Invesdaq

-

1

Posts -

0

Comments

-

-

-

-

Darren Sinden posted an update

3 weeks, 6 days ago-

Richard Berryreplied 3 weeks, 6 days ago

Those on site will be having a field day!

like like

like dislikeReacted by Darren Sinden

dislikeReacted by Darren Sinden -

-

-

Darren Sinden posted an update

1 month agoI am going to mention a speculative situation today rather than something with investment credentials . The reason for this is that the stock keeps triggering alerts and making bullish noises on my screens and systems so I don’t feel I can ignore it

Gerresheimer Ag GXI GR Is a German manufacturer of packaging products for medication and drug…[Read more]

-

Jackson Wong posted an update

1 month agoBabcock (LSE:BAB) renews cyclical bull run

In a keynote speech this week, Nato secretary general Mark Rutte issued a stark warning about Russia’s threatening behaviour.

“President Putin,” he warned “is in the empire-building business again. He is throwing everything he has at Ukraine, killing soldiers and civilians, destroying the havens…[Read more]

Reacted by Richard Berry -

-

Darren Sinden replied to the topic If you could only own one US stock, what would it be? in the forum US Stocks

1 month agoThis is a great question and my answer is timely and topical, because my stock pick is Broadcom AVGO US. A $1.95 trillion designer, developer and supplier of semiconductors.

Broadcom’s stock price has risen consistently in recent times its added +630.0% in the last three years for example. But its also delivered on an earnings front with 5 year…[Read more]

Reacted by Richard Berry And 1 Other -

-

Jackson Wong replied to the topic If you could only own one US stock, what would it be? in the forum US Stocks

1 month agoIndeed.

That’s the tricky part investing in US equities right now.

Many US stocks (not only tech) have gone up so much. Their valuation are at historic highs, which make them vulnerable to earnings disappointments in the year ahead.

If I were to start buying today with a highly defensive view, the universe where I’d pick one candidate would b…[Read more]

