Invesdaq

-

1

Posts -

0

Comments

-

-

-

-

Jackson Wong posted an update

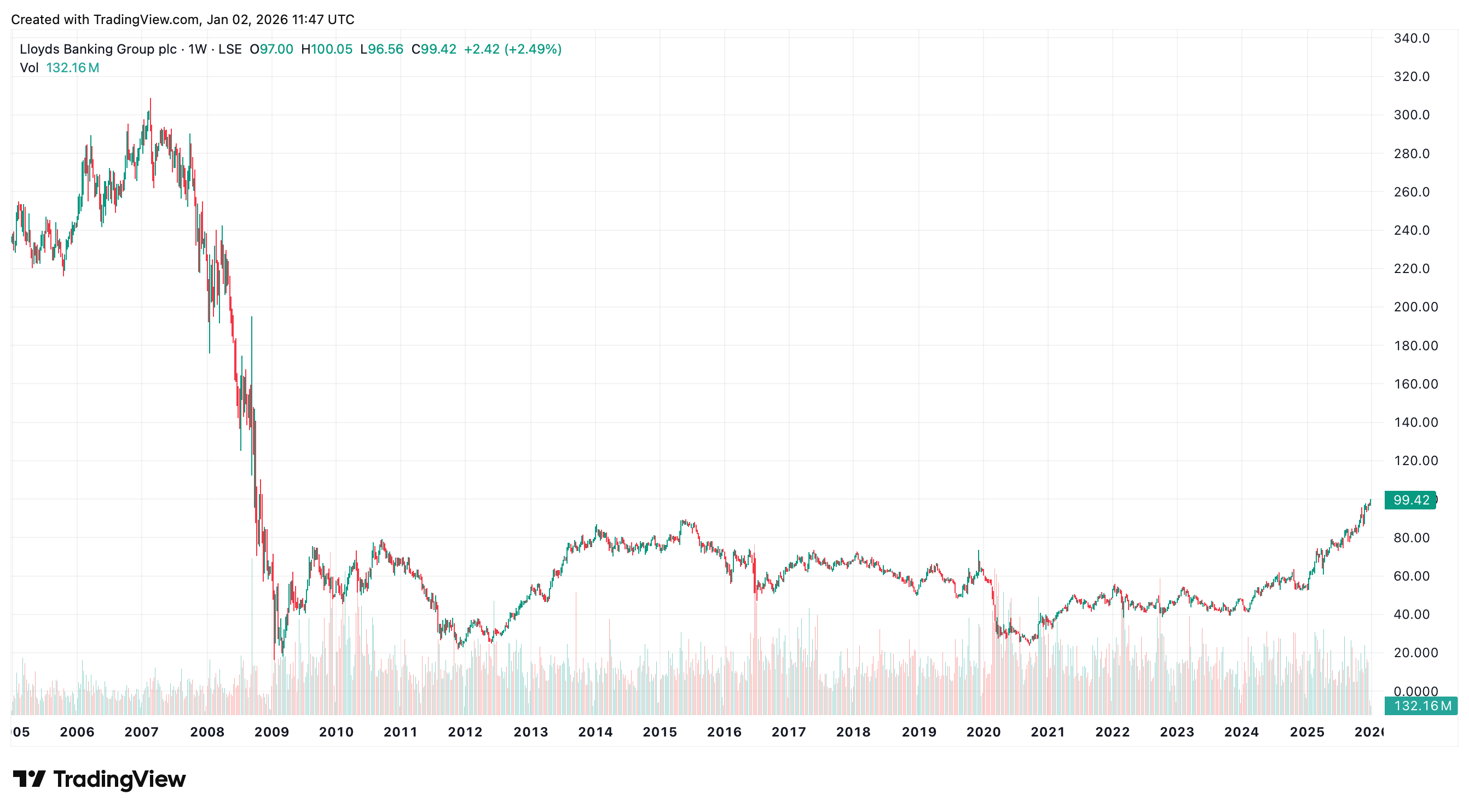

1 week, 2 days agoLloyds (LLOY) is on the brink of reaching triple-digit share price.

The first trading session of 2026 saw Lloyds, one of UK’s largest banks, hit an intra-day high of 100.0p.

