- This topic has 2 replies, 3 voices, and was last updated 1 week, 1 day ago by Edward Sheldon.

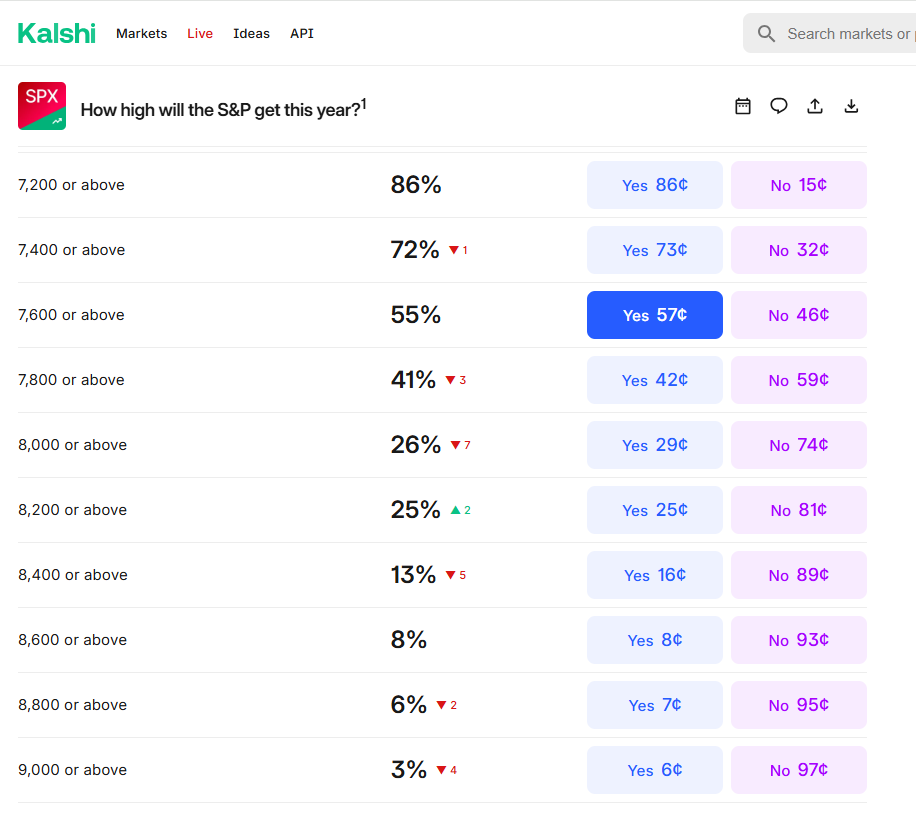

I’ve recently become a little bit obsessed with prediction markets. Yes I know they are just the US equivalent of binary options. But the US have been quick to regulate them as opposed to the FCA, which refused to touch them, meaning the industry was flooded with crooks. But anyway, there has got to be a good arb here somewhere. Any thoughts on how high the S&P 500 could get in 2026? Kalshi is currently predicting only a 3% chance of it breaking through 9,000…

Howard Marks, CEO of Oaktree Capital Management, which runs around US$218.0 billion wrote a well publicises article on S&P returns. this time last year. In the note he looked at the correlation between current S&P 500 PE ratios and future 10-year returns in the index. the data. which stretched back 27 years, suggested that:

“When people bought the S&P at p/e ratios in line with today’s multiple of 22, they always earned ten-year returns between plus 2% and minus 2%.”

The current FWD PE for the index is 22.1 times earnings and the index itself is up by just +1.02% year to date.

My honest opinion is that there is just too much going on at a macro level to be making longer term predictions about the index performance, over the balance of the year. If issues such as Greenland, the reprise of Trump Tariffs, and possibility of conflict with Iran resolve themselves in the next couple of months.

Then we could see another rally, but without that, I am thinking that we will see a year of mediocre/subpar returns from the S&P 500.

However, if January is anything to go by, it will be a very good year for stock picking and tactical trading.

There are lots of reasons to be bullish on the S&P 500 index right now.

For a start, the tech companies at the top of the index look poised for another year of strong growth. Nvidia, for example, is expected to see 54% revenue growth over the next year.

Secondly, the index is broadening out. Today, the S&P 500 is no longer only about tech – lots of sectors are doing well including Healthcare, Materials, and Industrials.

Third, corporate earnings are expected to grow at a healthy rate in the near term. According to FactSet, S&P 500 earnings are projected to increase 15% this year.

All that said, I expect to see volatility this year. With Donald Trump in the White House, there are going to be plenty of unexpected tweets/announcements that cause investor anxiety – this could put a cap on index growth.

Another issue is interest rates. If these don’t come down as expected, it could lead to stock market volatility.

One other issue to think about is valuations. Currently, the median P/E ratio across the S&P 500 on a forward-looking basis is about 20, which is quite high.

As for how high the index can go in 2026, I’m going to say that it can hit 7,400 at some point this year. That’s about 6% above today’s level.

For what it’s worth, here are some year-end targets from major Wall Street firms:

Goldman Sachs – 7,600

JP Morgan – 7,500

Morgan Stanley – 7,800

Oppenheimer – 8,100

Deutsche Bank – 8,000

Citigroup – 7,700

UBS – 7,700

Bank of America – 7,100

Looking at these targets, the consensus view is that the S&P 500 index is going to have another decent year.

- You must be logged in to reply to this topic.

Invesdaq

Welcome to Invesdaq, a social network for investors.