Darren Sinden

-

85

Posts -

6

Comments

-

-

-

-

Darren Sinden posted an update

1 month, 1 week agoDo you recall this post on Airtel Africa AAF LN https://invesdaq.com/activity/p/204

the stock is trading in between support and resistance and right now we are testing at the resistance around 318p.

A clean and sustained break/close above 320p would provide sustenance for the bulls so watch this space as they say.Reacted by Invesdaq -

-

Darren Sinden posted an update

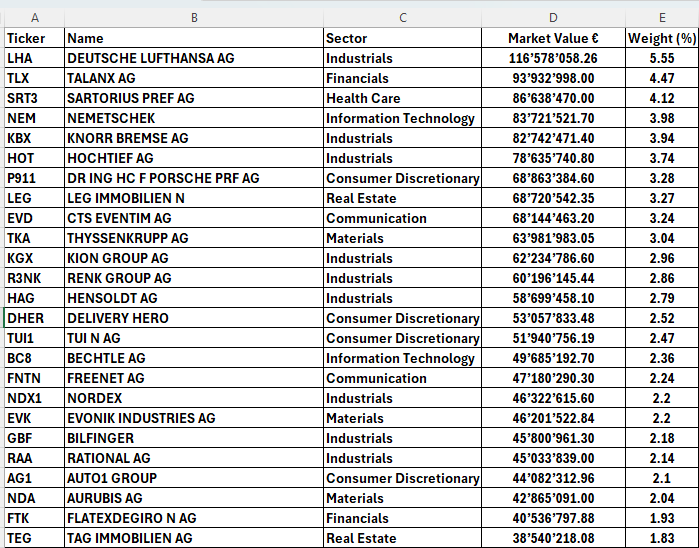

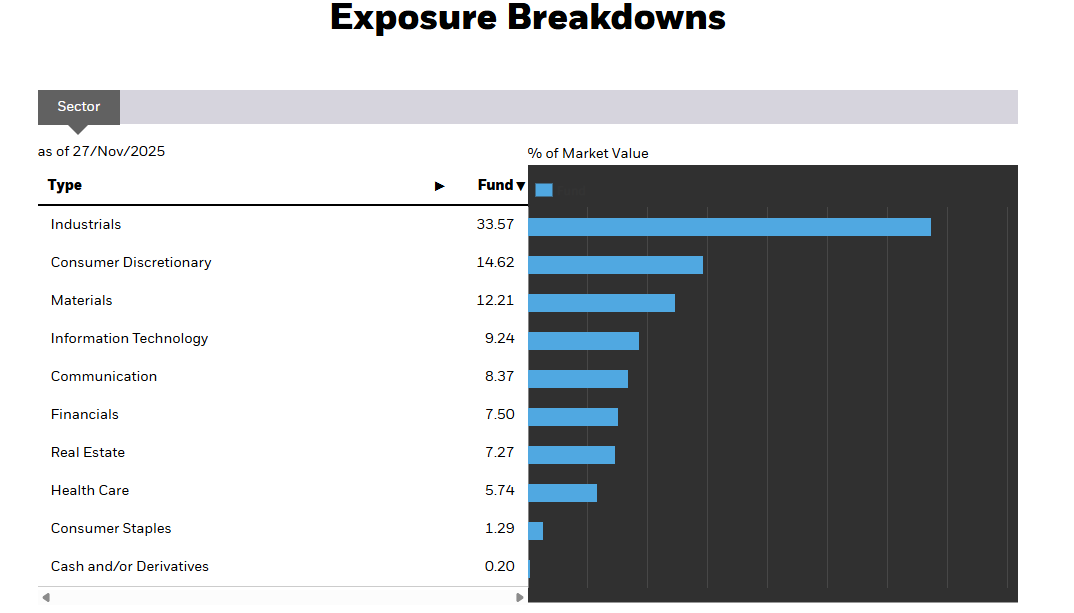

1 month, 1 week agoI cant help but notice that another of the German midcap stocks I mentioned on Monday, has been moving well today.

Engineer Thyssen Krupp AG TKA GR has added +6.00% in the session.

