Darren Sinden

-

85

Posts -

6

Comments

-

-

-

-

Darren Sinden posted an update

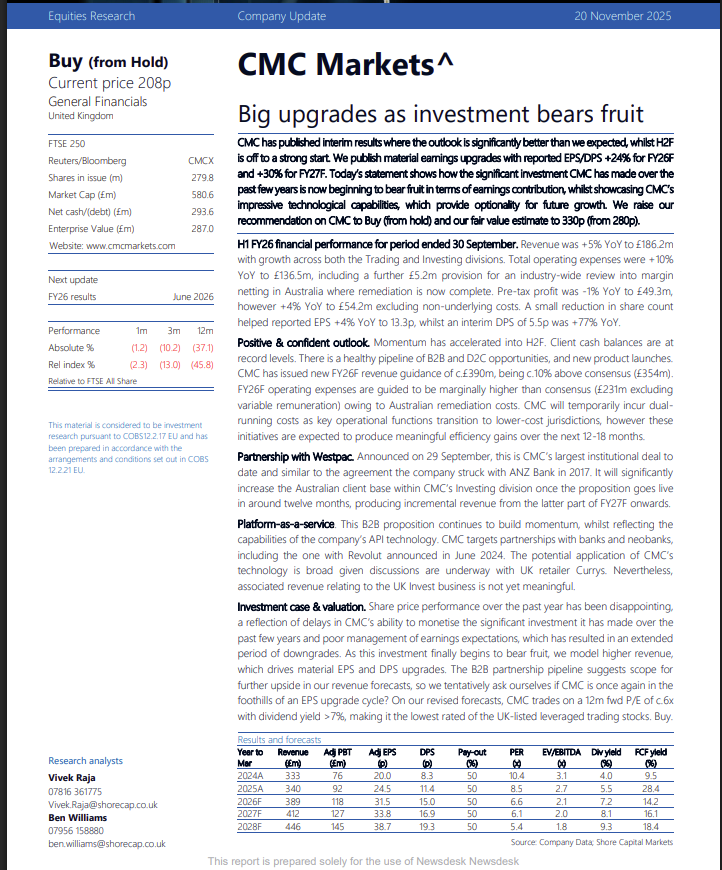

1 month, 3 weeks agoCMC Markets CMCX LN reported their interim results today:

This is what brokers Shore Capital had to say about them ( see below)

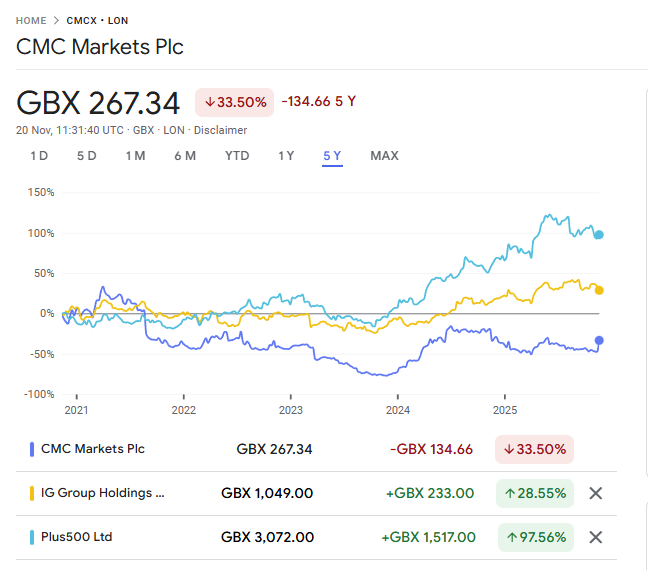

The market likes what they see and the stock has rallied by +29.00% ( second image)

Despite that V impressive gain. they still have plenty of room to play catchup versus IG Group and Plus 500.(image 3)

IG Group…[Read more]

3 CommentsReacted by Richard Berry-

Richard Berryreplied 1 month, 3 weeks ago

There’s got to be a divergence trade there somewhere… I would’nt be short any of those atm

like like

like dislikeReacted by Darren Sinden

dislikeReacted by Darren Sinden-

Darren Sindenreplied 1 month, 3 weeks ago

Agreed, not least because Kraken or another player could take a run at IG Group again

like like

like dislike

dislike

-

-

-

Darren Sinden posted an update

1 month, 3 weeks agoHas Danish wind farm builder Orsted ORSTE DC, spent too much time on the “Naughty Step “?

The charts below suggest that could be the case. And as you can see the candle chart is full of unfilled gaps above .

For the price to move into, and fill some of those gaps, we will need a catalyst and demonstrative performance from the share…[Read more]

-

Darren Sinden replied to the topic Will Lloyds Shares Reach £1 in 2025? in the forum UK Stocks

1 month, 3 weeks agoLloyds Banking Group has come within a whisper of trading at £1.00 in recent sessions, posting a high of 95.861p.

So, will one of the UKs most widely traded and owned shares be able to reach the round number, and what would it take to get it there?