-

Jackson Wong posted an update

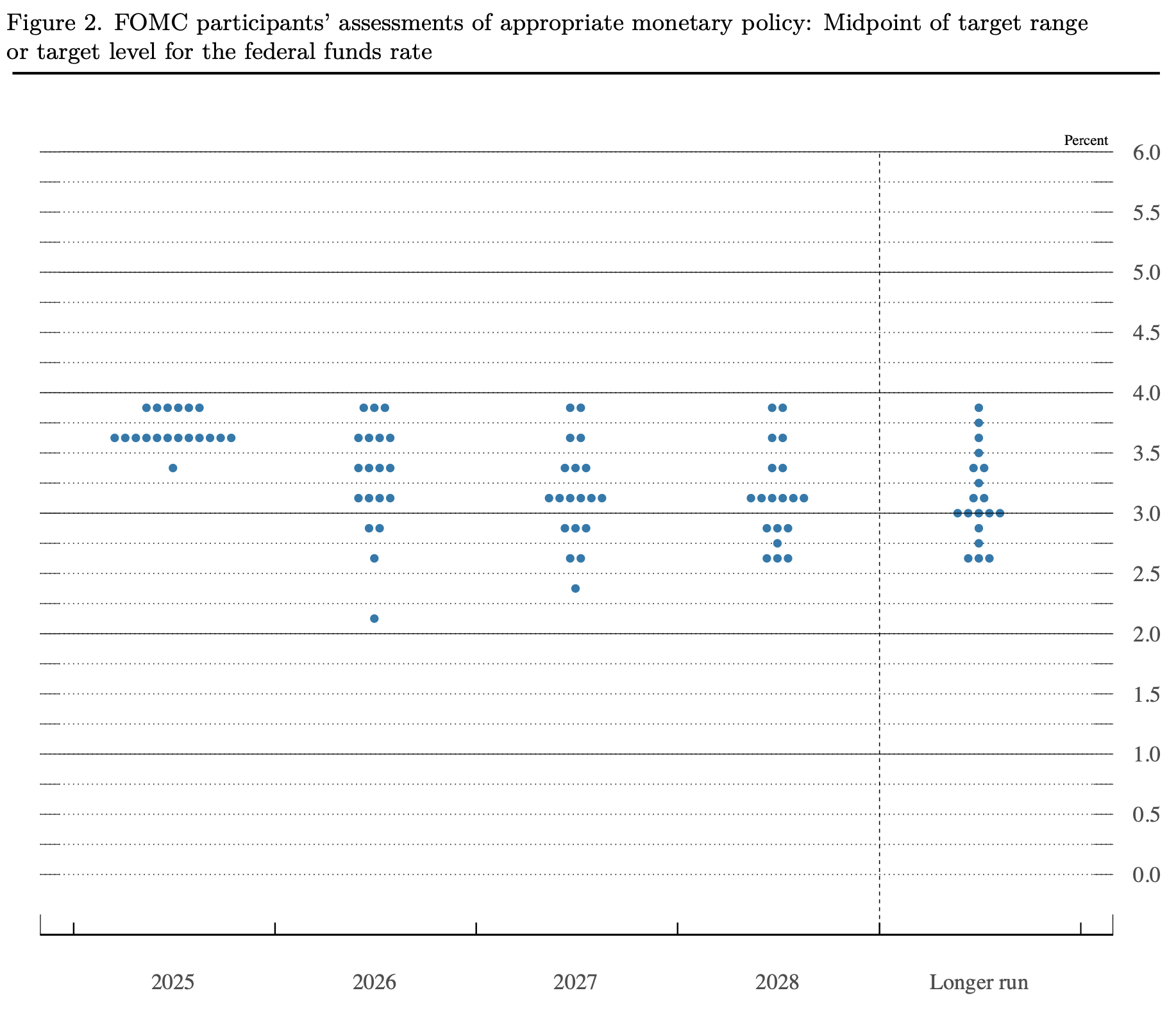

1 month agoUS rate cut boosts silver to all-time highs; watch platinum

After a contentious Fed meet on Wednesday, the final monetary decision was a 25 bps cut. The new band level is set at 3.5-3.75%.

Why contentious? Simply because there was no unanimous decision on: first, the direction of the policy rate and, second, the magnitude of the move. The result…[Read more]

