Invesdaq

-

1

Posts -

0

Comments

-

-

-

-

Darren Sinden posted an update

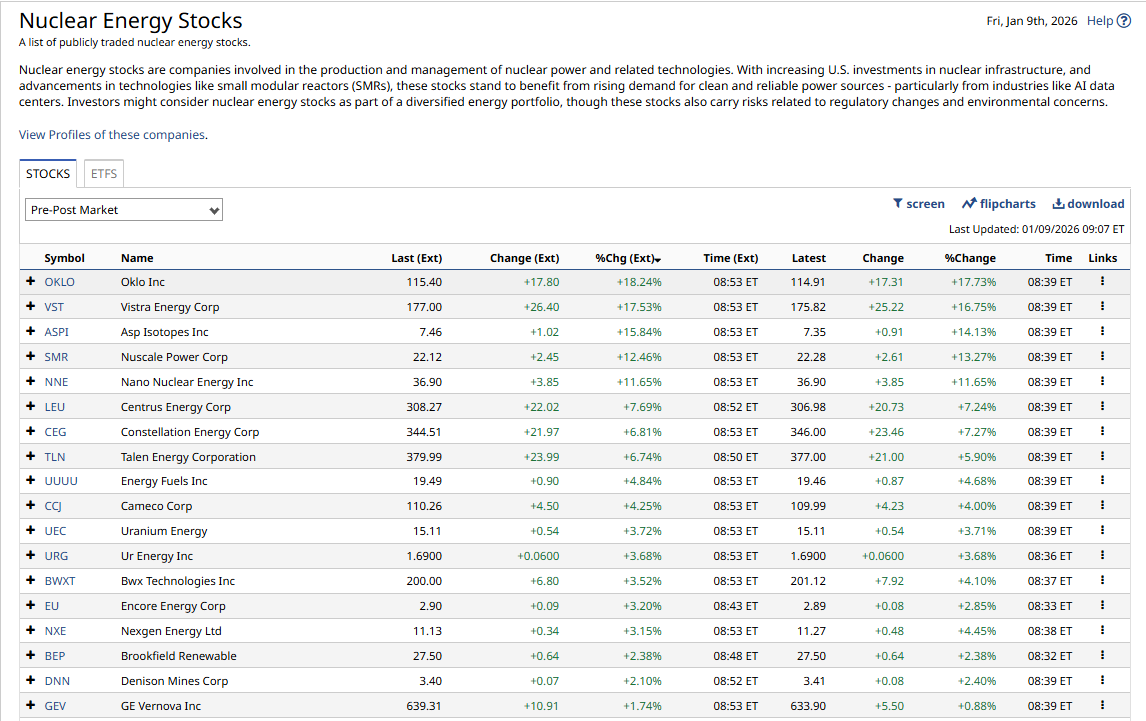

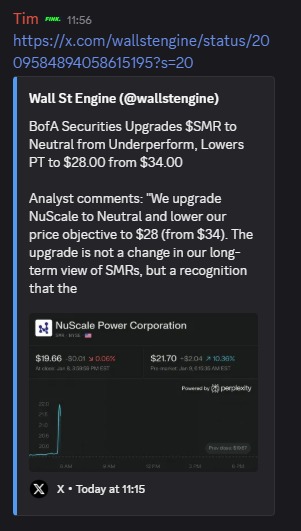

2 days, 5 hours agoNuclear stocks are to the fore in the US pre market as Meta Platforms META signs deals with OKLO OKLO and Vistra Energy VST the stocks are either side of +18.0% higher and the news has boosted other names among nuclear energy and uranium stocks.

URA US the GX Uranium ETF is up by +5.5% pre market

Stifel Canada wrote on Uranium stocks…[Read more]

-

Jackson Wong posted an update

2 days, 7 hours agoAmazon (AMZN) to regain upward initiative?

Out of the top techs last year, Amazon’s (AMZN) share price was the least exciting.

Look at its trading range over past 12 months. Price was mostly bouncing in between $200-$240, with occasional ventures outside these parameters.