What’s more the gains have been incremental across the day, following a gap higher on the open .

Right place, right time, right thinking it seems.

-

Darren Sinden posted an update

1 month, 1 week agoYou may recall I have posted recently on CMC Markets and IG Group, in the post on CMC Markets I compared its stock price to that of IG Group and sector peer Plus 500.

Citigroup analysts have written on the new of JV operation between Flutter’s Fan Duel and Plus 500 see below….

This is the kind of deal that shines a light on the hidden and…[Read more]

-

Darren Sinden posted an update

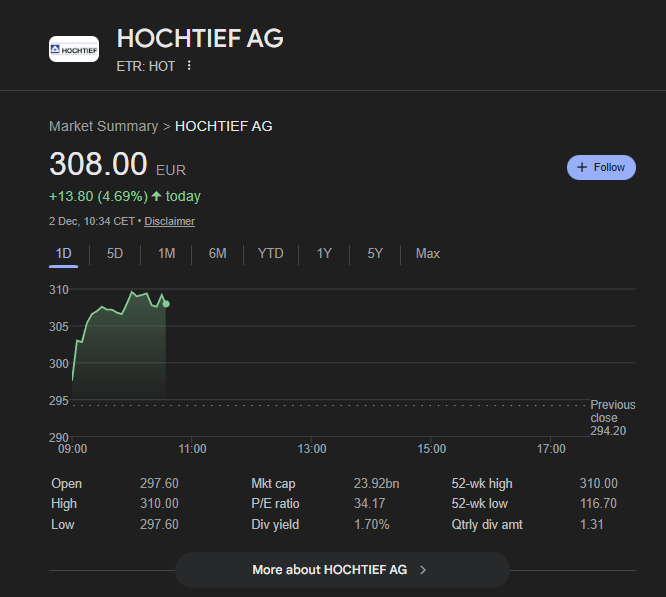

1 month, 1 week agoHochtief AG HOT GR, which I highlighted yesterday, in my comments on German midcaps, are up +4.70% today and have printed as high as €3.10 this morning .