This level was last reached in 2008 during the Global Financial Crisis, an event almost 18 years ago! You can say Lloyds’s current rally is almost a onc…[Read more]

Reacted by Richard Berry -

-

Jackson Wong started the topic Has Silver finally found its voice? in the forum Commodities

1 week, 5 days agoFor many long years, Silver was the forgotten cousin of gold – has it now found it’s voice…

When gold powered to new all-time highs back in 2024, silver was found languishing beneath $30 an ounce. That’s nearly $20 beneath its 1980 highs nearly half a century ago.

In other words, silver was trading – using inflation-adjusted pricing – a…[Read more]

-

Jackson Wong posted an update

2 weeks, 6 days agoTesco’s uptrend sits at inflection point

In most years, the two months around Christmas is pure retail bonanza. From Black Friday to Pre-Christmas sales to Boxing Day, retailers pump up the ‘feel good’ factor and squeeze every pound of spending from consumers.

But sometimes they can only do so much.

This year, UK retail sales growth from…[Read more]

1 CommentReacted by Richard Berry And 1 Other-

Richard Berryreplied 2 weeks, 6 days ago

Every little bit of support helps…

like like

like dislike

dislike

-

-

Darren Sinden posted an update

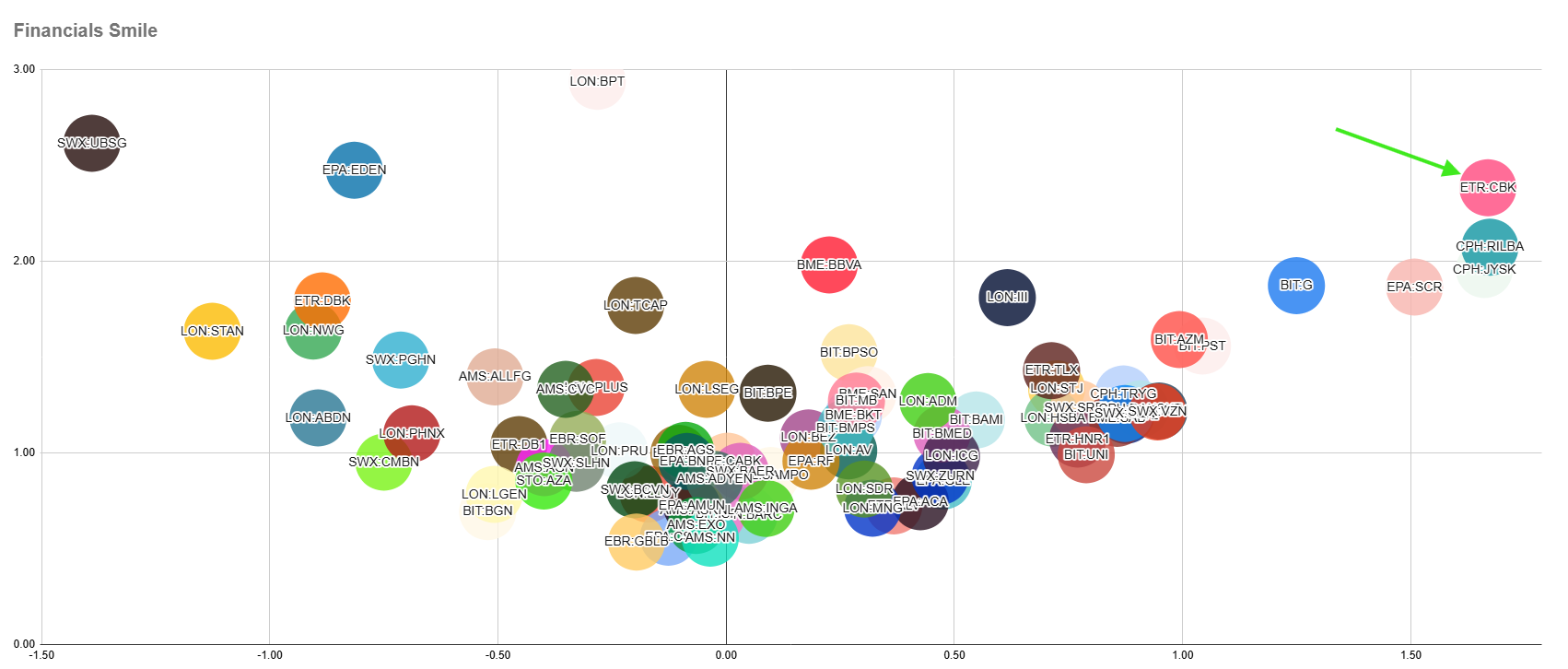

3 weeks, 2 days agoComing back to European banks I notice that, one of the names I follow, has been moving higher again today, and that’s CBK GR Commerzbank AG .