-

Darren Sinden posted an update

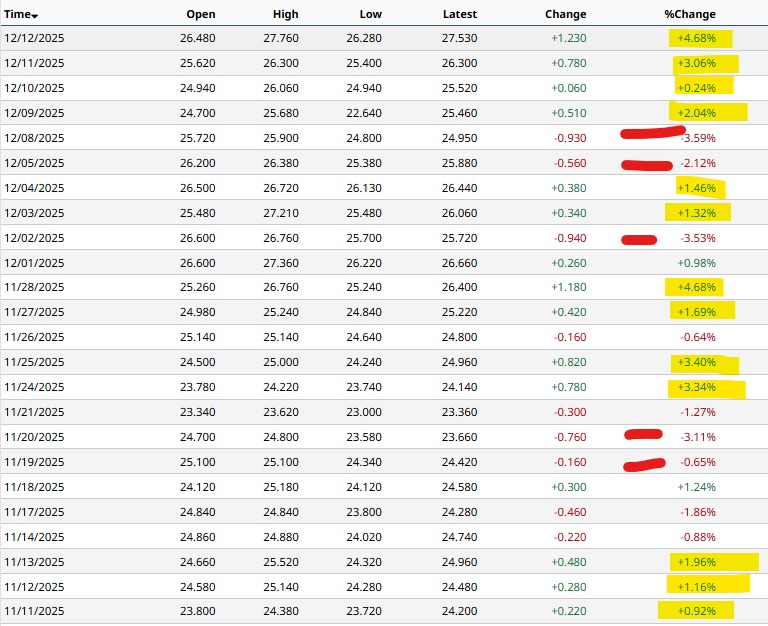

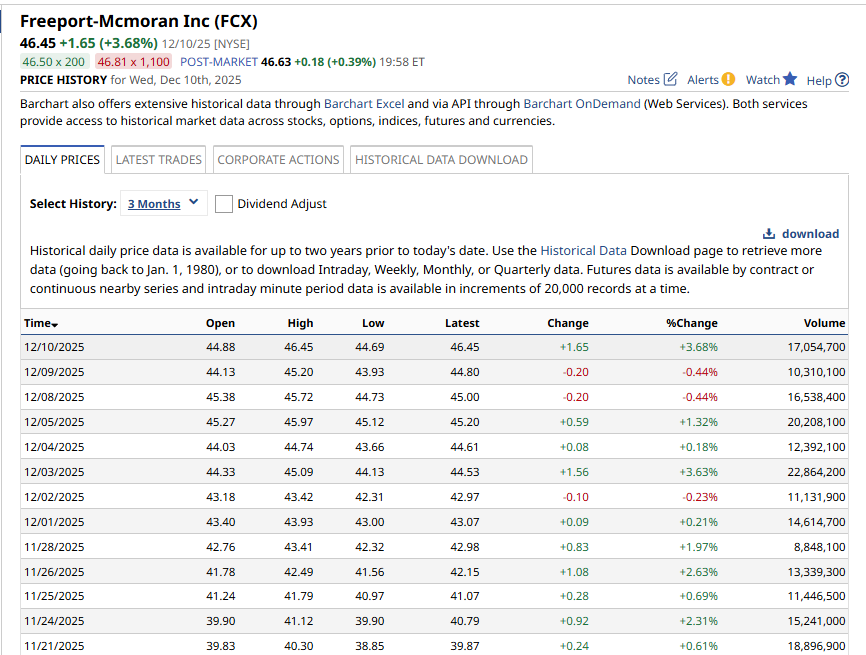

1 month agoFreeport Mcmoran FCX US continues to edge higher adding another +3.68% yesterday.

In fact, the stock is up by +13.43% over the last month and has posted 8 new 1- month highs in that period.

In the table below you can see how the stock has traded since late November green days clearly out numbering red in this period.

This is sort of…[Read more]

-

Jackson Wong posted an update

1 month ago‘Super glut’ heading oil’s way

While natural gas prices keep climbing, the other major energy fuel – crude oil – remains suppressed.

Crude’s 3-year chart below highlights this bear trend clearly. Since 2024, each reaction high was marginally lower than the one before. And each lower low dipped deeper south. Over time, a definitive “downtrend…[Read more]

Reacted by Richard Berry -

-

Darren Sinden posted an update

1 month agoComing back to Natural Gas prices there are some negative headlines about China LNG imports around this morning doing some digging its seems that this isn’t strictly new news but it is worth being aware of given China’s prominent position as a commodity importer and the fact that US Natural Gas is increasingly exported as LNG.

Dutch…[Read more]

-

Darren Sinden replied to the topic Why are natural gas prices surging? in the forum Commodities

1 month agoUS Natural Gas prices have added +11.47% over the last month and are up +33.10% over the year to date. Though prices are well off of the peak seen on December 5th. In fact Jan 26 futures- the current front month contract are some -12.0% below the spike seen in the first week of December.

It’s not uncommon for natural gas prices to spike higher…[Read more]

-

Darren Sinden posted an update

1 month agoRBC has written on UK Wealth Managers today the note is something of a compendium at 57 pages long. However, you can get a flavour of the overall tone from this snippet :

“Our view: An overall relatively benign Budget outcome has removed an overhang for the UK wealth sector which now looks well positioned to deliver strong earnings growth…[Read more]

-

Jackson Wong started the topic Why are natural gas prices surging? in the forum Commodities

1 month agoUS Natural Gas soars to three-year highs, but in comparison, WTI crude is fighting hard to stay north of $60.

Since the start of the North American winter season in October, Henry Hub natural gas futures have been climbing relentlessly to new long-term highs. Last week, prices rocketed to $5 per 10K MMBtu (British Thermal Unit), the highest…[Read more]

-

Darren Sinden posted an update

1 month agoBack on November the 19th, wearing a different hat, I wrote about how it pays to be tactical as a trader.

And with that it mind, I suggested that there was an upside opportunity in US equities, through year end, and into the New Year.

