Richard Berry

-

15

Posts -

8

Comments

-

-

-

-

Darren Sinden replied to the topic What are the best AI stocks to buy now? in the forum UK Stocks

3 weeks, 1 day agoDespite all the hyperbole on Instagram its not clear to me that anyone is making money directly from AI chat bots and agents or when that may change. I have likened the “AI boom” to a gold rush and as with a real world gold rush the people who do best are the ones selling picks and shovels to the miners.

I haven’t seen anything to change my mind…[Read more]

-

Good Money Guide posted an update

3 weeks, 2 days agoAs we close out 2025, Michael Brown (Senior Market Strategist from Pepperstone) and Michael Hewson discuss the latest Bank of England decision to cut rates, as well as looking back at the movers and shakers in 2025, and look ahead to what 2026 might bring, for stocks, bonds as well as…[Read more]

-

Darren Sinden posted an update

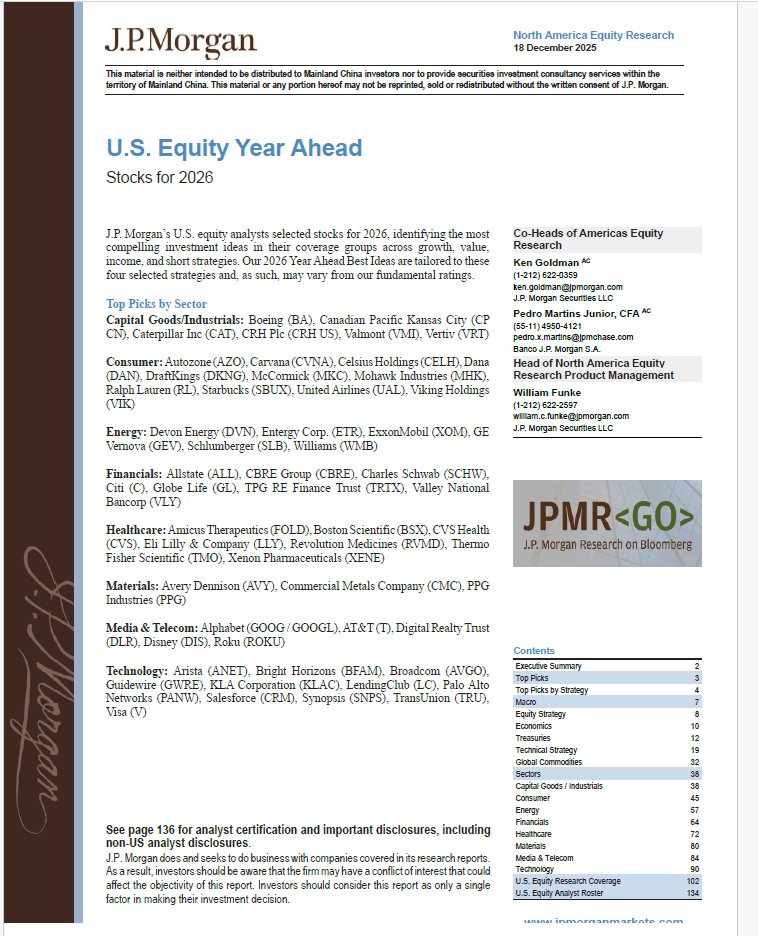

3 weeks, 2 days agoJP Morgan may not be publishing any more morning notes in the UK until Jan 5th 2026, but its US team has published an outlook for stocks in 2026.

Which includes a list of preferred stock in each sector a snapshot of which can be seen below.

The reports extends to 134 pages however the executive is as follows:

“!J.P. Morgan’s 2026 U.S. Equity Y…[Read more]

-

Edward Sheldon replied to the topic What are the best AI stocks to buy now? in the forum UK Stocks

3 weeks, 2 days agoI’ll give you three of my favourites and a wildcard:

* Nvidia – I expect 2026 to be another strong year for Nvidia. It will be rolling out its next-generation Vera Rubin chips and demand is likely to be high. On the recent Q3 earnings call, the company said that it has visibility to half a trillion dollars in Blackwell and Rubin revenue from the…[Read more]