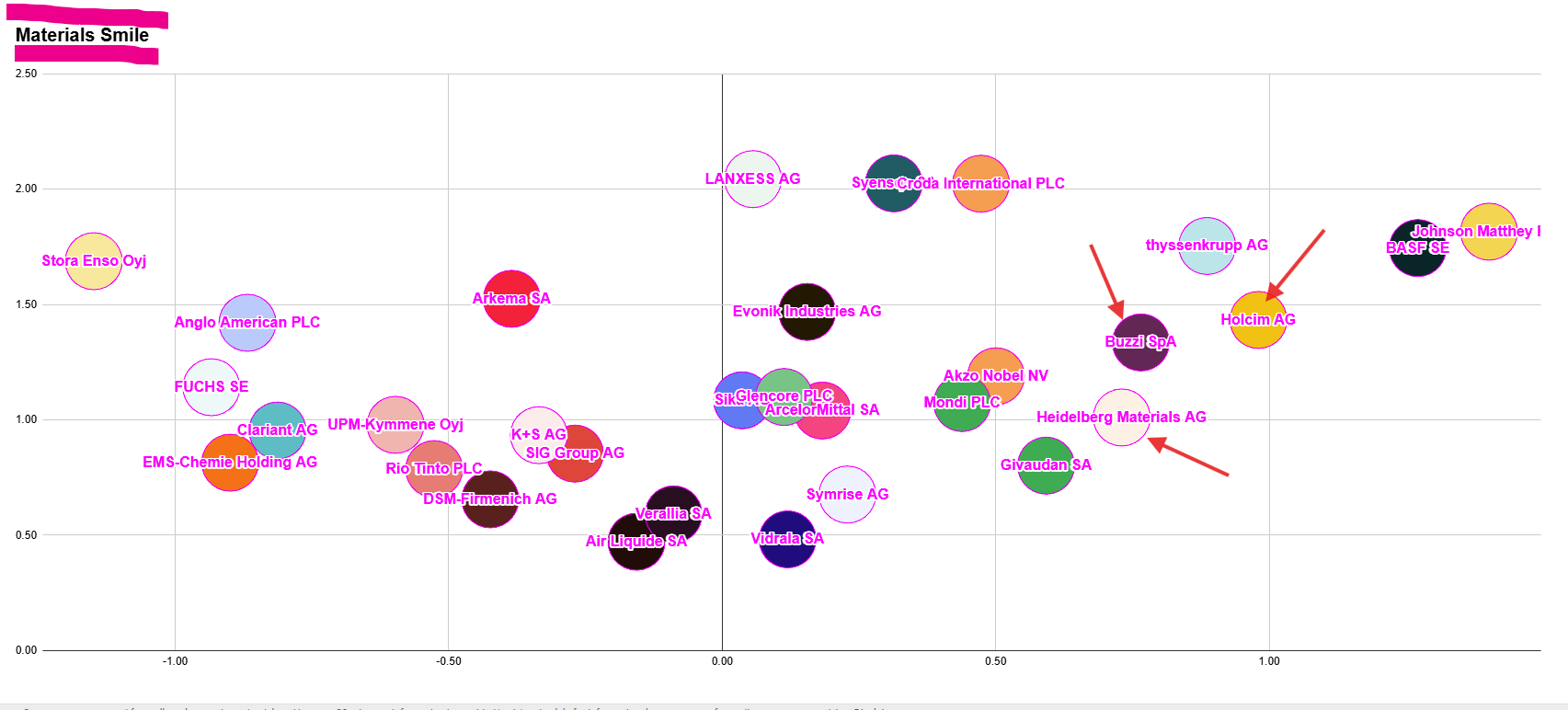

I also note the positive positioning on the European Materials sector smile, of several cement names as highlighted below.

These stocks are showing positive relative strength in their p…[Read more]

-

Darren Sinden posted an update

1 month, 1 week agoSome US Oil and Gas names are making interesting noises here DVN , APA and FANG catch my eye ……

-

John Smithreplied 1 month, 1 week ago

Test

like like

like dislike

dislike

-

-

Darren Sinden posted an update

1 month, 1 week agoThe deputy CEO and CIO of French asset manager Amundi made an interesting observation on LinkedIn last week saying that :

“European Small and Mid Caps are dirty cheap while many of those companies are of very good quality with high visibility and superior dividend yield. It is probably the result of a lack of interest and demand by investors…[Read more]