The tariff-induced sell-off in April kicked prices to $160; a bout of e…[Read more]

-

Darren Sinden posted an update

2 days, 11 hours agoOil prices are higher again as Donald Trump warns Iran about killing anti-regime protesters. Rumours circulated last night about sorties by US forces in the Straits of Hormuz ,a cricial water way for oil tankers. I note that China was thought likley to try and switch to Iranian crude if it’s excluded fronm Venezuelan supplies. Trump has also been…[Read more]

-

Darren Sinden posted an update

2 days, 11 hours agoSome interesting developments overnight as Glencore, approaches Rio Tinto about a possible merger or combination of assets . Mining insiders suggest that this is largely driven by Copper, even though Rio is mostly focused on other minerals and ores . Would imagine this bodes well for other major miners such as Freeport Mcmoran FCX US

-

Jackson Wong posted an update

3 days, 7 hours agoInvestors punish UK food and high street retailers over Christmas retail updates

A few Christmas retail trading updates have arrived today.

Tesco (TSCO), UK’s largest supermarket, reported a 3.2 percent rise in sales over the crucial Christmas period. Its share of the total grocery market stands at record levels.

More importantly, the £27 bi…[Read more]

Reacted by Brian Moore -

-

Darren Sinden posted an update

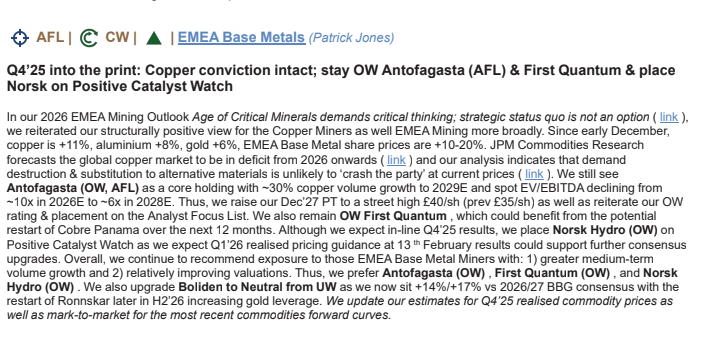

3 days, 11 hours agoCopper is in the headlines once again this morning JP Morgan writes on copper miners maintaining overweight recommendations on several stocks saying:

“JPM Commodities Research forecasts the global copper market to be in deficit from 2026 onwards ( link ) and our analysis indicates that demand destruction & substitution to alternative…[Read more]