Reacted by bearlybullish -

-

Darren Sinden posted an update

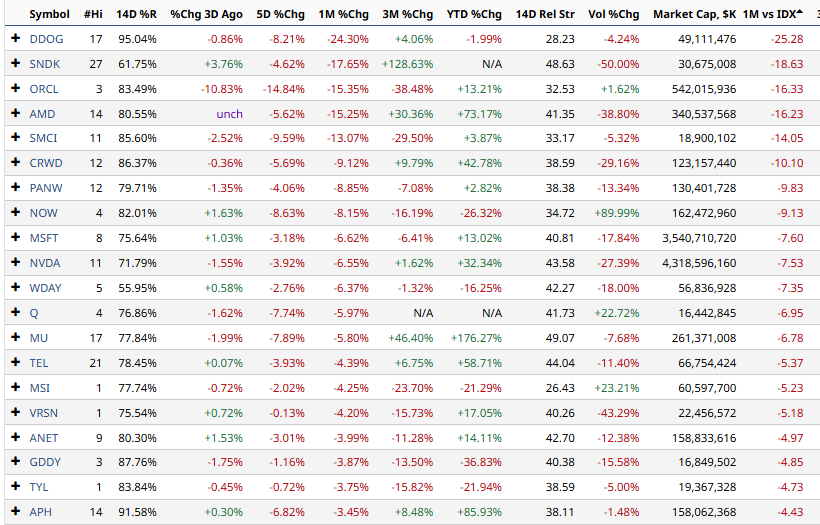

3 weeks, 3 days agoIs the S&P 500 Information Technology sector looking over sold in the short term?

With just 7.14% of stocks in the sector trading above their 5 D MA lines.

The two year chart below tracks this indicator – the magenta line is the low point during this term the indicator can go lower from here, but at least in the last 24 months it hasn’t hung…[Read more]