Up by almost +3.0% on the day , not exceptional in itself (though pretty good on a dull pre- Xmas Friday) but good enough to put CBK “right and centre” on the European Financials Sector Smile -…[Read more]

-

Darren Sinden posted an update

3 weeks, 2 days agoCopper has tested to new highs today however looking at the candle chart it seems to have rejected that move as of now.

The weekly close will be the important one here I note Freeport Mcmoran FCX US are called +0.94% higher in the US pre market.

However they are down over the last the week -2.20%. and below both the 3monthj and 6…[Read more]

-

Jackson Wong posted an update

3 weeks, 2 days agoWill Tesla become the next $2 trillion company?

As soon as Musk left DOGE (Department of Governmental Efficiency) in May, Tesla (TLSA)’s investors breathed a collective sigh of relief.

When the world’s richest man was fronting that department earlier this year, Tesla sales tanked, showrooms damaged and his reputation tarnished beyond rec…[Read more]

-

Darren Sinden posted an update

3 weeks, 2 days agoSometimes the behaviour of the markets deviates from economic theory and that certainly seems to be what’s happening in the first chart below, as EU banks continue rise even as EU interest rates fall .

Of course, European interest rates haven’t fallen in isolation, as the tweet below from Julian Jessop reminds us. And perhaps that makes the…[Read more]

-

Darren Sinden replied to the topic What are the best AI stocks to buy now? in the forum UK Stocks

3 weeks, 2 days agoDespite all the hyperbole on Instagram its not clear to me that anyone is making money directly from AI chat bots and agents or when that may change. I have likened the “AI boom” to a gold rush and as with a real world gold rush the people who do best are the ones selling picks and shovels to the miners.

I haven’t seen anything to change my mind…[Read more]

-

Darren Sinden posted an update

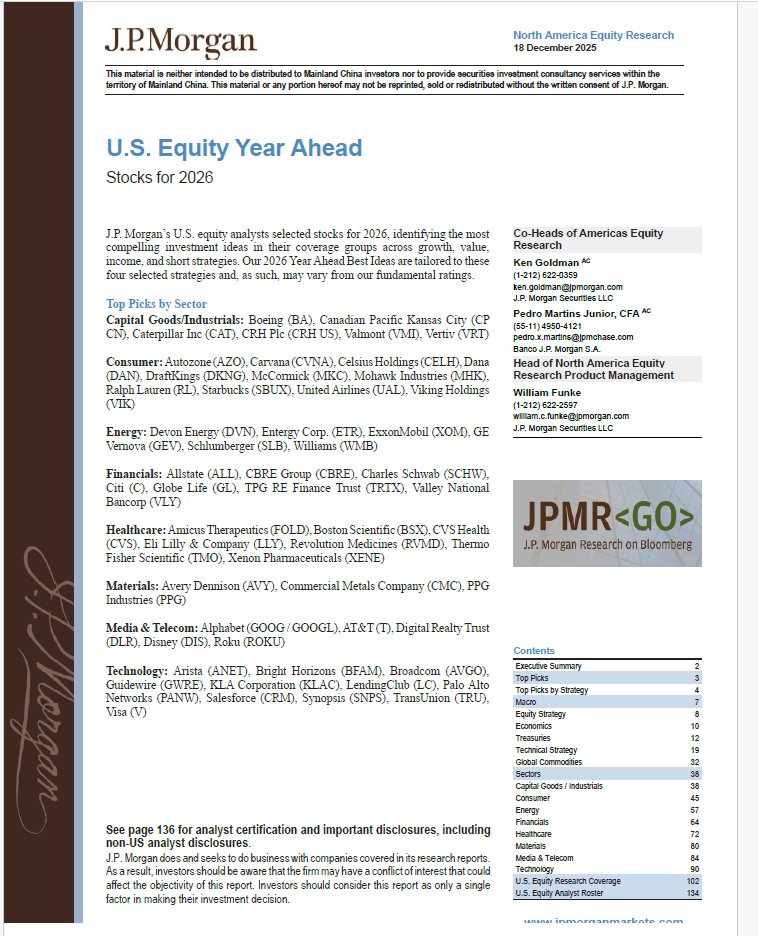

3 weeks, 3 days agoJP Morgan may not be publishing any more morning notes in the UK until Jan 5th 2026, but its US team has published an outlook for stocks in 2026.