The bullet points from that article are as follows:

Tactical Opportunity: There might be a tactical…[Read more]

-

Darren Sinden posted an update

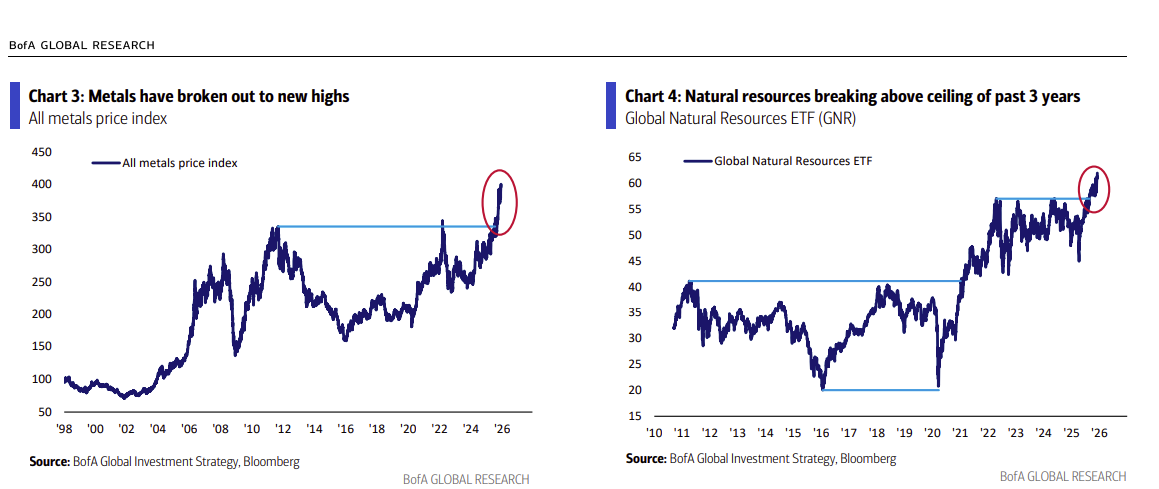

1 month, 1 week agoBank of America’s Flow Show report is published on Fridays and is always a good way to round off Friday afternoon (if you weren’t invited to lunch that is).

Its packed full of useful titbits and nuggets of information, such as the charts below: which tie in nicely with, and support, some of my recent posts, and the thinking behind them.

-

Darren Sinden posted an update

1 month, 1 week agoFreeport Mcmoran FCX US is moving nicely higher today up by +2.60%. Those gains follow on from a +3.63% gain, posted on Wednesday.

Spot copper is up +3.52% on the week and has printed at $5.40 per pound today .

The icing on the cake would be a weekly close in FCX above $45.85 but lets not count our chickens just yet.

