dan

-

0

Posts -

0

Comments

-

-

-

-

Darren Sinden posted an update

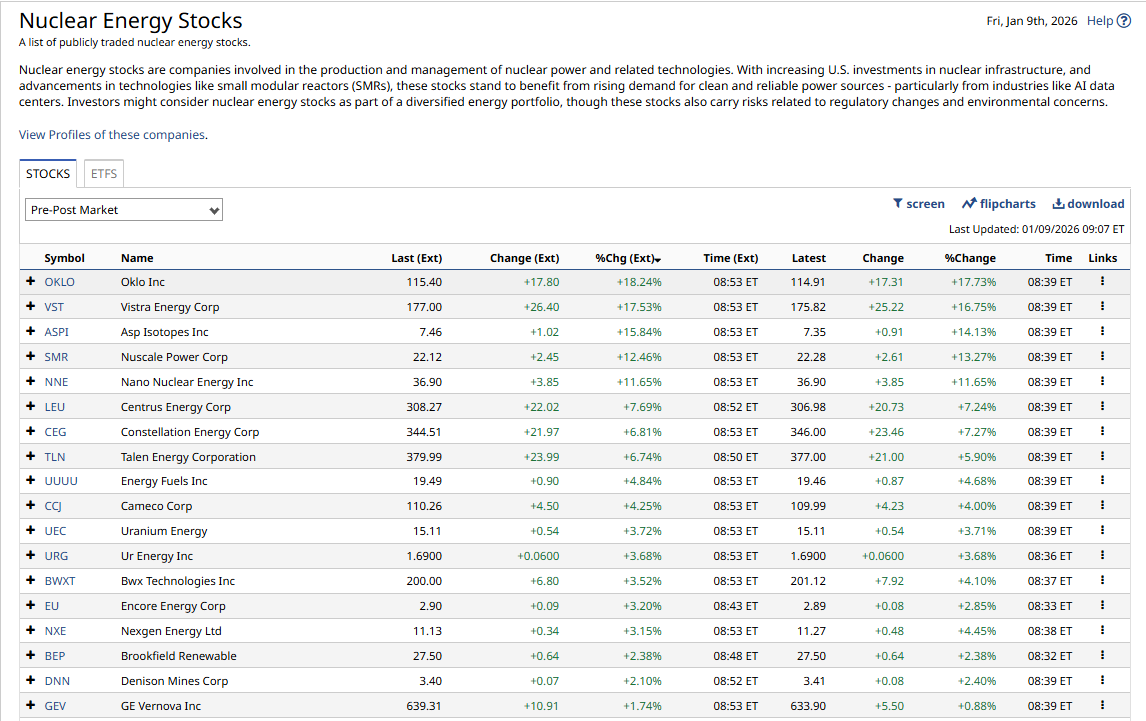

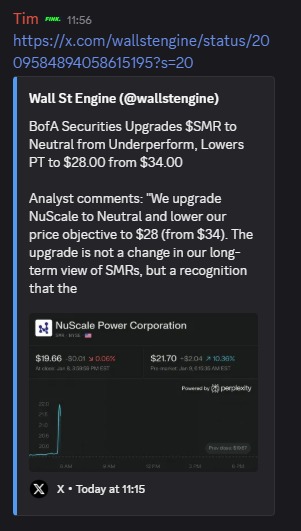

2 days, 2 hours agoNuclear stocks are to the fore in the US pre market as Meta Platforms META signs deals with OKLO OKLO and Vistra Energy VST the stocks are either side of +18.0% higher and the news has boosted other names among nuclear energy and uranium stocks.