-

Darren Sinden posted an update

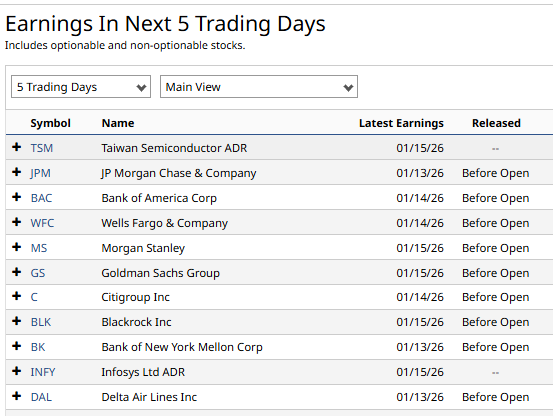

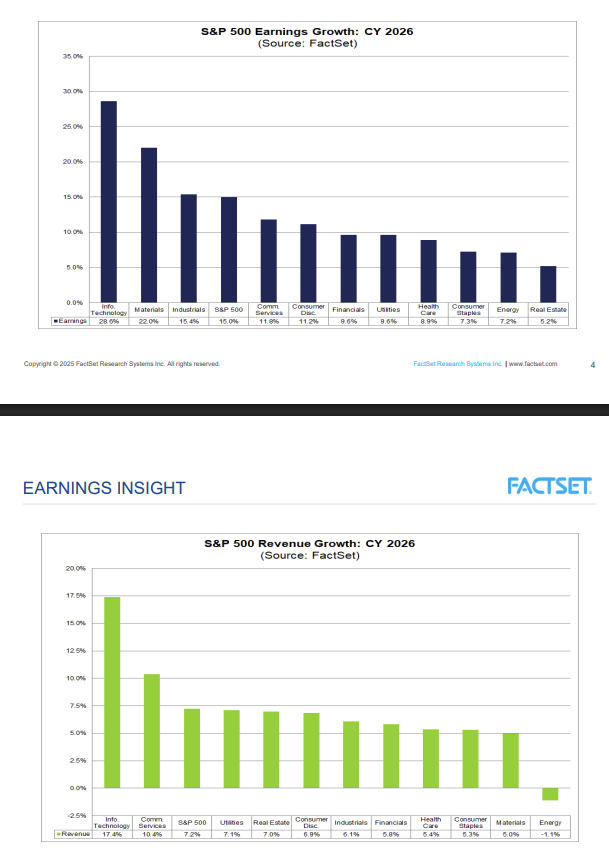

3 days, 11 hours agoQ4 2025 earnings season is fast approaching , in the US JP Morgan JPM US the world’s biggest bank, will unofficially kick off the process before the market open on January 13th.

Wall Street expects S&P 500 earnings to grow by an impressive +15.0% this year and though the Q4 25 reports aren’t directly part of that equation, the numbers and…[Read more]

-

Darren Sinden posted an update

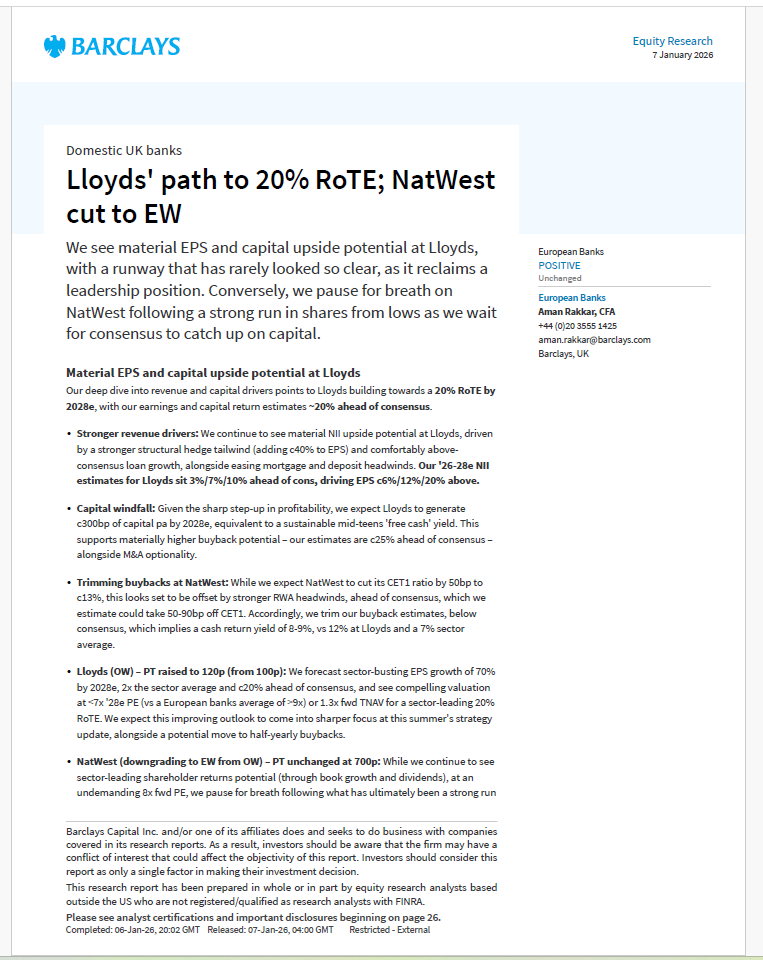

4 days, 5 hours agoWe recently looked at the where Lloyds Banking shares would be in 5 years time https://invesdaq.com/forums/topic/what-will-lloyds-share-price-be-in-5-years/

I was/ am bearish based on macro factors, the UK economy and the bank’s almost exclusive domestic revenue exposure .

