sector and into other sectors such as Financials, H…[Read more]

-

Edward Sheldon replied to the topic Why has the eToro share price done so bady? in the forum US Stocks

1 month, 2 weeks agoeToro shares have not performed well since the IPO. As I write this, they’re trading at $31 – about 40% below the IPO price of $52.

It’s hard to know exactly why the share price has tanked. I think it’s probably related to a few different factors including:

* Competition: eToro operates in a very competitive industry and it’s up against s…[Read more]

Reacted by Richard Berry -

-

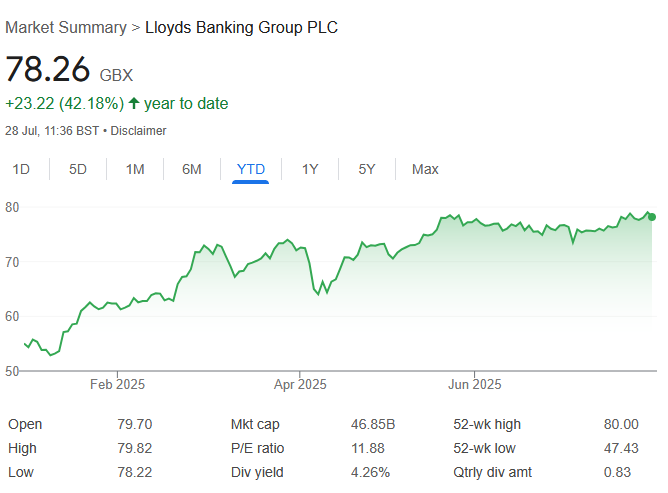

Edward Sheldon replied to the topic What will Lloyds share price be in 5 years? in the forum UK Shares

1 month, 3 weeks agoI think some banks stocks could do well over the next five years. However, I find it hard to get excited about Lloyds – I reckon it may underperform its peers.

One downside to this bank is that it is predominantly UK focused. So, its fortunes are tied to the UK economy, which isn’t exactly firing on all cylinders at the moment.

For 2026, the…[Read more]

-

Edward Sheldon replied to the topic Why are investors excited about The Smarter Web Company shares? in the forum UK Shares

1 month, 3 weeks agoWhen I last covered the Smarter Web Company, in June, I was quite bearish on it. At the time, I stated that it was a high-risk investment.

Since then, its share price has fallen from around 500p to 33p – a decline of approximately 93%. So, I was right to be bearish on it (hopefully my analysis saved a few investors from getting badly burnt).…[Read more]

Reacted by Richard Berry -

-

Edward Sheldon replied to the topic What are the best AI stocks to buy now? in the forum UK Shares

2 months, 1 week agoI’ll give you three of my favourites and a wildcard:

* Nvidia – I expect 2026 to be another strong year for Nvidia. It will be rolling out its next-generation Vera Rubin chips and demand is likely to be high. On the recent Q3 earnings call, the company said that it has visibility to half a trillion dollars in Blackwell and Rubin revenue from the…[Read more]

Reacted by bearlybullish -

-

Edward Sheldon replied to the topic Funds to Watch in 2026 in the forum Funds & ETFs

2 months, 2 weeks agoDepends what you are looking for but as a growth/quality investor, I like the Blue Whale Growth fund. This is a concentrated, growth-focused global equity fund managed by Stephen Yiu.

Yiu is good at identifying growth themes and capitalising on them. For example, he’s made a ton of money for investors in recent years on the AI buildout theme.…[Read more]

-

Edward Sheldon replied to the topic If you could only own one US stock, what would it be? in the forum US Stocks

2 months, 2 weeks agoFor me it would be Amazon (NASDAQ:AMZN).

Why? Well I’d want a company that operates in many different industries (to reduce my risk) and Amazon fits the bill here.

Today, it operates in a range of areas including online shopping, cloud computing, artificial intelligence (including AI chips), digital advertising, digital healthcare, space s…[Read more]

-

Edward Sheldon replied to the topic Why are natural gas prices surging? in the forum Commodities

2 months, 3 weeks agoI can think of a few reasons. For a start, it has been very cold in parts of the US recently. I was over in Minnesota for Thanksgiving and it was -10 deg celcius or colder on many days. We also got a ton of snow, which isn’t that common for that time of year. That kind of weather is going to increase demand for natural gas significantly due to t…[Read more]

-

Edward Sheldon replied to the topic Can The FTSE 100 Reach 10,000? in the forum Indices

3 months, 1 week agoI wouldn’t be surprised to see the FTSE 100 hit 10,000 in 2026. Here are five reasons why:

* We’re in the midst of a powerful bull market in global equities right now. I think there’s a decent chance this bull market will continue in 2026 as economic growth is solid and corporate earnings are rising.

* The Footsie’s valuation isn’t that high…[Read more]

-

Edward Sheldon replied to the topic Will Lloyds Shares Reach £1 in 2025? in the forum UK Shares

3 months, 1 week agoMy gut feeling is that the share price won’t hit £1 in 2025. Why? There are a few reasons:

* The valuation looks pretty full right now. Currently, analysts expect earnings of 7.33p per share from Lloyds this year. That puts the bank’s P/E ratio at 12. For a domestic bank that has minimal exposure to higher growth areas of banking such as weal…[Read more]

Reacted by Richard Berry -

-

Edward Sheldon started the topic What will Lloyds share price be in 5 years? in the forum UK Shares

7 months agoLloyds (LLOY:LON) shares have been a great investment over the last five years. Believe it or not, they’re up about 200% over this timeframe – a return of around 25% per year. What about the next five years though? Can the share price keep rising or are we likely to see returns moderate?

Timing is key with bank stocks

Before we discuss the…[Read more] -

Edward Sheldon started the topic Why are investors excited about The Smarter Web Company shares? in the forum UK Shares

8 months, 1 week agoUK investors have been piling into a little-known growth stock called The Smarter Web Company (SWC.AQ) recently. Last week, the stock was the most bought stock on Hargreaves Lansdown by number of deals.

Should you follow the crowd and buy shares in the company? Let’s take a look at what’s going on here.

What does The Smarter Web Company do?…[Read more]