URA US the GX Uranium ETF is up by +5.5% pre market

Stifel Canada wrote on Uranium stocks…[Read more]

-

Darren Sinden posted an update

2 days, 8 hours agoOil prices are higher again as Donald Trump warns Iran about killing anti-regime protesters. Rumours circulated last night about sorties by US forces in the Straits of Hormuz ,a cricial water way for oil tankers. I note that China was thought likley to try and switch to Iranian crude if it’s excluded fronm Venezuelan supplies. Trump has also been…[Read more]

-

Darren Sinden posted an update

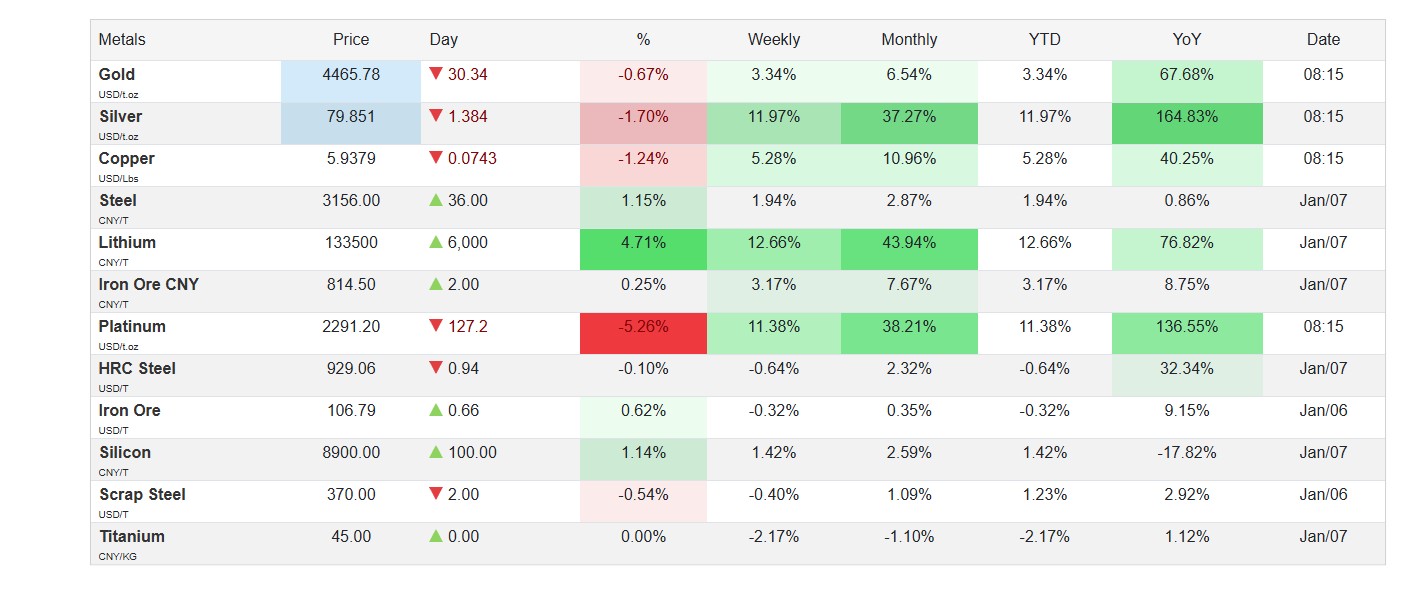

2 days, 8 hours agoSome interesting developments overnight as Glencore, approaches Rio Tinto about a possible merger or combination of assets . Mining insiders suggest that this is largely driven by Copper, even though Rio is mostly focused on other minerals and ores . Would imagine this bodes well for other major miners such as Freeport Mcmoran FCX US

-

Darren Sinden posted an update

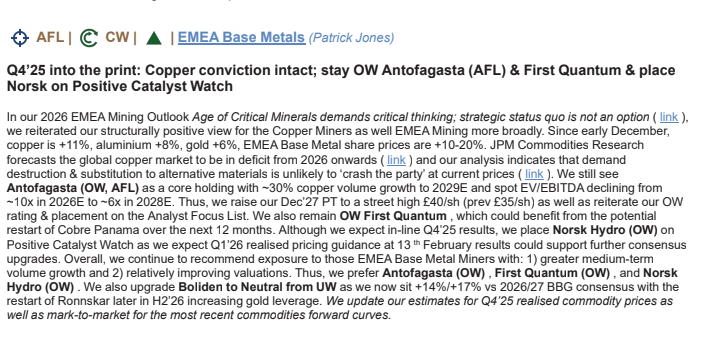

3 days, 8 hours agoCopper is in the headlines once again this morning JP Morgan writes on copper miners maintaining overweight recommendations on several stocks saying:

“JPM Commodities Research forecasts the global copper market to be in deficit from 2026 onwards ( link ) and our analysis indicates that demand destruction & substitution to alternative…[Read more]

-

Darren Sinden posted an update

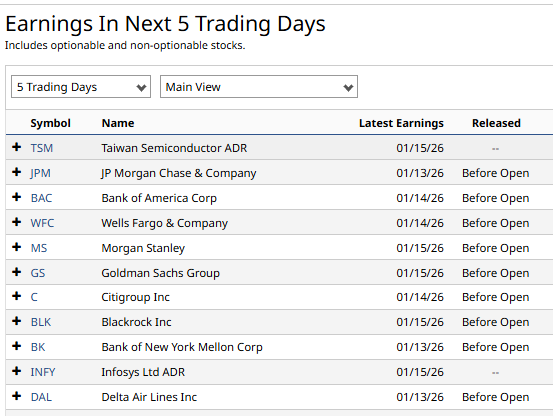

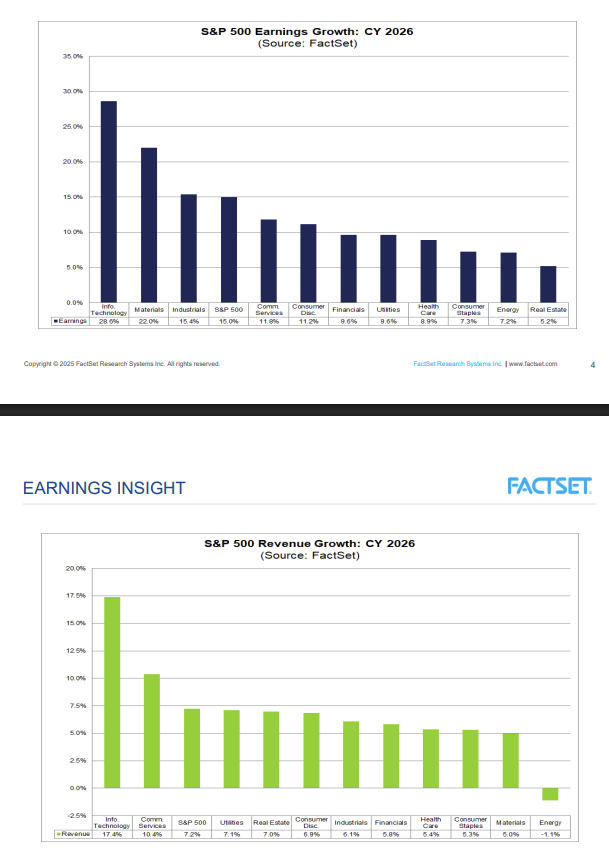

3 days, 8 hours agoQ4 2025 earnings season is fast approaching , in the US JP Morgan JPM US the world’s biggest bank, will unofficially kick off the process before the market open on January 13th.

Wall Street expects S&P 500 earnings to grow by an impressive +15.0% this year and though the Q4 25 reports aren’t directly part of that equation, the numbers and…[Read more]