Which includes a list of preferred stock in each sector a snapshot of which can be seen below.

The reports extends to 134 pages however the executive is as follows:

“!J.P. Morgan’s 2026 U.S. Equity Y…[Read more]

-

Jackson Wong posted an update

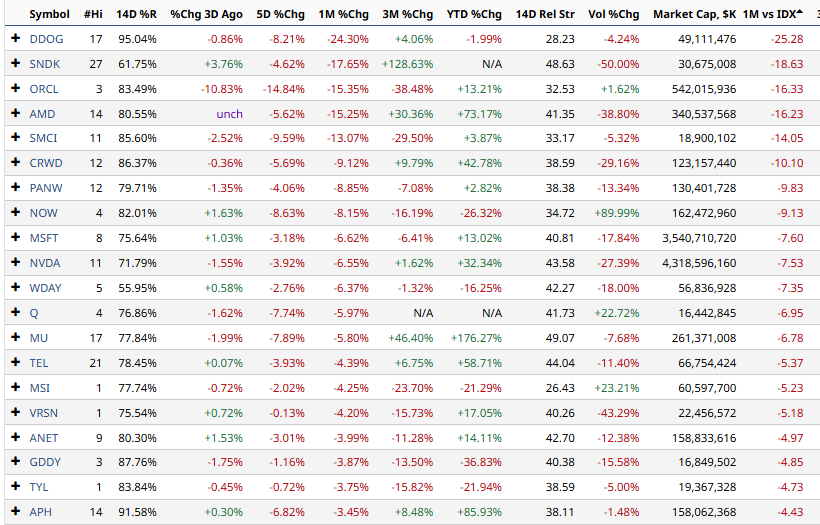

3 weeks, 3 days agoAI fatigue?

Volatility is often a hallmark of speculative markets. Nothing is more speculative these days than the Artificial Intelligence (AI) industry.

Until autumn this year, the sector enjoyed blanket bumper returns. Articulating the word “AI” is imperative in investor presentations, in company reports and in market engagements. The ult…[Read more]

-

Jackson Wong replied to the topic Funds to Watch in 2026 in the forum Funds

3 weeks, 4 days agoMany good points made by Richard, Darren and Sheldon above.

In the realm of asset allocation, the ‘allocation’ part is often a key driver of long-term returns. The other important part is of course the funds themselves.

How much you invest in each asset class determine the overall returns. When investing in funds, investors have to answer:

-

Darren Sinden posted an update

3 weeks, 4 days agoIs the S&P 500 Information Technology sector looking over sold in the short term?

With just 7.14% of stocks in the sector trading above their 5 D MA lines.

The two year chart below tracks this indicator – the magenta line is the low point during this term the indicator can go lower from here, but at least in the last 24 months it hasn’t hung…[Read more]