-

Darren Sinden posted an update

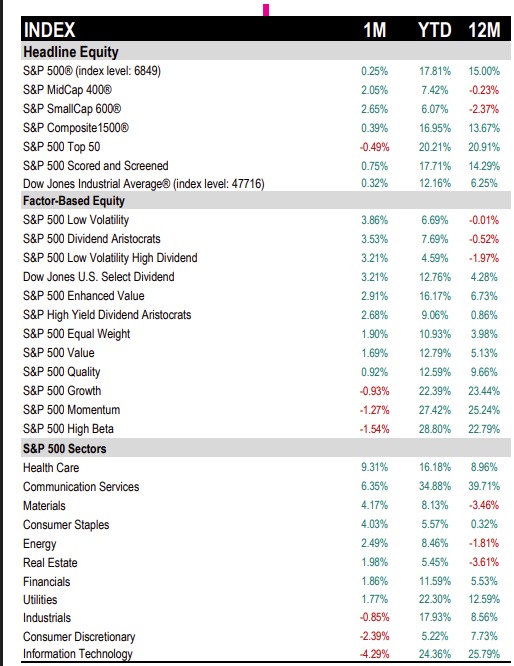

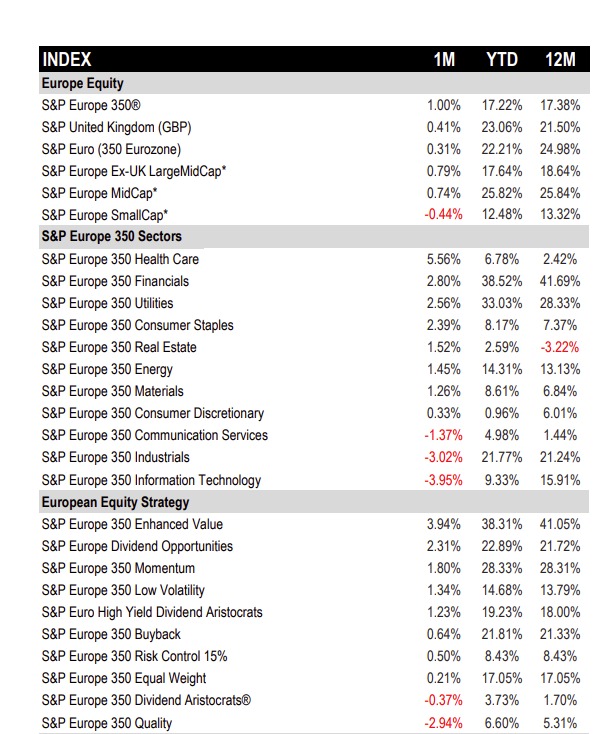

1 month, 1 week agoThe start of a new month provides traders and investors with an opportunity to look back over the prior period to examine what worked and what didn’t.

In the images below we see data compiled by S&P DJI for both European and the US markets,

One thing that stands out to me is the rebound in dividend related styles / factors in both tables.…[Read more]

Reacted by Richard Berry -

-

Darren Sinden posted an update

1 month, 2 weeks agoYou may recall that in a comment about CMC Markets CMCX LN just under a week ago , I highlighted that IG Group IGG LN were among the most oversold UK Stocks .

Well the stock price has started to address that statistic today, rallying by +11.00%.

Lets not forget that according to industry press IG were recently approached by Crypto…[Read more]

Reacted by Richard Berry -

-

Darren Sinden posted an update

1 month, 2 weeks agoWe didn’t have to look far for another example of mispriced US stock in fact we didn’t even need to leave the retail sector. Abercrombie and Fitch ANF US are up + 26.00% as the stock beat earnings consensus by 30.0 cents and pointed to growth at their Hollister subsidiary.

The stock was rated as a moderate buy among 12 analysts – 4 of whom…[Read more]

-

Darren Sinden posted an update

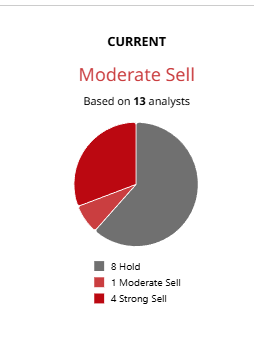

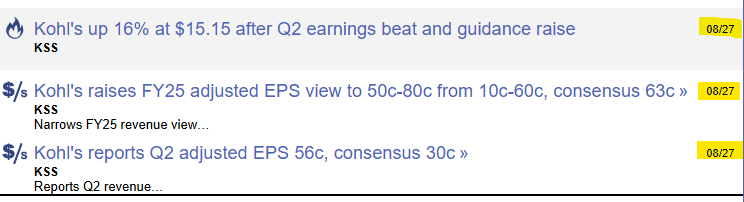

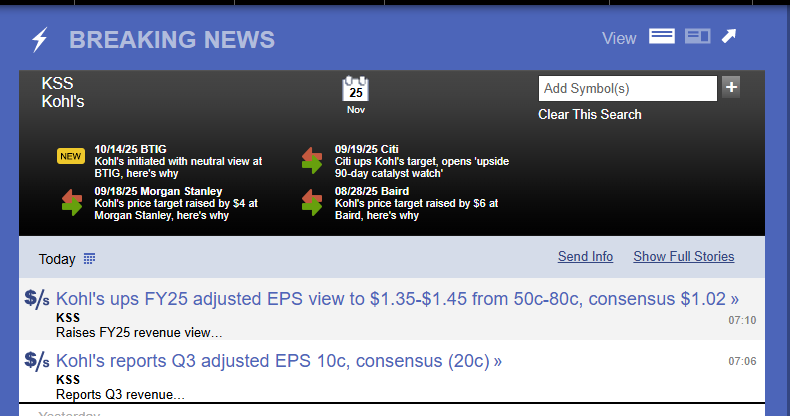

1 month, 2 weeks agoHere are the analysts recommendations the Hi Low and Consensus price targets and a reminder that this is not the first time lately that Kohls has surprised on the upside .

