- This topic has 5 replies, 4 voices, and was last updated 2 days, 22 hours ago by Darren Sinden.

UK investors have been piling into a little-known growth stock called The Smarter Web Company (SWC.AQ) recently. Last week, the stock was the most bought stock on Hargreaves Lansdown by number of deals.

Should you follow the crowd and buy shares in the company? Let’s take a look at what’s going on here.

What does The Smarter Web Company do?

The Smarter Web Company is a digital marketing company that has recently been buying Bitcoin. Its aim is to become a major ‘Bitcoin treasury company’ like Strategy, the company formerly known as MicroStrategy.

Listed on the UK’s Aquis Exchange, the company became publicly-listed via an Initial Public Offering (IPO) in April this year. It is run by CEO Andrew Webley, who founded the company in 2009 after previously holding a senior technology position at Hargreaves Lansdown.

Why are investors excited about The Smarter Web Company shares?

There are several reasons investors are excited about this stock. One is that US company Strategy has had great success with its Bitcoin treasury strategy. Over the last five years, its share price has risen spectacularly, pushing its market cap up to around $100 billion. Investors are hoping that this UK company can replicate its success.

Another is that the stock offers a way to get exposure to Bitcoin within a Stocks and Shares ISA or Self-Invested Personal Pension (SIPP) account. Today, many UK investors want access to digital assets such as Bitcoin. However, currently, it is not possible to buy Bitcoin or Bitcoin ETFs in a tax-efficient account in the UK. Ultimately, this company – which is akin to a Bitcoin investment fund – is filling a gap in the market.

How has the SWC share price performed?

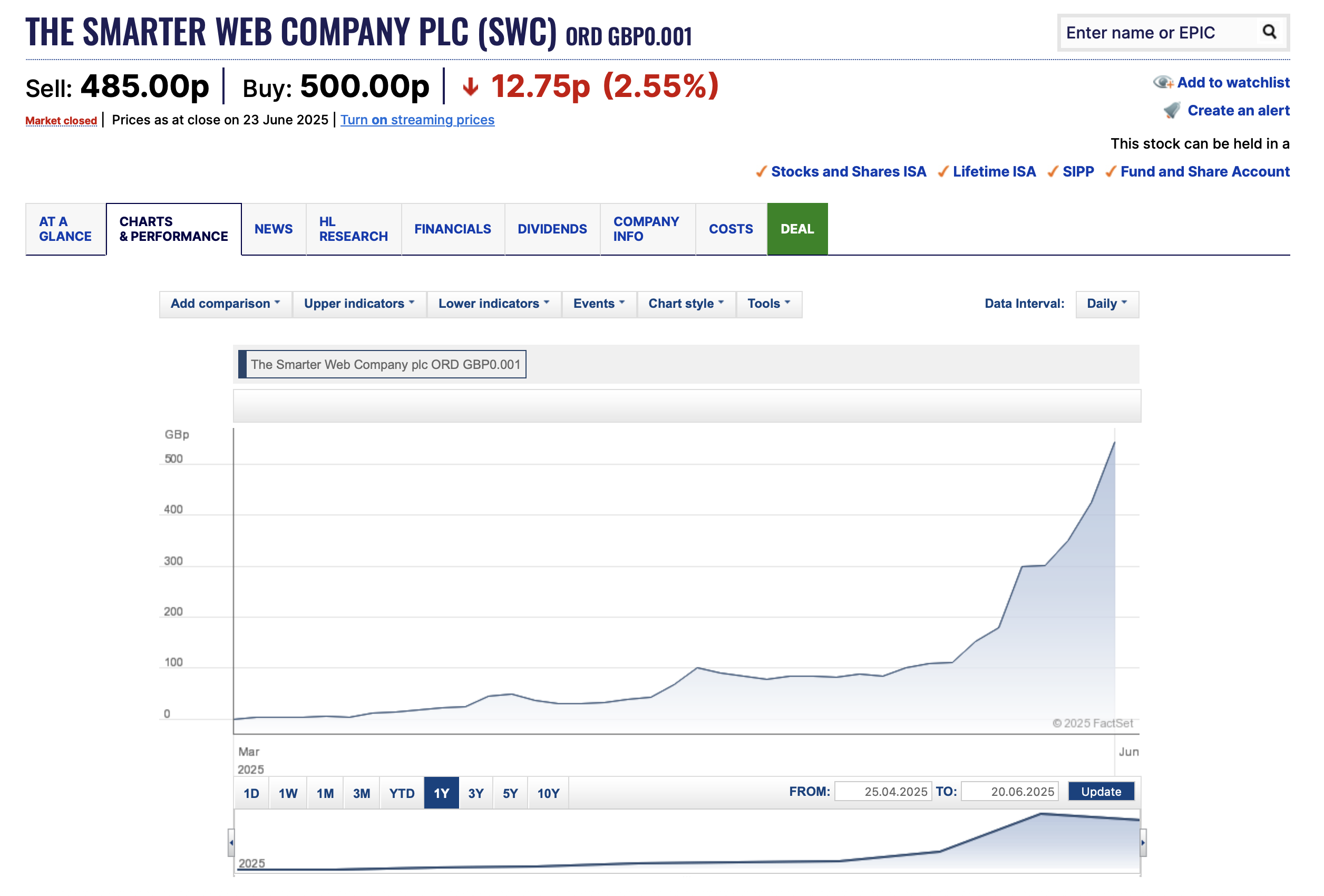

Since the Smarter Web Company’s IPO in April, its share price has surged. Today, it is sitting near 500p, up almost 20,000% from the IPO price of 2.5p.

At the current share price, the company has a market cap of over £1bn. That would put it in the FTSE 250 index if it was trading on the UK’s main market.