-

Jackson Wong posted an update

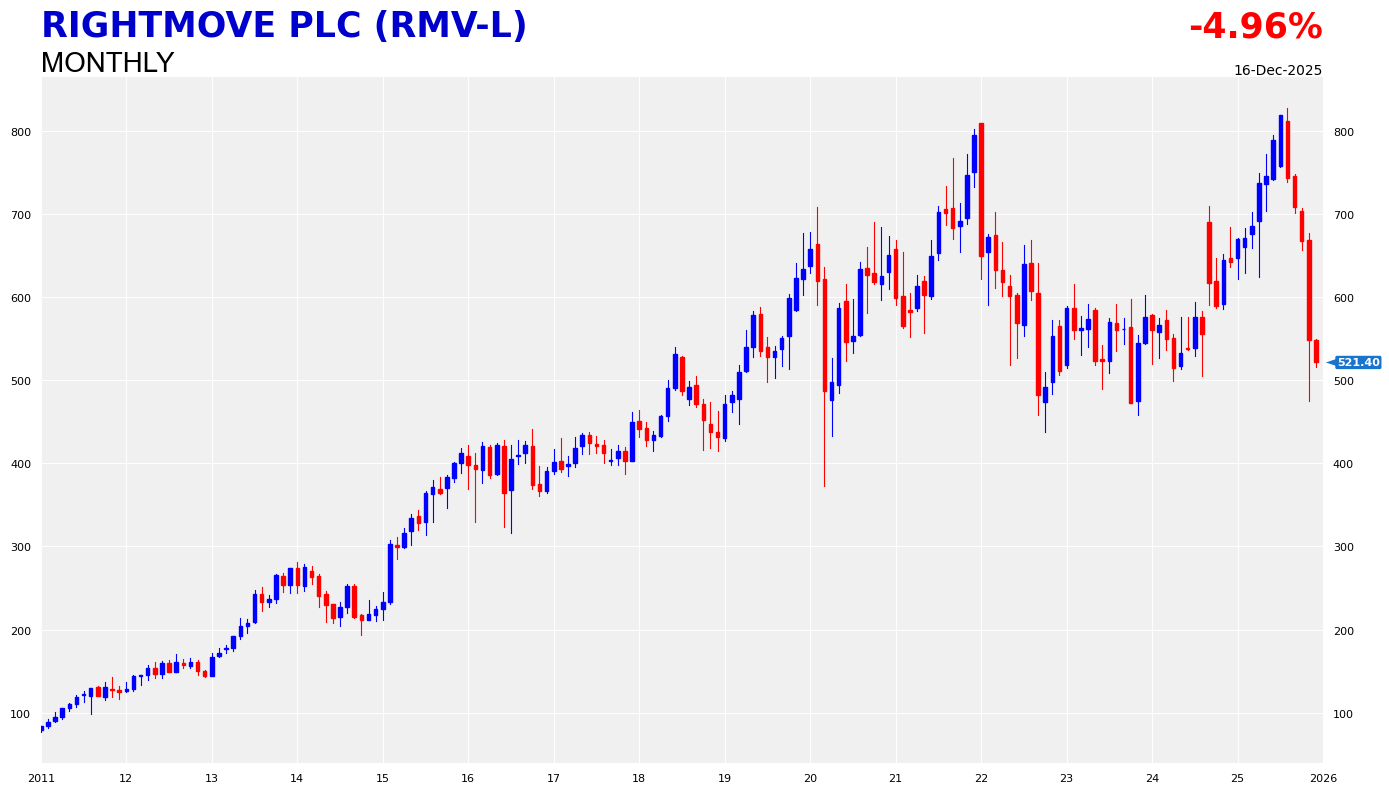

3 weeks, 4 days agoTime to exit property listing platforms?

One recent news article (“Zillow shares are getting crushed. Here’s why.”, CNBC, December 16) caught my eye attention.[1]

The reason is that Google (US:GOOG), the search monopoly giant, is muscling in real estate listing. Starting late 2025, Google has been testing the waters by inserting some prope…[Read more]