-

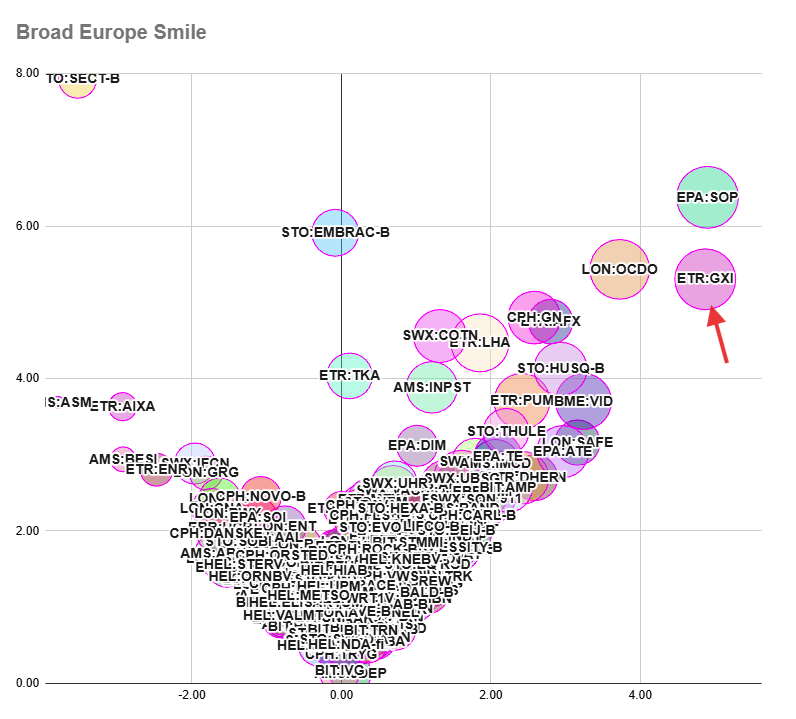

Darren Sinden posted an update

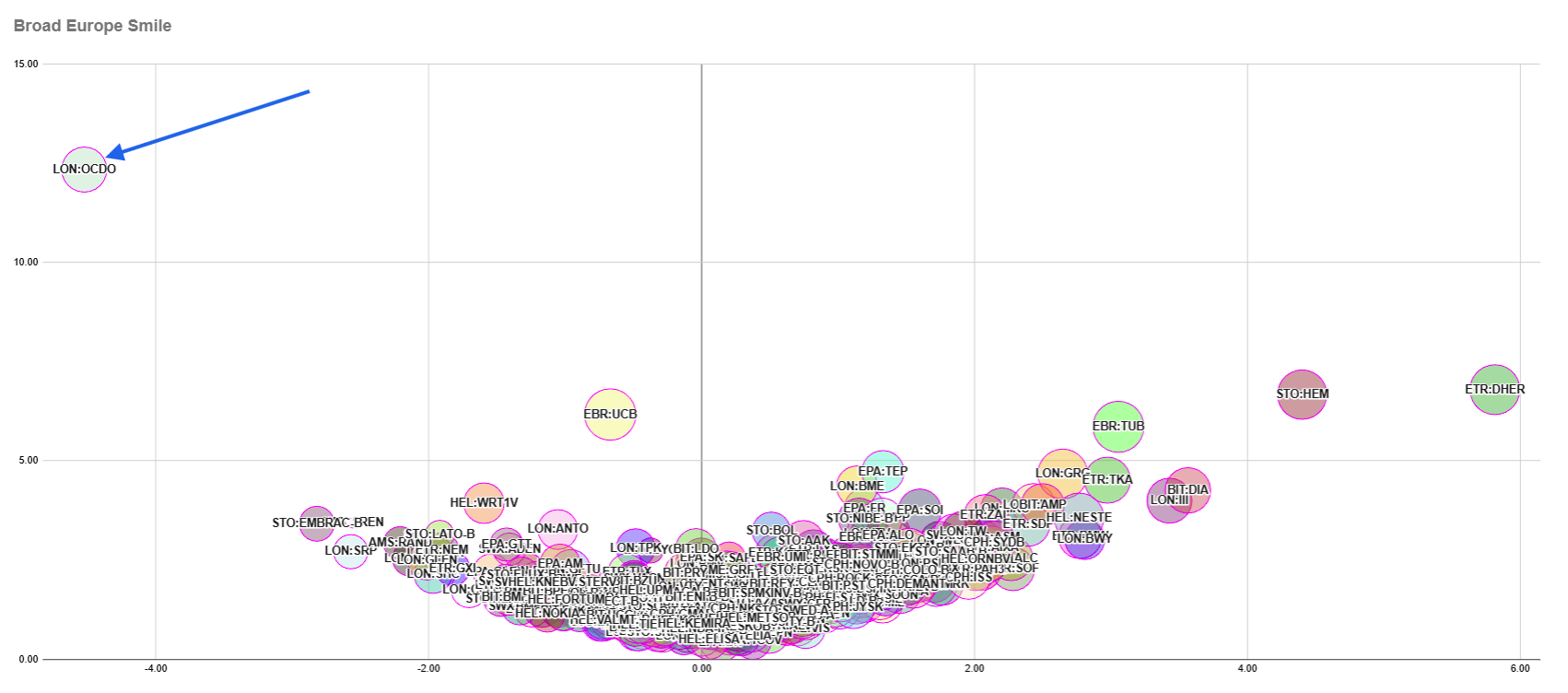

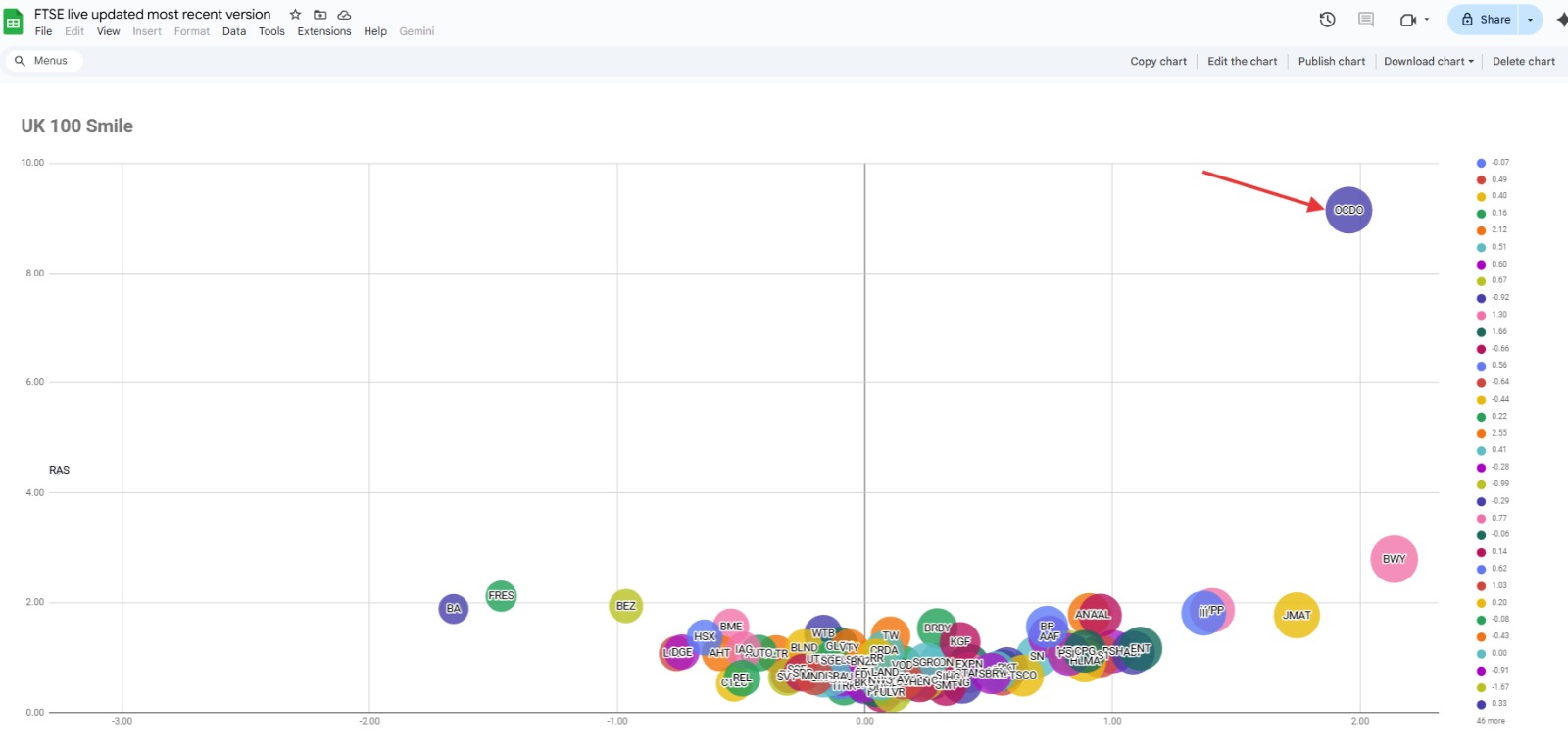

1 month, 1 week agoHow interesting to compare and contrast the relative positioning of Ocado OCDO LN on the Broad Europe smile at 8.17 am this morning, and again at 1.55 pm this afternoon.