-

Darren Sinden posted an update

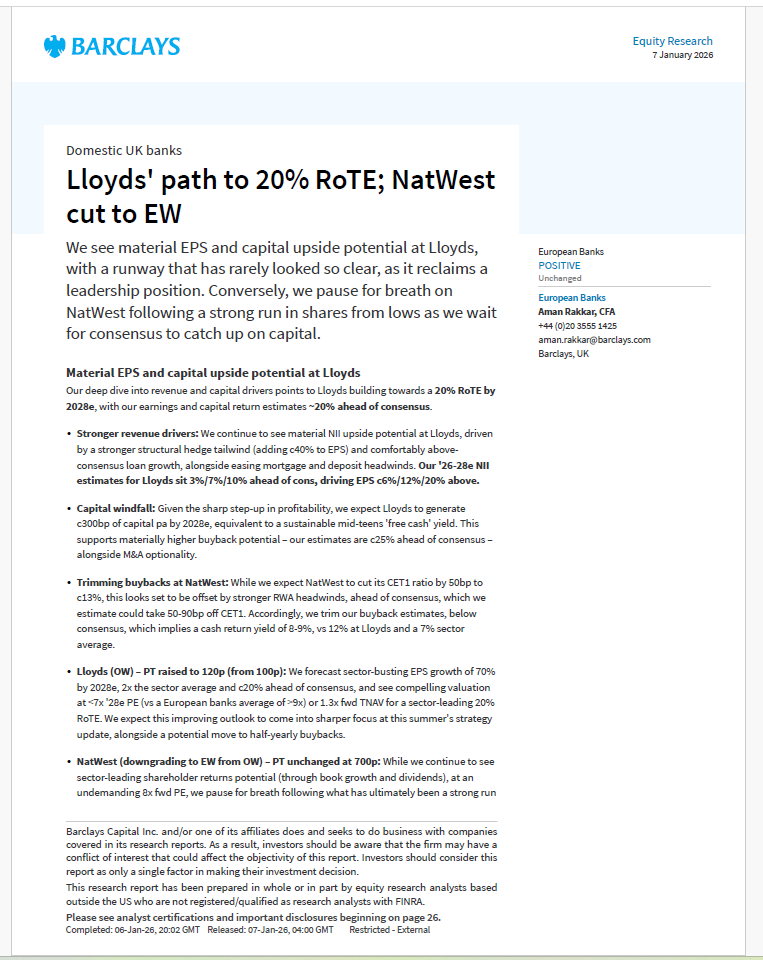

4 days, 2 hours agoWe recently looked at the where Lloyds Banking shares would be in 5 years time https://invesdaq.com/forums/topic/what-will-lloyds-share-price-be-in-5-years/

I was/ am bearish based on macro factors, the UK economy and the bank’s almost exclusive domestic revenue exposure .

However, Barclays take a different view it seems (as you can see…[Read more]