-

Darren Sinden posted an update

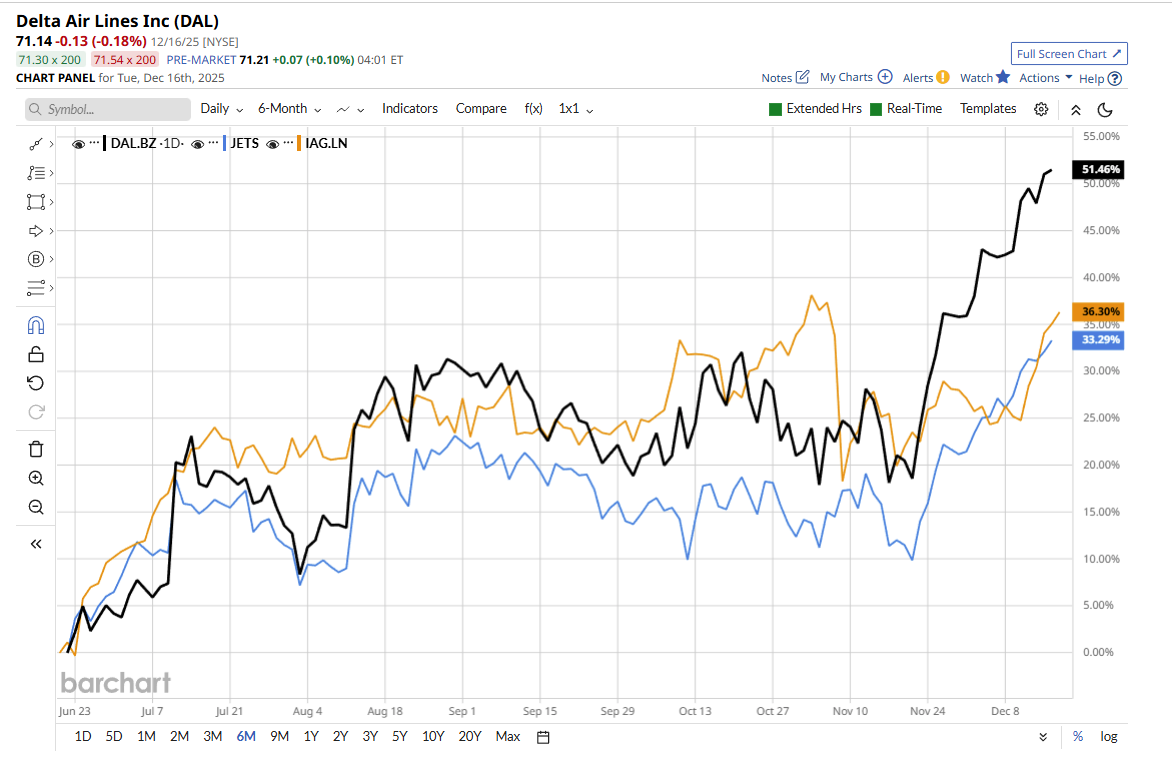

3 weeks, 4 days agoInteresting that Jackson highlights IAG LN this morning, as I posted elsewhere on DAL US Delta Airlines the stock had been climbing since Dec 3rd putting 6 positive sessions out of ten in the interim. The stock may have found its near term ceiling have closed down by -0.18% on Tuesday.

Though I don’t think we can complain too much after a…[Read more]

-

Jackson Wong posted an update

3 weeks, 5 days agoBritish Airways (IAG) eyes a return to pre-covid peak

After a long and laborious climb, British Airways (trading under ticker IAG) finally nears its pre-covid price level.

The owner of BA and Iberia rose four sessions in a row to hit intraday peak of 420p. This level is just 10p shy of the multi-year peak recorded on 3 Nov.

IAG’s robust a…[Read more]

-

Darren Sinden posted an update

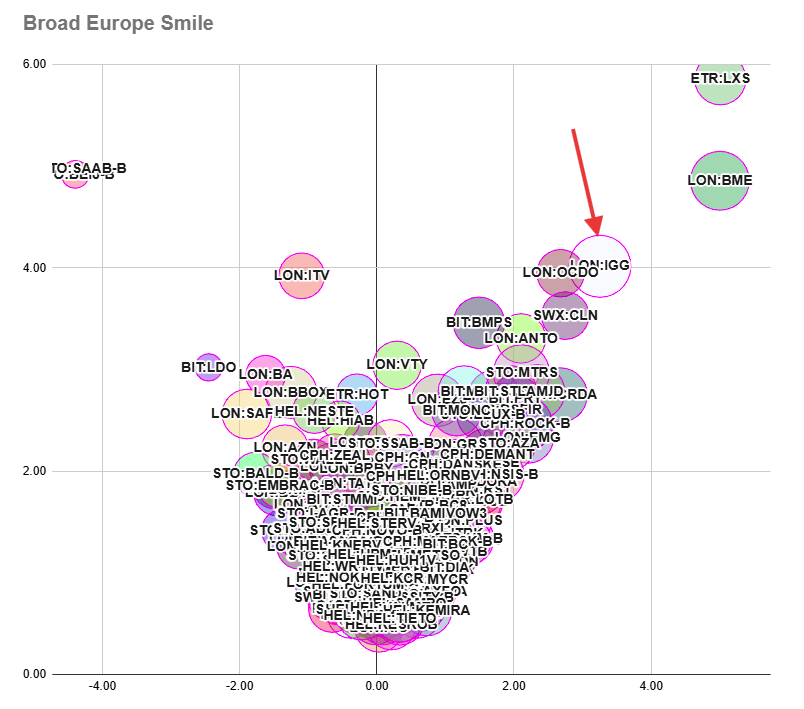

3 weeks, 5 days agoIG Group IGG LN stand out on the Broad European smile this morning, I note.