Are The Smarter Web Company shares a good investment?

Looking at this company, I see it as a very high risk investment today. There are a few reasons why.

The first is that Bitcoin itself is a very volatile asset. This is an asset that tends to experience falls of 30%+ on a regular basis. If it was to experience another significant drop, the value of The Smarter Web Company’s holdings would take a big hit. This could expose investors to major losses.

The second issue is that the value of the company far exceeds the value of the Bitcoin it owns. According to recent reports, The Smarter Web Company owns 346.63 Bitcoin at present. At today’s Bitcoin price of approximately $101,500, that’s roughly £26 million of Bitcoin. Given that the company has a market cap of more than £1 billion, it looks extremely overvalued at the moment. Currently, it is trading a massive premium to its Bitcoin holdings.

The third issue is that the company is going to have to continually raise money to buy more Bitcoin. This is likely to dilute existing shareholders’ holdings.

One other issue worth mentioning is that this kind of company doesn’t really have any competitive advantage. In other words, any company can enter the market and steal market share. I think we are likely to see more Bitcoin treasury companies appear in the near future. This could lead to capital outflows here.

Now, it’s worth noting that The Smarter Web Company has a ‘days to cover mNAV’ ratio of around 35 days, according to Webley. This ratio measures how long it would take a company, at its current buying pace, to accumulate enough Bitcoin to justify its market cap, based on its current multiple of net asset value (mNAV) and daily BTC yield. A ratio of 35 is relatively low and indicates that The Smarter Web Company could potentially grow into its valuation. Note that US rival Strategy has a ratio of over 600 currently.

Meanwhile, there is a chance that Bitcoin could rise significantly from here. It if was to soar in value, the value of The Smarter Web Company’s BTC holdings could increase substantially.

All things considered, however, I see The Smarter Web Company shares as very risky. With this stock, one should only invest capital that they are willing to lose.

What does everyone think of Smarket Web Company now? Especially with the approval of crypto ETNs and ETPs for UK retail investors. A reader sent this question through the Good Money Guide but as all analysis has moved to Invesdaq I’ve added it here instead:

I am very impressed with Andrew Webbly but, Is your view still the same (very risky) that you would not recommend investing in The Smarter Web Company as written by Ed Sheldon on 24th June 2025

I feel I would?

Thank you

Mark Salkel

When I last covered the Smarter Web Company, in June, I was quite bearish on it. At the time, I stated that it was a high-risk investment.

Since then, its share price has fallen from around 500p to 33p – a decline of approximately 93%. So, I was right to be bearish on it (hopefully my analysis saved a few investors from getting badly burnt).

Is the stock worth buying at 33p? I’m not convinced.

One of the main reasons this stock saw interest last year was that it offered a way to get Bitcoin exposure in a Stocks and Shares ISA or SIPP. At the time, the FCA had banned crypto ETNs and ETPs for retail investors.

The FCA has since lifted the ban on these products, however. So, UK investors are likely to have many different ways to access crypto-assets in the future, meaning less need for Smarter Web Company and other crypto treasury companies (these companies may find it harder to raise money to buy more Bitcoin in the future).

I will point out that there are some reasons to be bullish here today. Currently, Smarter Web Company owns 2,664 Bitcoins. At today’s Bitcoin price, these Bitcoins are worth about £180 million. Yet the company’s market cap is only around £100 million. So, there could be a value opportunity here.

It’s worth noting that right now, the price of Bitcoin is depressed. If it was to rally again, it would boost the value of the Smarter Web Company’s holdings and probably also its share price. There are no guarantees that Bitcoin will rise in the near term though. Recently, interest in crypto has been declining with Google searches of “Bitcoin” falling dramatically.

In summary, the stock looks more attractive at 33p than when it was trading at 500p. However, I still see it as a high-risk investment.

Bitcoin Treasury companies are not something I can warm to I am afraid. You could have made a case for them for them as a way for UK retail clients to gain exposure to bitcoin, via the stock market. However, now that UK private clients can trade in Crypto ETNs that argument has lost its lustre.

Smarter Web and its peers are only as good as the price of Bitcoin and the appetite among investors for the next fund raising round. To date the appetite has been good but I wonder what happens if and when a Bitcoin Treasury company tries to raise fresh cash in a crypto downturn?

Having traded at 500p at the 2025 peak, some may argue that at 33.0p Smarter Web are cheap but for that logic to apply you need to believe they cant go substantially lower which I don’t.

As an analyst once said about Ratner’s the jeweller ” cant recommend a purchase ”

SWC essentially aped Microstrategy (MSTR)’s “bitcoin stacking” strategy, by diluting equity to buy bitcoins.

In doing so, SWC hopes that the market will reward the company with high-priced shares. Sometimes this works; sometimes it doesn’t.

Look at MSTR. Its share prices plummeted by -66% in the second half of 2025! For SWC, as Sheldon pointed out above, its share price decline is even larger than that of MSTR’s.

Investors abandoned the whole treasury asset sector in 2H of 2025 because they felt these digital asset companies (DACs) were overvalued. Why buy DACs when you can buy bitcoins and cryptos directly?

But after such a severe decline, I would not rule out a bounce. The bear trend is extremely oversold and more importantly, bitcoin remains close to $100K despite all the backdrop noise.

All these factors may lead to a sudden rebound in those DACs.

A trade in SWC may be opened. But I do stress that this is just a trade rather than a long-term investment proposition.

This news might benefit Smarter Web’s stock price.

“MSTR +4.4% in the pre market as MSCI announces it will not exclude digital asset treasury cos from MSCI Indexes.”

- You must be logged in to reply to this topic.

Invesdaq

Welcome to Invesdaq, a social network for investors.