Richard Berry

-

15

Posts -

8

Comments

-

-

-

-

Darren Sinden posted an update

1 month, 1 week agoThe deputy CEO and CIO of French asset manager Amundi made an interesting observation on LinkedIn last week saying that :

“European Small and Mid Caps are dirty cheap while many of those companies are of very good quality with high visibility and superior dividend yield. It is probably the result of a lack of interest and demand by investors…[Read more]

-

Darren Sinden posted an update

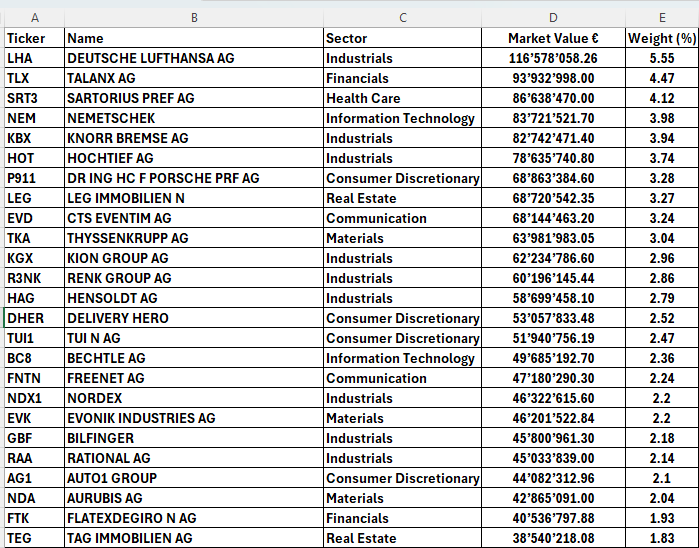

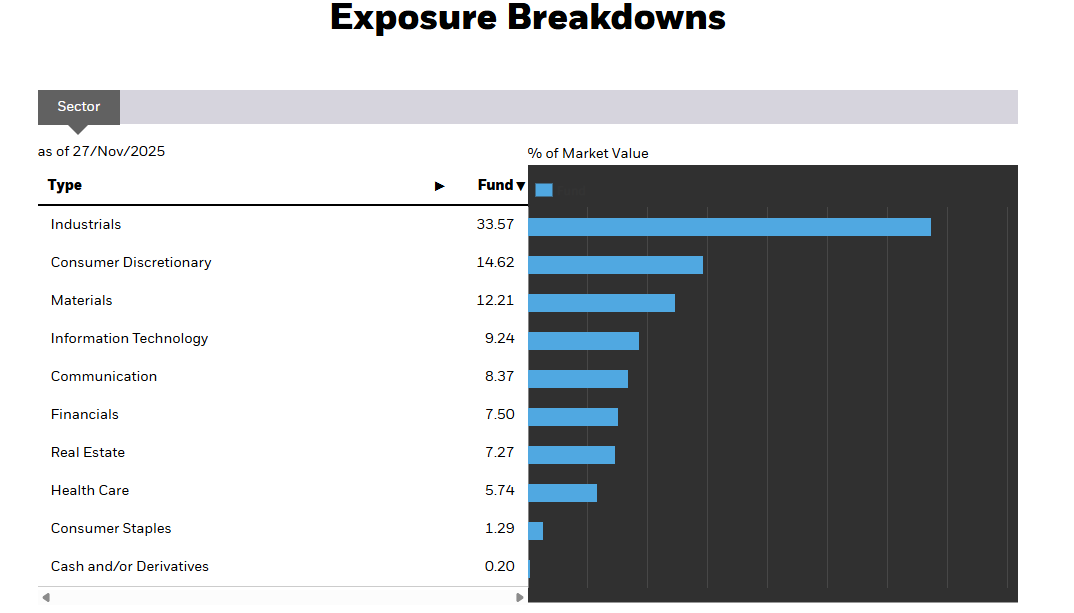

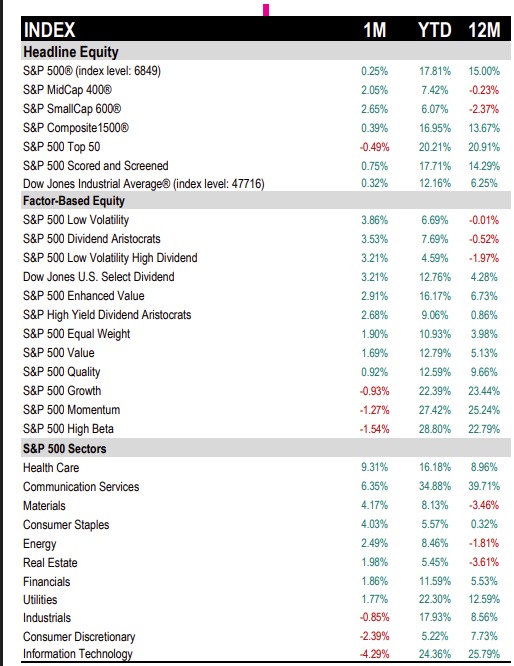

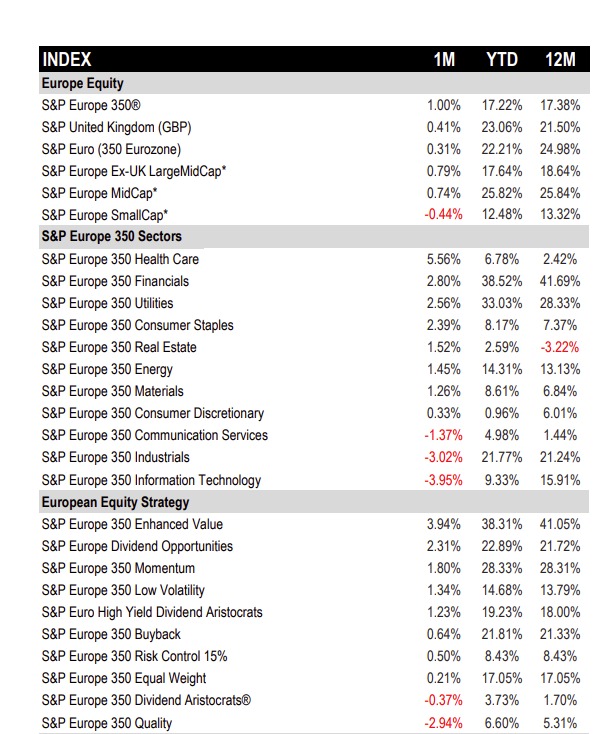

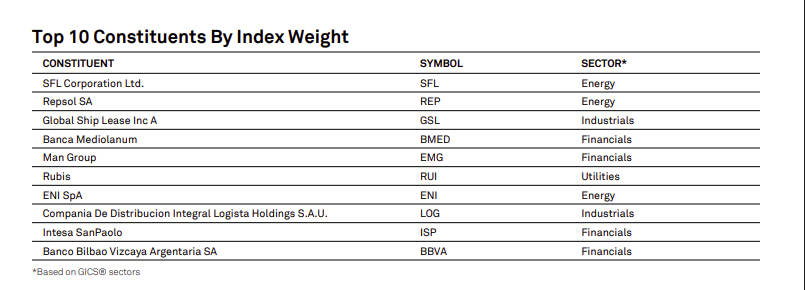

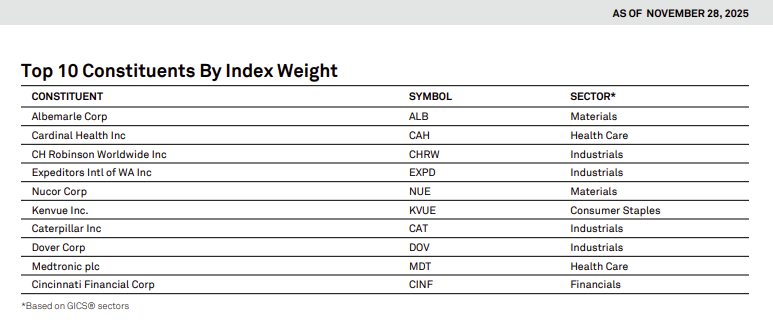

1 month, 1 week agoThe start of a new month provides traders and investors with an opportunity to look back over the prior period to examine what worked and what didn’t.