-

Darren Sinden posted an update

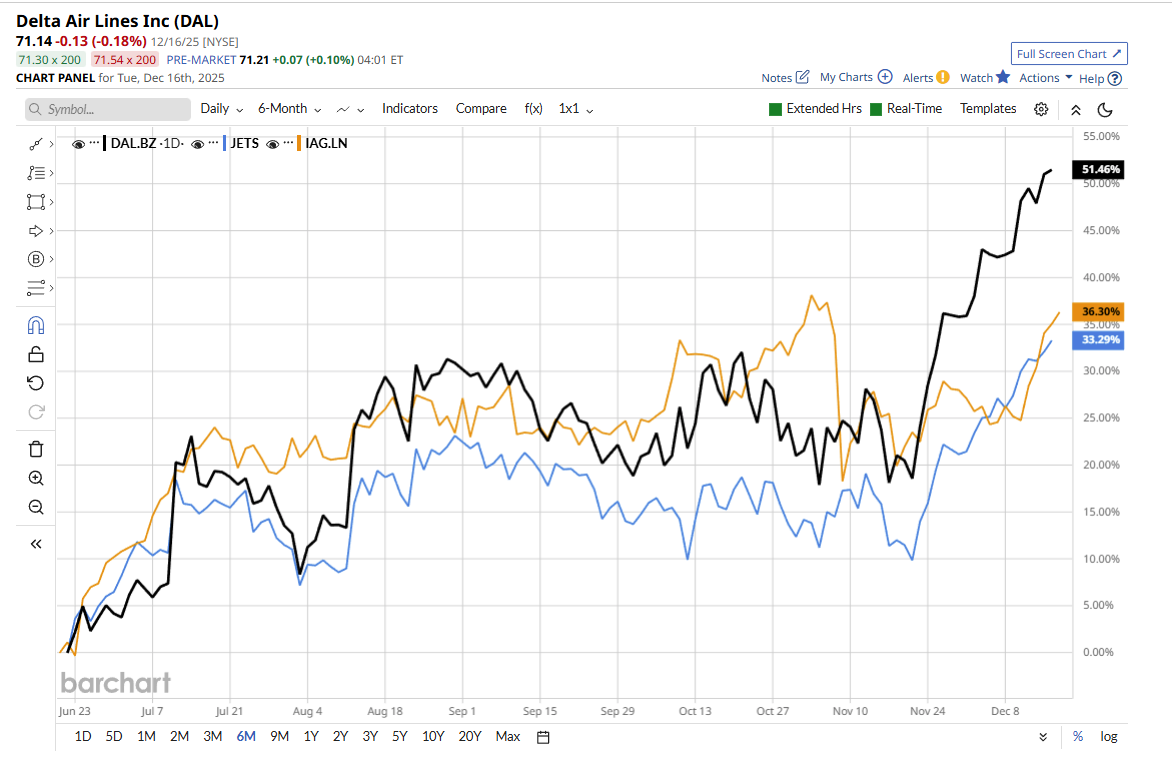

3 weeks, 3 days agoInteresting that Jackson highlights IAG LN this morning, as I posted elsewhere on DAL US Delta Airlines the stock had been climbing since Dec 3rd putting 6 positive sessions out of ten in the interim. The stock may have found its near term ceiling have closed down by -0.18% on Tuesday.

Though I don’t think we can complain too much after a…[Read more]

-

Edward Sheldon replied to the topic Funds to Watch in 2026 in the forum Funds

3 weeks, 3 days agoDepends what you are looking for but as a growth/quality investor, I like the Blue Whale Growth fund. This is a concentrated, growth-focused global equity fund managed by Stephen Yiu.

Yiu is good at identifying growth themes and capitalising on them. For example, he’s made a ton of money for investors in recent years on the AI buildout theme.…[Read more]