Enthusiasm has waned ,as traders reflect on the idea of compensation vs an ongoing relationship with U$ supermarket chain Kroger.

And we can see how the stock transitioned,…[Read more]

-

Jackson Wong posted an update

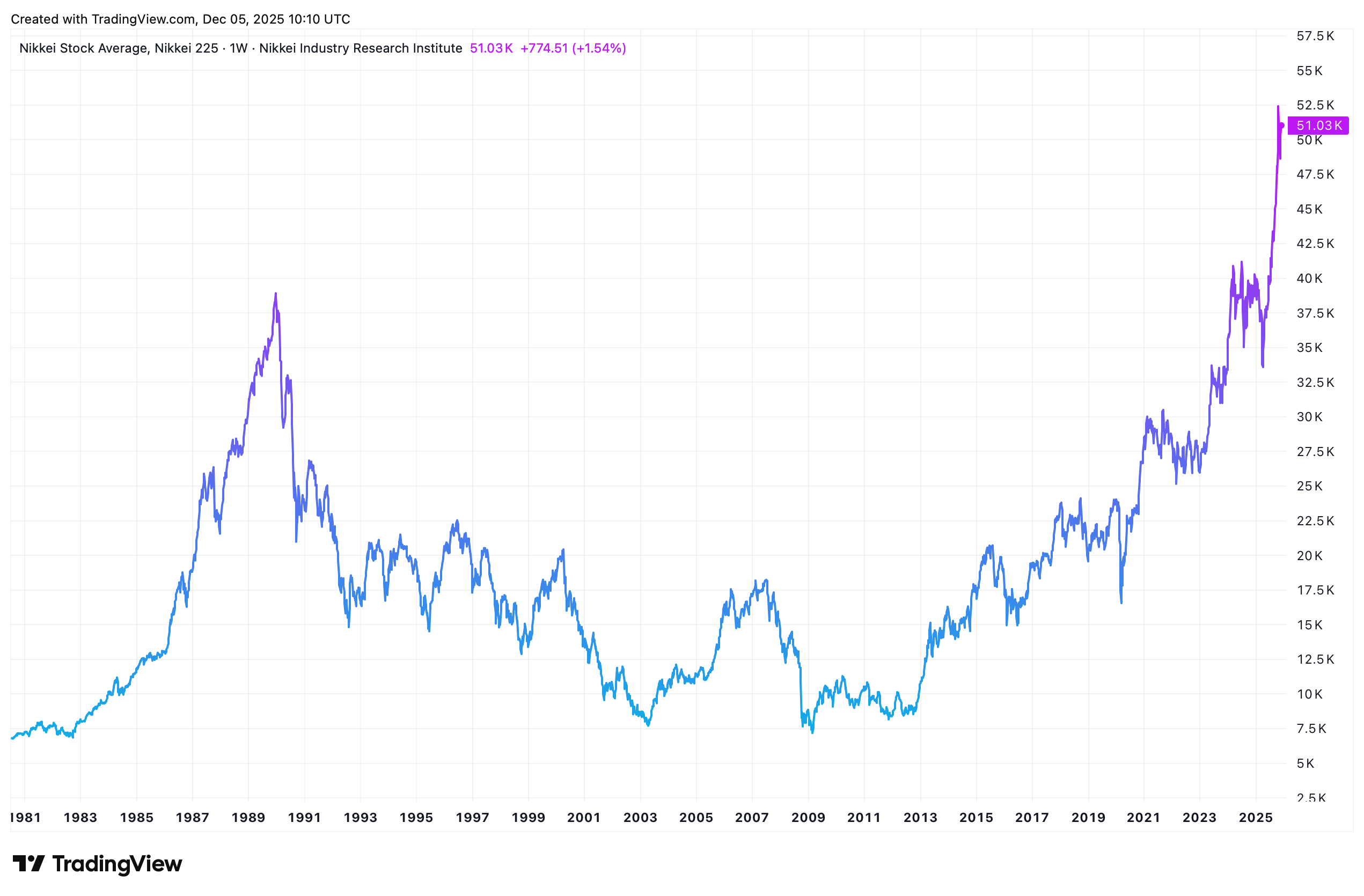

1 month, 1 week agoJapan in a secular bull market

After the onset of the great covid pandemic, one financial boom happened after another. From the EV bubble to crypto to MEME ‘stonks’ to AI, these speculative frenzies just never stop.