-

Darren Sinden posted an update

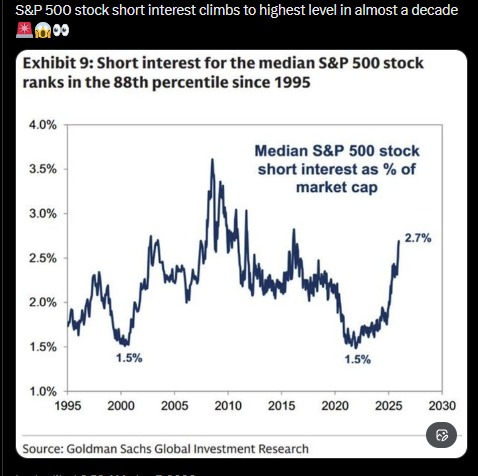

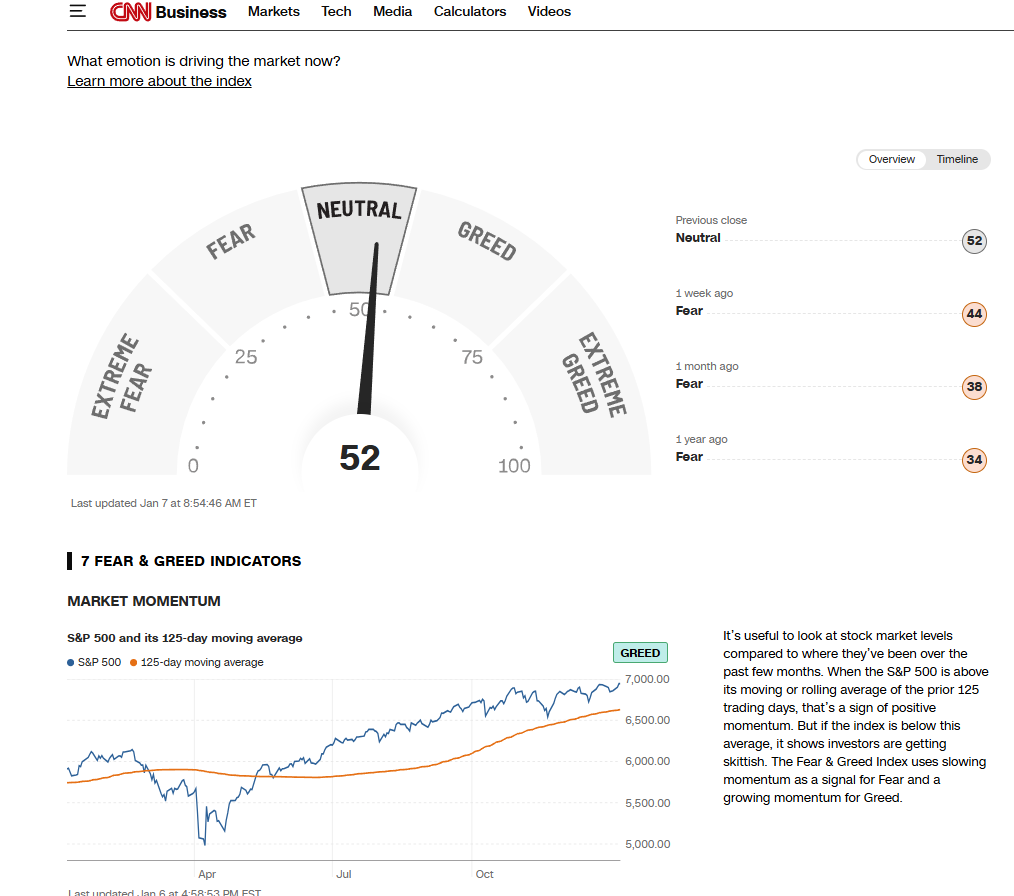

4 days, 3 hours agoA contrarian indicator in the S&P500 (?) at the same time that CNN’s Greed and Fear indicator goes to neutral ………..

Reacted by Richard Berry -

-

Darren Sinden replied to the topic Why are investors excited about The Smarter Web Company shares? in the forum UK Stocks

4 days, 3 hours agoThis news might benefit Smarter Web’s stock price.

“MSTR +4.4% in the pre market as MSCI announces it will not exclude digital asset treasury cos from MSCI Indexes.”

-

Darren Sinden posted an update

4 days, 3 hours agoInterestingly ALB US get written up today in the US :

Albemarle (ALB) Brokerage Firm: Robert W. Baird | Action: Upgrade | Ratings Change: Neutral » Outperform | Price Target: $210| Current Price $161.93

-

Darren Sinden posted an update

4 days, 8 hours agoA month ago I highlighted the upside potential in copper miner Freeport Mcmoran FCX US ( you can view the comments here https://invesdaq.com/members/fatdaz/activity/265/)

I am pleased to report that the stock has rallied by just under +25.0% in the intervening period and has even outperformed Antofagasta ANTO LN over the last 4 weeks.

Metal…[Read more]

-

Richard Berry replied to the topic Are Aston Martin shares a good investment? in the forum UK Stocks

5 days, 4 hours agoI honestly can’t see Aston Martin shares ever improving – if I wanted to lose money on AML, I’d buy one of their new cars instead.

-

Darren Sinden replied to the topic What will Lloyds share price be in 5 years? in the forum UK Stocks

5 days, 6 hours agoThis looks like a deceptively easy question on the face of it, after all the stock returned +80.65% over the last 12 months, according to data from Barchart.com.

However the more I dig into the question the more complex it becomes. And that’s because we have to look away from the performance data and ratios, and consider the bigger picture.…[Read more]