-

Darren Sinden posted an update

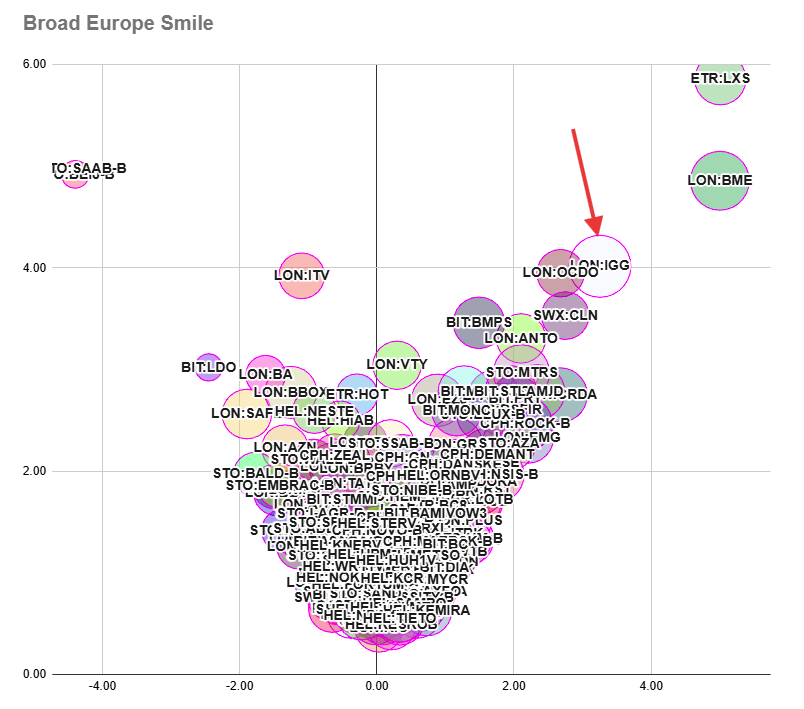

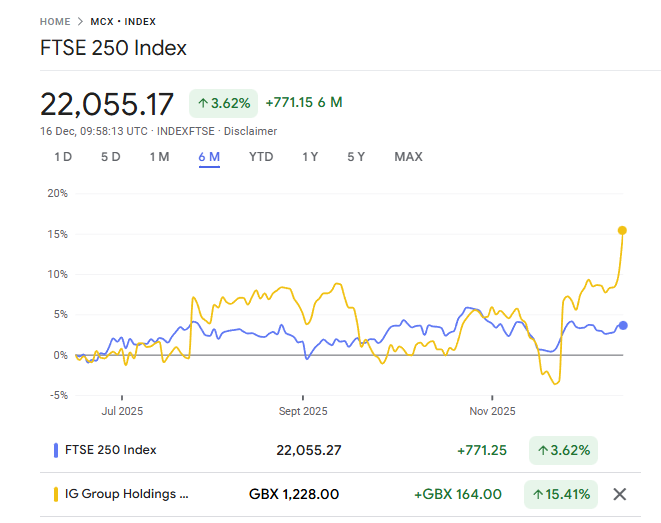

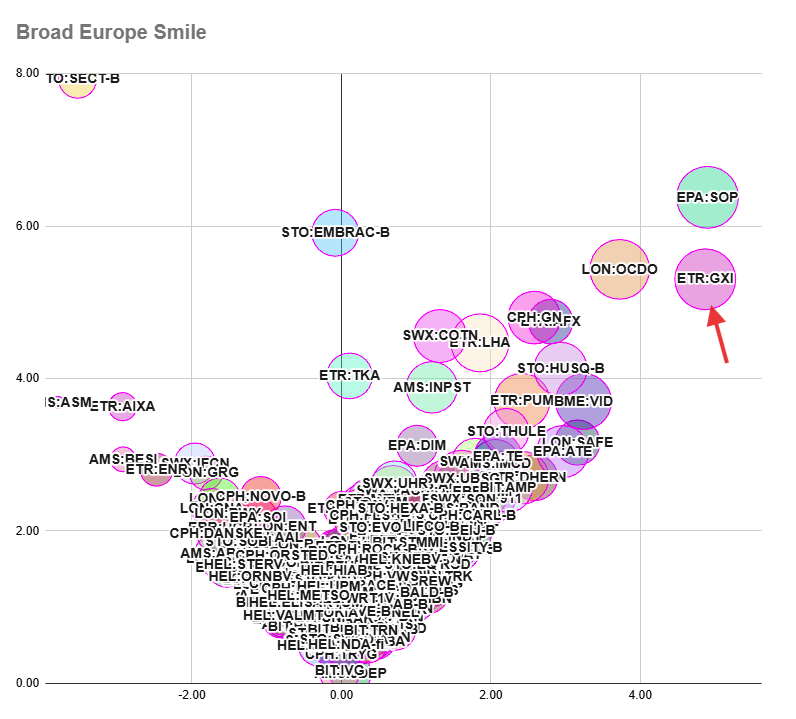

3 weeks, 4 days agoIG Group IGG LN stand out on the Broad European smile this morning, I note.

Reacted by Richard Berry -

-

Darren Sinden replied to the topic Funds to Watch in 2026 in the forum Funds

3 weeks, 4 days agoFund investing is a thorny subject the sad truth is that few actively managed funds will beat their benchmarks, in any given year and fewer still will manage to do that on a consistent basis.

Against that when you buy a fund you are outsourcing the management of your money to an expert/team of experts, in their field. And that appeals to many…[Read more]

-

Darren Sinden posted an update

3 weeks, 4 days agoI last flagged IG Group, IGG LN on budget day (see the link below).

My thoughts have been that the stock is undervalued, and the fact that Kraken, for one, was interested in merging with company effectively means that its open to offers. After all CEO Breon Corcoran is an outsider, without any historical allegiance to the brand or its…[Read more]