However, Barclays take a different view it seems (as you can see…[Read more]

-

Darren Sinden posted an update

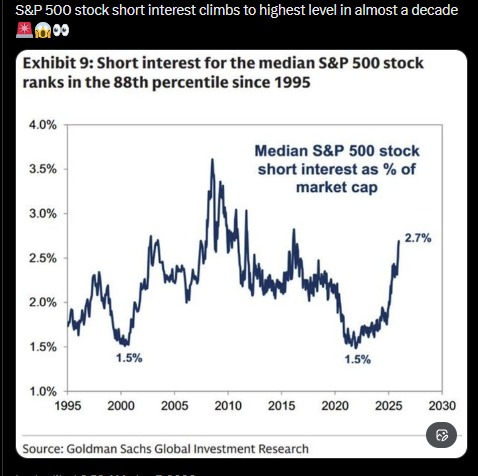

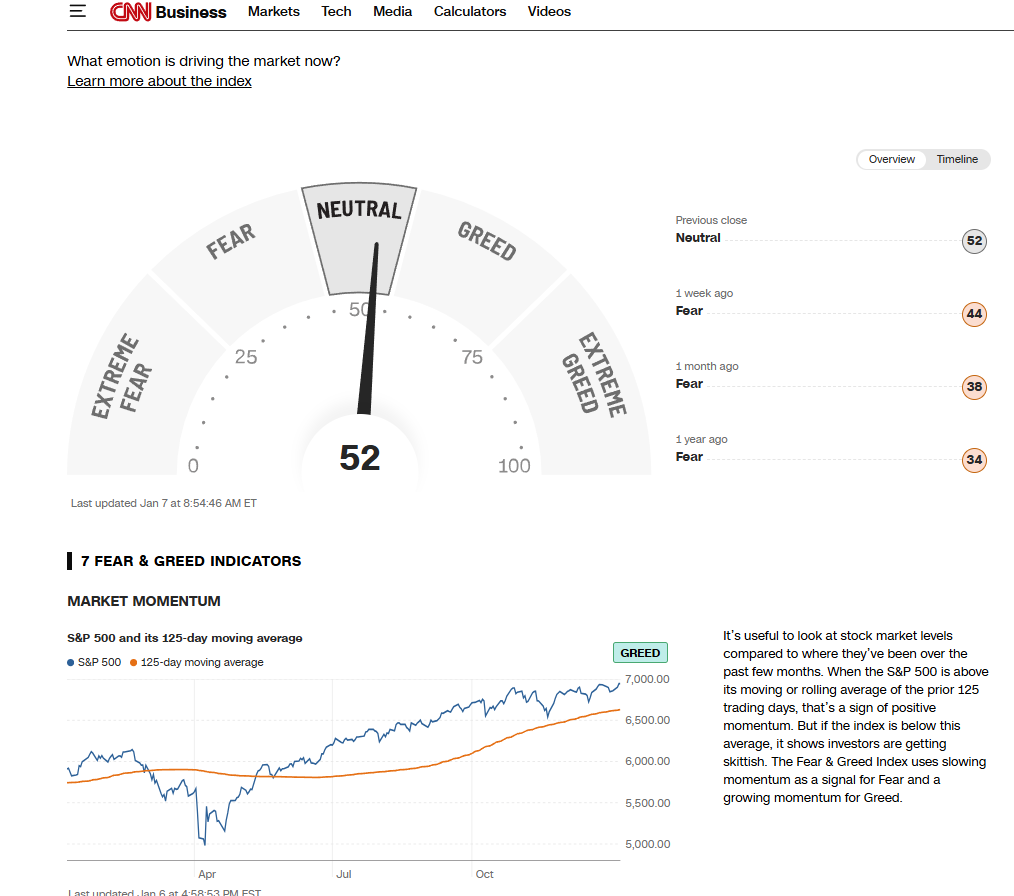

4 days, 6 hours agoA contrarian indicator in the S&P500 (?) at the same time that CNN’s Greed and Fear indicator goes to neutral ………..

Reacted by Richard Berry -

-

Darren Sinden replied to the topic Why are investors excited about The Smarter Web Company shares? in the forum UK Stocks

4 days, 6 hours agoThis news might benefit Smarter Web’s stock price.

“MSTR +4.4% in the pre market as MSCI announces it will not exclude digital asset treasury cos from MSCI Indexes.”

-

Darren Sinden posted an update

4 days, 6 hours agoInterestingly ALB US get written up today in the US :

Albemarle (ALB) Brokerage Firm: Robert W. Baird | Action: Upgrade | Ratings Change: Neutral » Outperform | Price Target: $210| Current Price $161.93

-

Jackson Wong posted an update

4 days, 8 hours ago2026 is bringing new opportunities to the defense industry.