Reacted by Richard Berry -

-

Darren Sinden replied to the topic Funds to Watch in 2026 in the forum Funds

3 weeks, 5 days agoFund investing is a thorny subject the sad truth is that few actively managed funds will beat their benchmarks, in any given year and fewer still will manage to do that on a consistent basis.

Against that when you buy a fund you are outsourcing the management of your money to an expert/team of experts, in their field. And that appeals to many…[Read more]

-

Darren Sinden posted an update

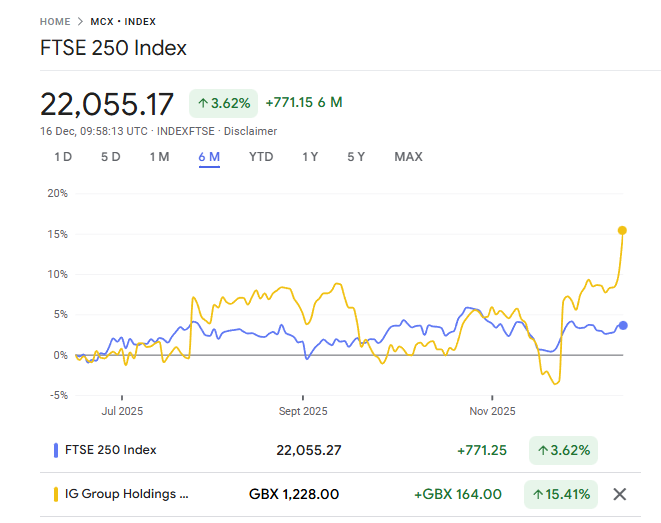

3 weeks, 5 days agoI last flagged IG Group, IGG LN on budget day (see the link below).

My thoughts have been that the stock is undervalued, and the fact that Kraken, for one, was interested in merging with company effectively means that its open to offers. After all CEO Breon Corcoran is an outsider, without any historical allegiance to the brand or its…[Read more]

4 CommentsReacted by Richard Berry-

Richard Berryreplied 3 weeks, 5 days ago

Always been bullish on brokers…

like like

like dislike

dislike-

Darren Sindenreplied 3 weeks, 5 days ago

Great minds etc

like like

like dislike

dislike

-

-

-

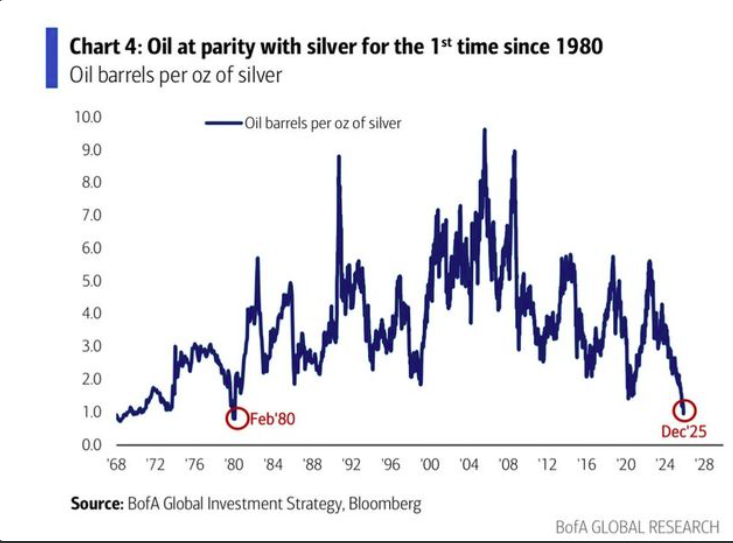

Darren Sinden posted an update

3 weeks, 6 days agoI know I keep writing about metals, but that’s where the action and the interest is at the moment.

Take this chart for example, published by Bank of America and highlighted by Ole Sloth Hansen, Saxo’s commodity strategist.

What is tell us is that silver is at a relative valuation to oil, that we haven’t seen since 1980.

What’s particu…[Read more]

-

Jackson Wong posted an update

3 weeks, 6 days agoSwiss Franc ending 2025 on a high note

One safe-haven asset often overlooked by many investors is the Swiss Franc.

Traders are frequently attracted by gold and AI. But 2025 was an equally good year for Switzerland’s currency.

Take a quick look at British Pound-Swiss Franc’s (GBPCHF) long-term chart. The rate only travels in one direction : Dow…[Read more]