-

Darren Sinden posted an update

1 month, 2 weeks agoUS mid tier department store Kohls KSS US is set open higher by around +27.0% today after it reported estimate beating numbers.

At least 13 analysts cover the stock on Wall Street so I am forced to wonder how did most of them get it so wrong and how many other stocks out there have been incorrectly labelled ??

-

Darren Sinden posted an update

1 month, 2 weeks agoThe UK is often criticised for lack of technology and growth stocks and much of that criticism is justified.

However, there are growth stocks in the UK top flight and one of those is Airtel Africa AAF LN .

The stock is up +167.0%over the year to date, and by +206.0% over the last 52 weeks .

It’s posted 74 new highs in 2025 and has a…[Read more]

-

Darren Sinden posted an update

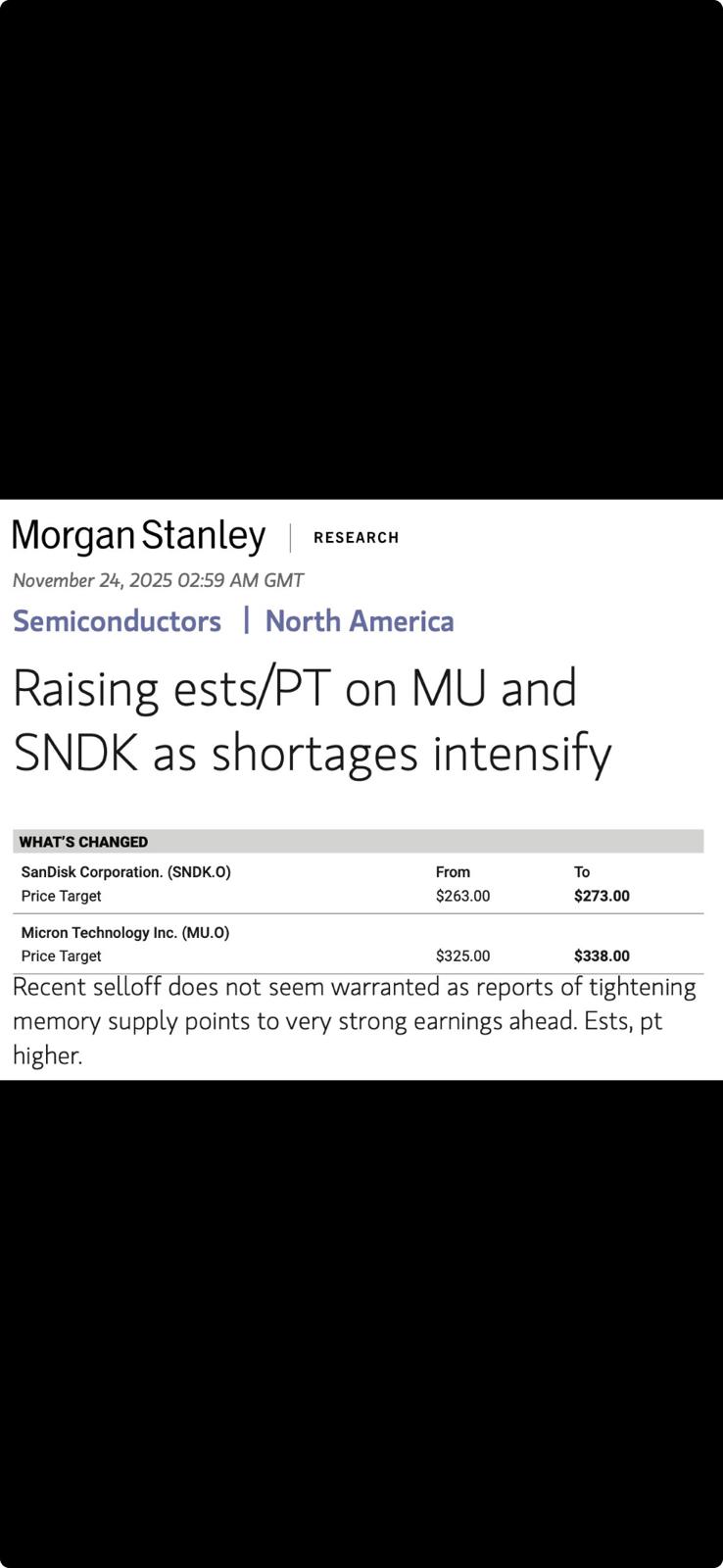

1 month, 2 weeks agoMemory stocks have rebounded today with Sandisk SNDK up by + 12.0% , Western Digital WDC up +8.0% and Micron MU by +7.0%. this comment from Morgan Stanley is likely behind some of those gains .

-

Darren Sinden posted an update

1 month, 2 weeks agoGood Morning all,

The mood in the market this morning seems to be one of cautious optimism. I will be watching the Nasdaq 100 index for clues and in particular how it performs around old support and resistance circa 24446/50 and 25536/40 above that .

In Europe the Dax has opened up by +1.0% and the Stoxx 600 by +0.57%.

-

Darren Sinden posted an update

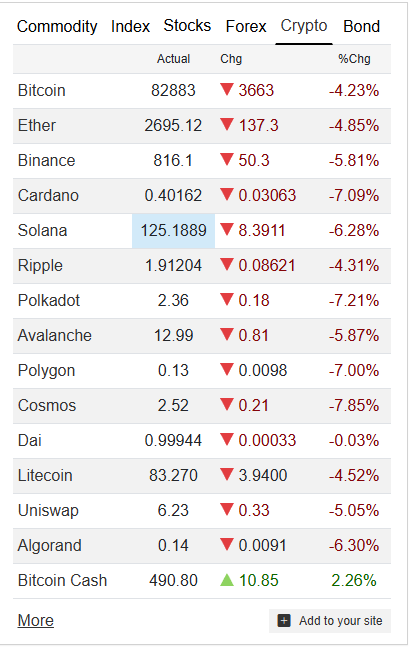

1 month, 2 weeks agoLooking at how Bitcoin is performing today it looks like it’s risk-off into the weekend .

And on that note I wish you a good one .

-

Darren Sinden posted an update

1 month, 2 weeks agoAlmost an hour into the US trading day and the Nasdaq 100 index is once gain struggling to post and retain gains on the day.