4 CommentsReacted by Richard Berry-

Richard Berryreplied 3 weeks, 4 days ago

Always been bullish on brokers…

like like

like dislike

dislike-

Darren Sindenreplied 3 weeks, 4 days ago

Great minds etc

like like

like dislike

dislike

-

-

-

Darren Sinden posted an update

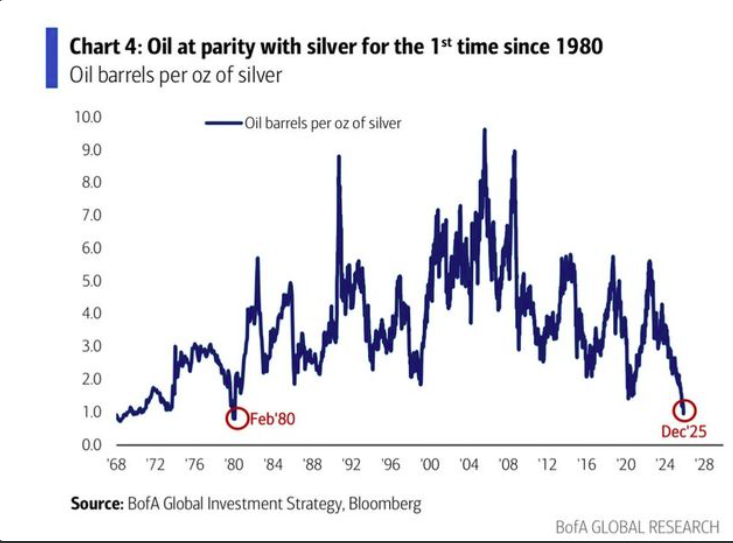

3 weeks, 5 days agoI know I keep writing about metals, but that’s where the action and the interest is at the moment.

Take this chart for example, published by Bank of America and highlighted by Ole Sloth Hansen, Saxo’s commodity strategist.

What is tell us is that silver is at a relative valuation to oil, that we haven’t seen since 1980.

What’s particu…[Read more]

-

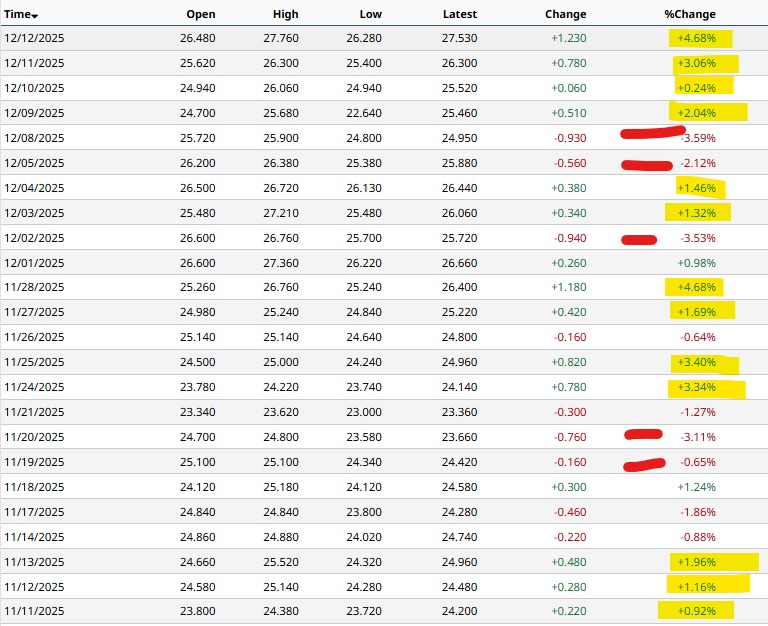

Darren Sinden posted an update

3 weeks, 5 days ago-

Richard Berryreplied 3 weeks, 5 days ago

Those on site will be having a field day!

like like

like dislikeReacted by Darren Sinden

dislikeReacted by Darren Sinden -

-

-

Good Money Guide posted an update

4 weeks, 1 day agoLooking for a great book about the stock market? Try Reminiscences of a Stock Operator as recommended in our CEO interviews…

-

Darren Sinden posted an update

4 weeks, 1 day agoI am going to mention a speculative situation today rather than something with investment credentials . The reason for this is that the stock keeps triggering alerts and making bullish noises on my screens and systems so I don’t feel I can ignore it

Gerresheimer Ag GXI GR Is a German manufacturer of packaging products for medication and drug…[Read more]

-

Darren Sinden replied to the topic If you could only own one US stock, what would it be? in the forum US Stocks

4 weeks, 1 day agoThis is a great question and my answer is timely and topical, because my stock pick is Broadcom AVGO US. A $1.95 trillion designer, developer and supplier of semiconductors.

Broadcom’s stock price has risen consistently in recent times its added +630.0% in the last three years for example. But its also delivered on an earnings front with 5 year…[Read more]

Reacted by Richard Berry And 1 Other -

-

Good Money Guide posted an update

1 month agoIt’s a big week for earnings: Nike, FedEx and Currys all report as 2025 draws to a close.