Geopolitical tensions are surging in all corners of the world, from South America to eastern Europe to the Middle East. Even the faraway island – Greenland (population only 57,000!) – is being cast under the spotlight.

No wonder investors are piling into defense stocks, particularly UK…[Read more]

-

Darren Sinden posted an update

4 days, 11 hours agoA month ago I highlighted the upside potential in copper miner Freeport Mcmoran FCX US ( you can view the comments here https://invesdaq.com/members/fatdaz/activity/265/)

I am pleased to report that the stock has rallied by just under +25.0% in the intervening period and has even outperformed Antofagasta ANTO LN over the last 4 weeks.

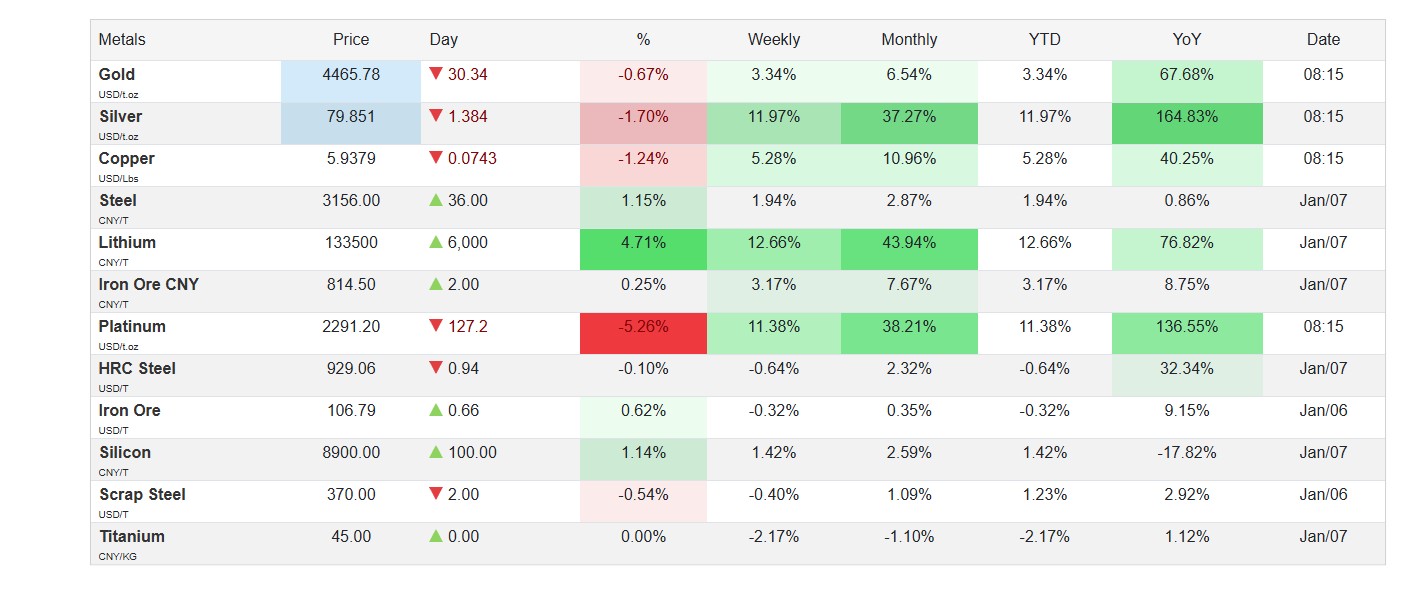

Metal…[Read more]

-

Jackson Wong wrote a new post

5 days, 5 hours agoFive Stock Trends To Watch In 2026

A Happy New Year to all! Not even a week into 2026, and seismic events are already unfolding at pace. […]

-

Darren Sinden replied to the topic What will Lloyds share price be in 5 years? in the forum UK Stocks

5 days, 9 hours agoThis looks like a deceptively easy question on the face of it, after all the stock returned +80.65% over the last 12 months, according to data from Barchart.com.