Lloyds has comfortably outperformed the FTSE 100 so far this year. Its shares have risen by…[Read more]

-

Darren Sinden replied to the topic Can The FTSE 100 Reach 10,000? in the forum Indices

1 month, 3 weeks agoWhen it comes to the FTSE 100 Index will it, or won’t it reach 10,000? Is the question on most investors’ minds.

As I type we are some 450 points or approximately -5.0% beneath that round number.

The index has added +15.39% year to date, so we would need to see that jump by+ 30.0% to hit the target, and that might be asking too much before…[Read more]

-

Darren Sinden posted an update

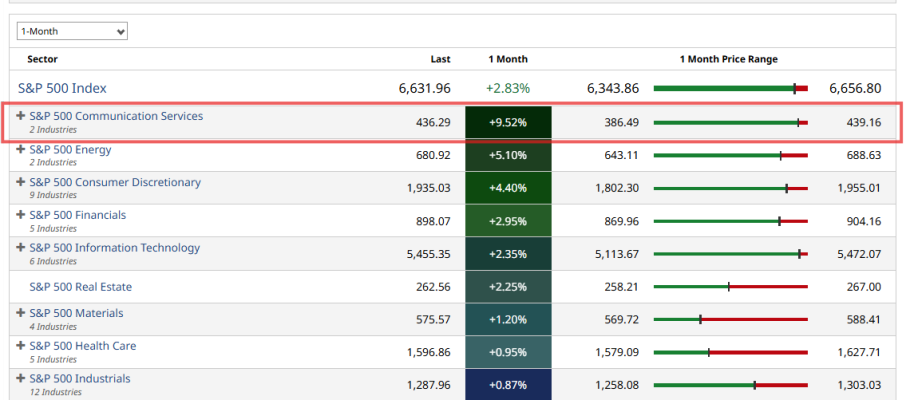

2 months agoit was very noticeable today that US stocks that were higher in the pre market session ,and which might have been expected to have added to their gains in regular trading, didn’t .

A classic example was Marvel Tech MRVL US which gapped higher in the Pre-Mkt, trading up to $104.00, having closed at $92.90 on Wednesday evening .

However, as…[Read more]

-

Darren Sinden posted an update

2 months, 1 week agoMemory names in the US are running again with SNDK US STX US MU US and WDC US all up sharply today. The later has posted a new all time high as well.

I follow the sector closely and have done for 25 years.

SNDK US SanDisk have been one of my top picks this year- since they were spun out of Western Digital WDC US, which retained a 1 9.99% stake…[Read more]

Reacted by Richard Berry -

-

Darren Sinden posted an update

2 months, 1 week agoPalantir Technology PLTR US behaved very well in the run up to earnings yesterday, putting on +20.0% since October 22nd.

PLTR reported after the close last night, beat estimates, and raised its guidance for the FY 2025.

Seven US brokers raised their price targets for the stock on the back of the earnings report .

And yet the share price is…[Read more]