In our latest podcast, @mhewson-marketinsights and Michael Brown dig into:• Whether Nike can recover after a “lacklustre swoosh”

• FedEx as a bellwether for the US economy

• Why Currys’ strong year may be at risk of a profits warningIf you follow retail…[Read more]

-

Edward Sheldon replied to the topic If you could only own one US stock, what would it be? in the forum US Stocks

1 month agoFor me it would be Amazon (NASDAQ:AMZN).

Why? Well I’d want a company that operates in many different industries (to reduce my risk) and Amazon fits the bill here.

Today, it operates in a range of areas including online shopping, cloud computing, artificial intelligence (including AI chips), digital advertising, digital healthcare, space s…[Read more]

-

Good Money Guide posted an update

1 month ago🎅 Stocks In Your Stockings is back for the third year!

As you all know, junior ISAs are one of the most tax-efficient ways to invest for your children, so now is a great time to give them some stocks in their stockings.

Leave a verified review on Good Money Guide for a chance to win a £500…[Read more]

-

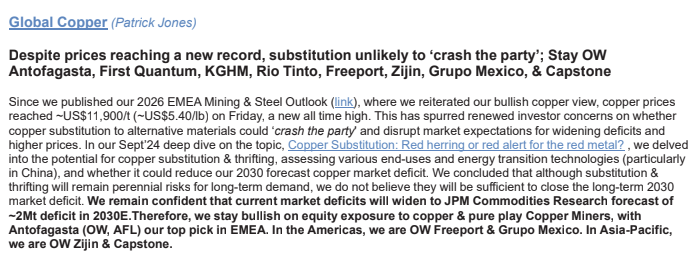

Darren Sinden posted an update

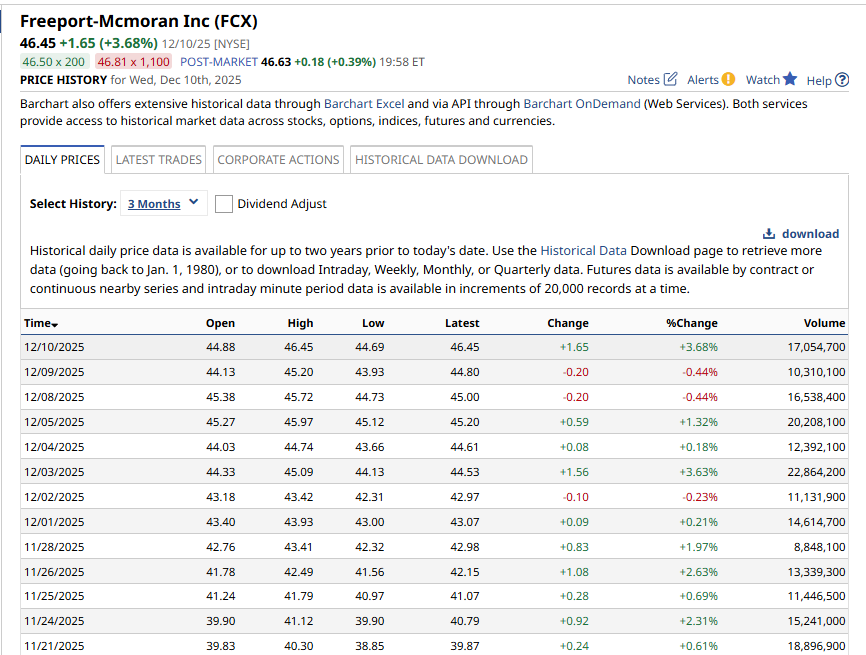

1 month agoFreeport Mcmoran FCX US continues to edge higher adding another +3.68% yesterday.

In fact, the stock is up by +13.43% over the last month and has posted 8 new 1- month highs in that period.

In the table below you can see how the stock has traded since late November green days clearly out numbering red in this period.

This is sort of…[Read more]

-

Darren Sinden posted an update

1 month agoComing back to Natural Gas prices there are some negative headlines about China LNG imports around this morning doing some digging its seems that this isn’t strictly new news but it is worth being aware of given China’s prominent position as a commodity importer and the fact that US Natural Gas is increasingly exported as LNG.

Dutch…[Read more]