-

Darren Sinden posted an update

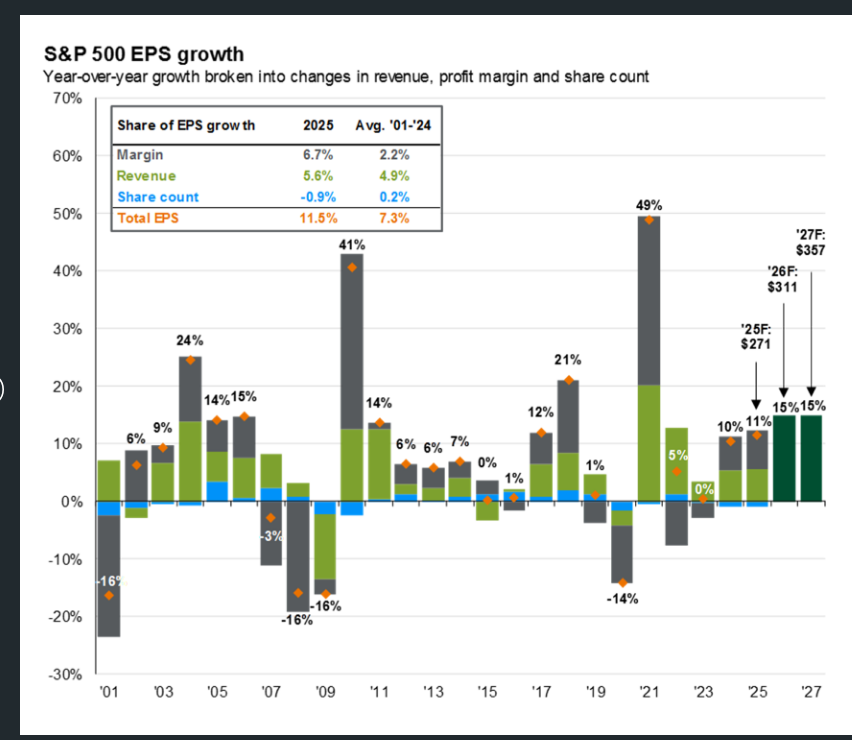

6 days, 5 hours agoWall Street analysts are forecasting EPS growth for S&P 500 stocks in 2026 with EPS expected to hit $311 over the full year according to data from JPM AM ( see image one below) up from the $271 forecast for 2025.

Earnings season will be with us again soon enough , JP Morgan, JPM US, is set to report Q4 2025 earnings on 13/01/2026.

-

Darren Sinden posted an update

6 days, 6 hours agoThe first proper trading day of 2026 and there is plenty to contemplate – The events at the weekend were unprecedented, but then again we have never had a US president like Donald Trump have we?

European defence stocks are higher this morning RHM GR, Rheinmetall AG are up + 7.70% for instance- this was one of my top picks in 2025 and right…[Read more]

-

Darren Sinden replied to the topic Why are investors excited about The Smarter Web Company shares? in the forum UK Stocks

6 days, 7 hours agoBitcoin Treasury companies are not something I can warm to I am afraid. You could have made a case for them for them as a way for UK retail clients to gain exposure to bitcoin, via the stock market. However, now that UK private clients can trade in Crypto ETNs that argument has lost its lustre.

Smarter Web and its peers are only as good as the…[Read more]

-

Richard Berry replied to the topic Why are investors excited about The Smarter Web Company shares? in the forum UK Stocks

1 week, 2 days agoA reader sent this question through the Good Money Guide but as all analysis has moved to Invesdaq I’ve added it here instead:

I am very impressed with Andrew Webbly but, Is your view still the same (very risky) that you would not recommend investing in The Smarter Web Company as written by Ed Sheldon on 24th June 2025

I feel I would?