-

Darren Sinden posted an update

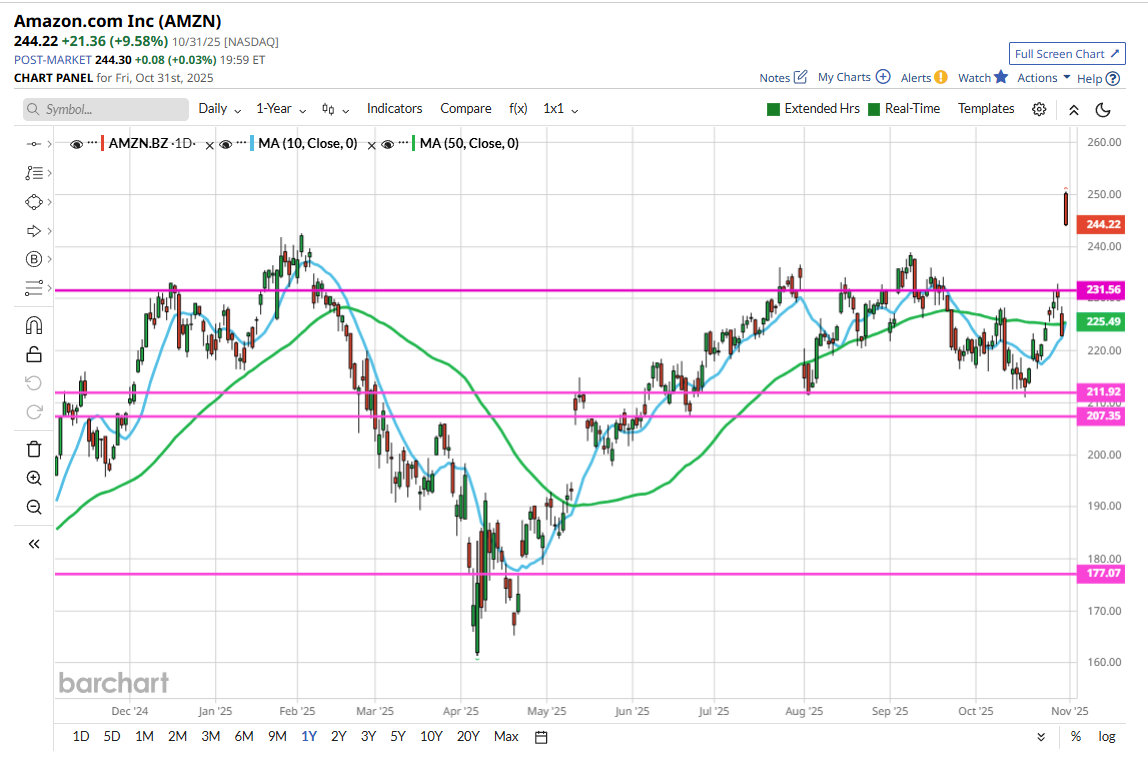

2 months, 1 week agoComing back to Amazon AMZN US its seems that (my) objections are being over ridden as the company announces a $38.00 billion deal with AI darling Open AI (never mind the fact that Open AI is loss making and it’s writing cheques it probabaly can’t cash ,right now).

-

Darren Sinden posted an update

2 months, 1 week agoAmazon AMZN US is something of a marmite stock right now.

Morgan Stanley are fans however and have made a bullish case for the e-commerce to cloud computing giant which can be summarized as follows:

Morgan Stanley analysts project that AWS is entering a powerful AI-driven growth phase, driven by massive capacity expansions, surging AI…[Read more]

-

Darren Sinden posted an update

2 months, 2 weeks agoI seem to have an affinity with Finnish stocks this week: First of all Nokia announced a $1.0 bln investment from AI giant Nvidia NVDA, yesterday, that news sent Nokia up by +20.0% .

However i had been bullish on the name since early October – see the green line below. so the Nvidia move was icing on the cake.

Having read JP Morgans…[Read more]

-

Darren Sinden posted an update

2 months, 2 weeks agoQuantum Computing stocks are heading hire in the US again today led by D-Wave QBTS US.

This very much as momentum and sentiment driven sector and one that’s highly volatile as result but there are opportunities despite or perhaps because of that.For example, D-Wave stock QBTS wa s up by just +3.83% at 13.16 London time today in the US pre…[Read more]

-

Darren Sinden posted an update

2 months, 2 weeks agoTalk of a outline trade deal between China and the US has seen Markets trade higher this morning. Details of the deal will supposedly be confirmed when the Presidents of the two countries meet in South Korea, on Thursday. A confirmed deal would be good news, though as ever the devil will be in the detail.

Traders and investors are likely…[Read more]

-

Darren Sinden posted an update

2 months, 2 weeks agoAhead of next months UK Budget several sources point to the likelihood of a further rise in the National Living Wage for example this from Panmure Liberum.

“Whilst it won’t be confirmed until the Budget, the rate for the National Living Wage looks set to increase by 5.4% from April 2026 according to the ASHE data released yesterday. The Low Pay C…[Read more]

-

Darren Sinden posted an update

2 months, 2 weeks agoMeanwhile JP Morgan shares some highlights from its recent Global Capex Survey saying that “our survey paints an increasingly bullish picture for the demand outlook for data centers

(DC) and associated upstream infrastructure capex,”Adding that ” Within the coverage, this backdrop supports our OW ratings on Siemens, Legrand, Prysmian and IMI,…[Read more]

-

Darren Sinden posted an update

2 months, 2 weeks agoMorgan Stanley writes on European equities this morning, highlighting the potential for accelerating M&A activity on the continent. The bank’s analysts say that:

” Europe is benefiting from the global M&A upswing. Our team lays out a compelling

case for a continued recovery in global M&A volumes from still well below cycle-average

or peak levels.…[Read more] -

Darren posted an update

2 months, 2 weeks agoUS CPI data was out a little earlier this afternoon, and to be honest, it surprised most people in the market, coming in below expectations. True, inflation in the US is still rising, but it’s doing so at a slower pace .

Eben Core Inflation, the measure that I tend to watch, slowed to just 3.0% from prior prints at 3.10% see the chart below.That…[Read more]

Reacted by TURMACU DAN -

-

Darren posted an update

2 months, 3 weeks agoI have been watching Sweden’s Svenska Handelsbanken AB for several weeks now as the stock gently moved higher, testing back to horizontal resistance <earnings today haven't provided a catalyst for a move higher, unfortunately, with Bloomberg reporting that

"Svenska Handelsbanken AB reported third-quarter profit from lending that was broadly…[Read more]

-

Darren posted an update

2 months, 4 weeks agoIn terms of movers today in the UK and Europe, British Land Rallies on a strong trading update, boosted by the return to the office – BLND LN has risen by +5.30% to trade at 382.4p. The real Estate sector in the UK has been in focus this week, with bid speculation around Big Yellow Group BYG LN and a sympathetic move higher in Safestore SAFE LN.…[Read more]

-

Darren posted an update

2 months, 4 weeks agoMorgan Stanley writes on European Airlines today, under the title “Short Haul Pain, Long Haul Gain” IAG is their top pick; the British Airways and Iberia owner is listed in both London and Madrid. MS points to transatlantic strength and higher levels of profitability and cash flow at IAG. RYA Ryan Air is also rated as overweight. Despite…[Read more]