Markets are effectively a continuous auction between buyers and sellers, who are trying to establish an equilibrium price, at which business can be transacted .

An imbalance in the supply or demand, of either buyers…[Read more]

-

Darren Sinden posted an update

1 month, 3 weeks agoIts very easy to focus on silicon valley and the hyperscalers when thinking about data entre capex and buildout .

However ,there are real world winners too .

For example Finnish engine and turbine maker Wartsila WRT1V the stock is up 9.26% today on deal to supply 27 engines to a US datacentre.( see…[Read more]

-

Darren Sinden posted an update

1 month, 3 weeks agoThis is what Swiss bank UBS has to say about those Nvidia earnings:

Summary Thoughts

Consistent w/our preview, NVDA’s guidance was very solid (even better than our $63-64B) with demand commentary delivering another full throated message that the market is too concerned about any “bubble” that may be forming.

While still probably prudent to…[Read more]

-

Darren Sinden posted an update

1 month, 3 weeks agoLooking at Nasdaq 100 CFDs today its pretty clear where the resistance has been in the morning session. Nvidia earnings last night may have provided the markets with a tonic, but that will only matter, if the wider market can build on that, make gains and hold on to them into the US close.

What are you thoughts?

-

Richard Berryreplied 1 month, 3 weeks ago

I’m probably more likely to buy puts rather than calls at those levels… short to medium term anyway.

like like

like dislikeReacted by Darren Sinden

dislikeReacted by Darren Sinden-

Darren Sindenreplied 1 month, 3 weeks ago

I will remain sceptical until the price action shows me otherwise as to options I am told that the recent up tick in volatility has made short term/ ODTE options too dear for many to sensibly trade.

like like

like dislike

dislike

-

-