Thank… -

Darren Sinden posted an update

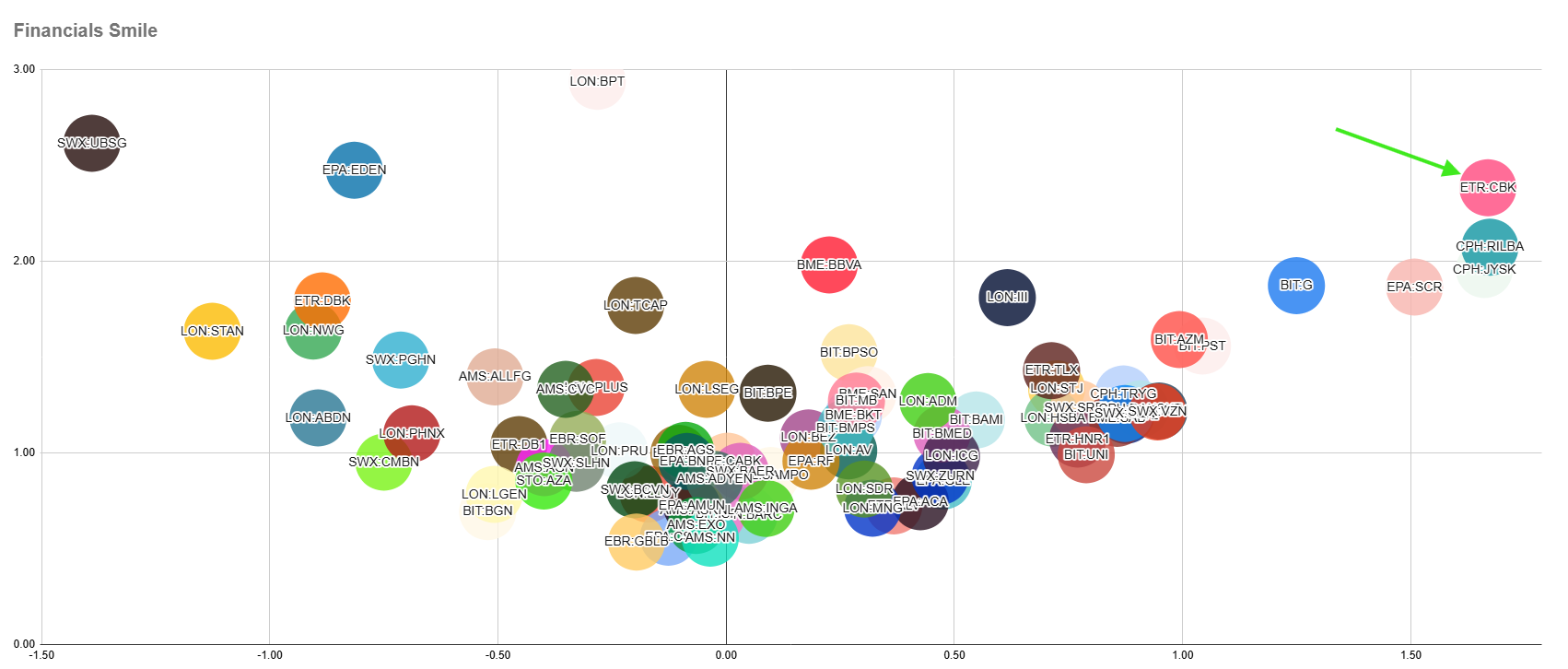

3 weeks, 2 days agoComing back to European banks I notice that, one of the names I follow, has been moving higher again today, and that’s CBK GR Commerzbank AG .

Up by almost +3.0% on the day , not exceptional in itself (though pretty good on a dull pre- Xmas Friday) but good enough to put CBK “right and centre” on the European Financials Sector Smile -…[Read more]

-

Darren Sinden posted an update

3 weeks, 2 days agoCopper has tested to new highs today however looking at the candle chart it seems to have rejected that move as of now.

The weekly close will be the important one here I note Freeport Mcmoran FCX US are called +0.94% higher in the US pre market.

However they are down over the last the week -2.20%. and below both the 3monthj and 6…[Read more]

-

Darren Sinden posted an update

3 weeks, 2 days agoSometimes the behaviour of the markets deviates from economic theory and that certainly seems to be what’s happening in the first chart below, as EU banks continue rise even as EU interest rates fall .

Of course, European interest rates haven’t fallen in isolation, as the tweet below from Julian Jessop reminds us. And perhaps that makes the…[Read more]

-

Darren Sinden replied to the topic What are the best AI stocks to buy now? in the forum UK Stocks

3 weeks, 2 days agoDespite all the hyperbole on Instagram its not clear to me that anyone is making money directly from AI chat bots and agents or when that may change. I have likened the “AI boom” to a gold rush and as with a real world gold rush the people who do best are the ones selling picks and shovels to the miners.

I haven’t seen anything to change my mind…[Read more]