However the more I dig into the question the more complex it becomes. And that’s because we have to look away from the performance data and ratios, and consider the bigger picture.…[Read more]

-

Jackson Wong replied to the topic Why are investors excited about The Smarter Web Company shares? in the forum UK Stocks

6 days, 7 hours agoSWC essentially aped Microstrategy (MSTR)’s “bitcoin stacking” strategy, by diluting equity to buy bitcoins.

In doing so, SWC hopes that the market will reward the company with high-priced shares. Sometimes this works; sometimes it doesn’t.

Look at MSTR. Its share prices plummeted by -66% in the second half of 2025! For SWC, as Sheldon…[Read more]

-

Darren Sinden posted an update

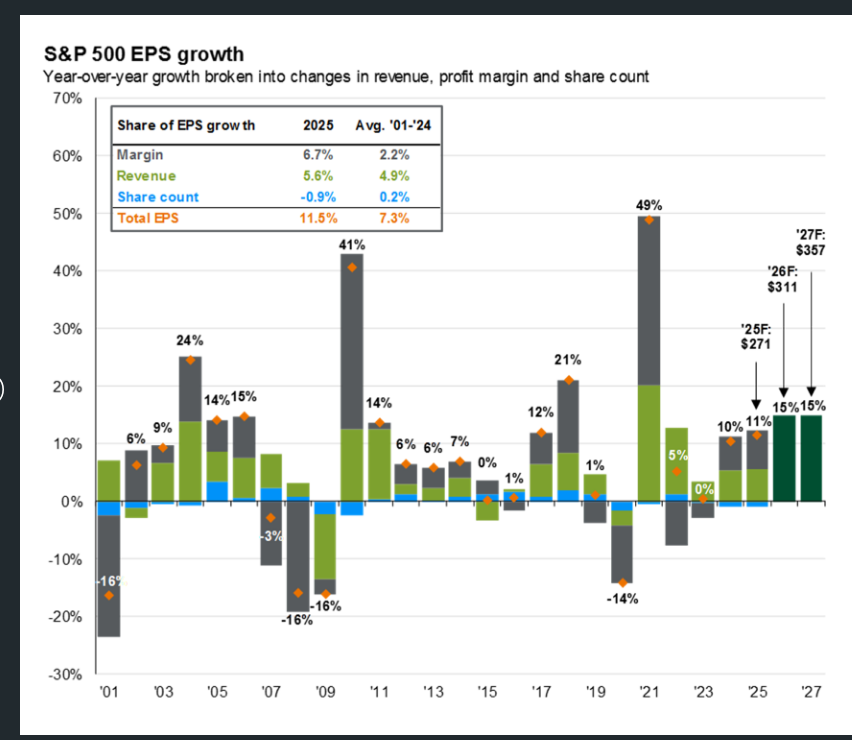

6 days, 8 hours agoWall Street analysts are forecasting EPS growth for S&P 500 stocks in 2026 with EPS expected to hit $311 over the full year according to data from JPM AM ( see image one below) up from the $271 forecast for 2025.

Earnings season will be with us again soon enough , JP Morgan, JPM US, is set to report Q4 2025 earnings on 13/01/2026.

-

Jackson Wong posted an update

6 days, 9 hours agoMarks & Spencer approaching ‘bounce or break’ moment

Investors are waiting nervously for Christmas trading updates from major British retailers.

Given the backdrop of employment, income and tax uncertainties, consumers are clearly not in a keen mood to splash out.

Hence, I flagged the chart precarity of Marks & Spencer (MKS).

During 202…[Read more]

-

Darren Sinden posted an update

6 days, 9 hours agoThe first proper trading day of 2026 and there is plenty to contemplate – The events at the weekend were unprecedented, but then again we have never had a US president like Donald Trump have we?

European defence stocks are higher this morning RHM GR, Rheinmetall AG are up + 7.70% for instance- this was one of my top picks in 2025 and right…[Read more]

-

Darren Sinden replied to the topic Why are investors excited about The Smarter Web Company shares? in the forum UK Stocks

6 days, 10 hours agoBitcoin Treasury companies are not something I can warm to I am afraid. You could have made a case for them for them as a way for UK retail clients to gain exposure to bitcoin, via the stock market. However, now that UK private clients can trade in Crypto ETNs that argument has lost its lustre.

Smarter Web and its peers are only as good as the…[Read more]