But there is one that is still not widely mentioned. That is Japan.

The great normalisation of the country’s economy and finan…[Read more]

-

Darren Sinden posted an update

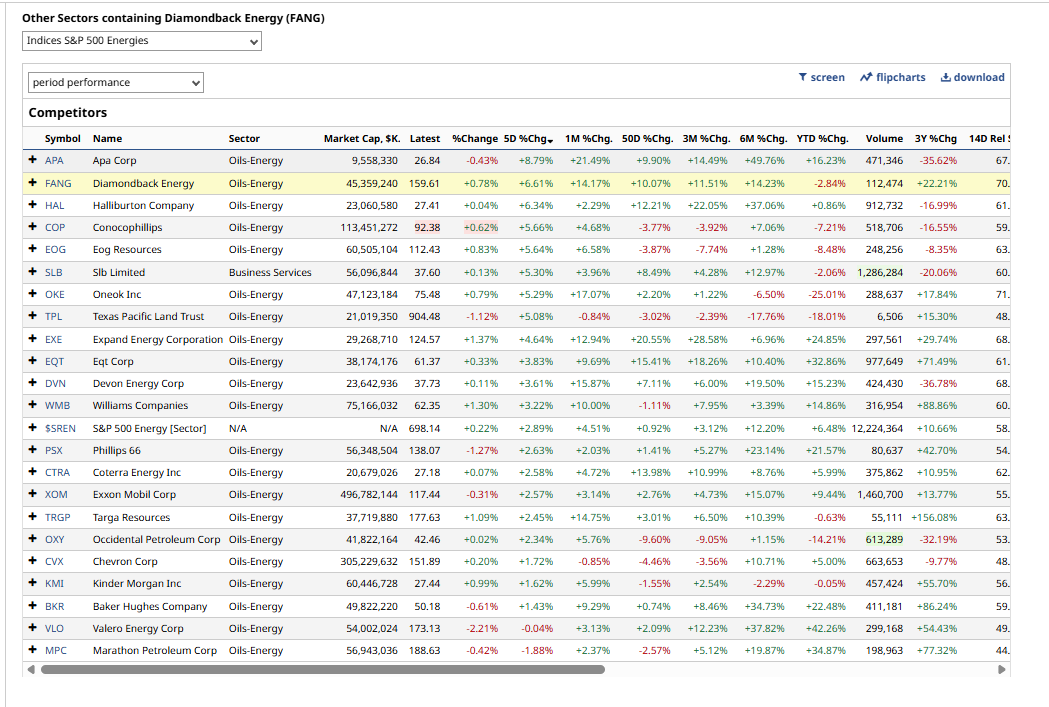

1 month, 1 week agoNice to see some of the US oil names I highlighted recently, coming to the party.

APA Corp (APA US ) are up by almost +8.80% over the last 5 days for example, Diamond Back (FANG) have added +6.60%, and Devon Energy, a somewhat more pedestrian +3.61%.

However, they’re all ahead of the S&P 500 Energy sector which is up by just +2.89% in…[Read more]

-

Jackson Wong posted an update

1 month, 1 week agoDollar Down?

President Trump has announced that he will make an announcement in early 2026, concerning the new Fed chairman.

During the last summer, an intense political battle was fought over the leadership of the venerable institution. From Lisa Cook’s appointment to Fed’s multibillion renovation, no stone was left unturned in the bid to cha…[Read more]

-

Darren Sinden posted an update

1 month, 1 week agoInteresting to note that Freeport McMoran bounced by +3.63% yesterday, having traded up to $45.09 on the day.

Copper and copper stocks remain in the mix with Citigroup writing positively on both Glencore and BHP today. The bank is neutral on BHP though they have a tactical short term view on the long-side but they are buyers of Glencore .