In the images below we see data compiled by S&P DJI for both European and the US markets,

One thing that stands out to me is the rebound in dividend related styles / factors in both tables.…[Read more]

Reacted by Richard Berry -

-

Good Money Guide posted an update

1 month, 2 weeks agoIn this week’s Good Money Guide podcast Michael Brown (Senior Market Strategist from Pepperstone) and Michael Hewson discuss this week’s buy now, pay later Klarna budget statement, and whether it makes a December rate cut more or less likely. They also look at the latest results from easyJet and Kingfisher and look ahead to numbers from Bal…[Read more]

Reacted by John Smith -

-

Darren Sinden posted an update

1 month, 2 weeks agoYou may recall that in a comment about CMC Markets CMCX LN just under a week ago , I highlighted that IG Group IGG LN were among the most oversold UK Stocks .

Well the stock price has started to address that statistic today, rallying by +11.00%.

Lets not forget that according to industry press IG were recently approached by Crypto…[Read more]

Reacted by Richard Berry -

-

Darren Sinden posted an update

1 month, 2 weeks agoWe didn’t have to look far for another example of mispriced US stock in fact we didn’t even need to leave the retail sector. Abercrombie and Fitch ANF US are up + 26.00% as the stock beat earnings consensus by 30.0 cents and pointed to growth at their Hollister subsidiary.

The stock was rated as a moderate buy among 12 analysts – 4 of whom…[Read more]

-

Darren Sinden posted an update

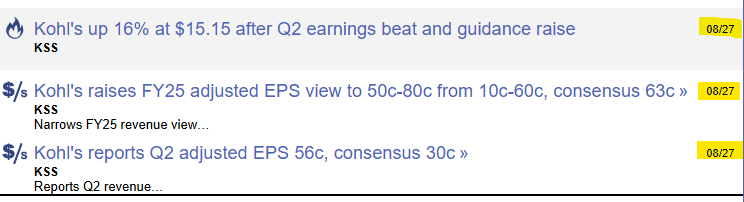

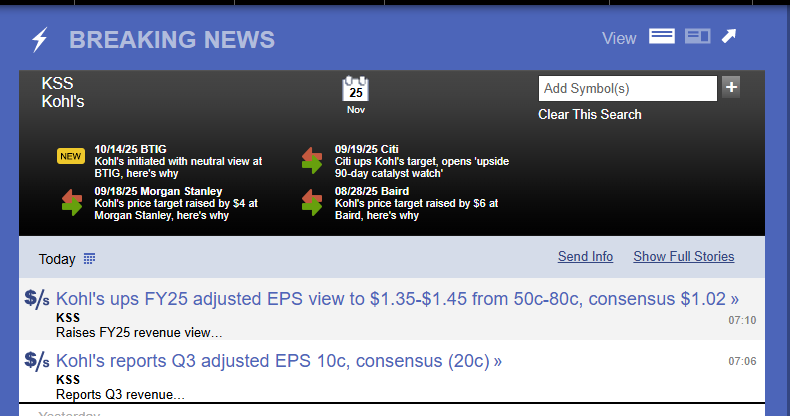

1 month, 2 weeks agoHere are the analysts recommendations the Hi Low and Consensus price targets and a reminder that this is not the first time lately that Kohls has surprised on the upside .

-

Darren Sinden posted an update

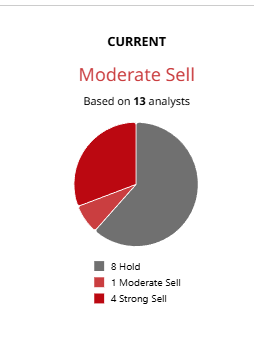

1 month, 2 weeks agoUS mid tier department store Kohls KSS US is set open higher by around +27.0% today after it reported estimate beating numbers.

At least 13 analysts cover the stock on Wall Street so I am forced to wonder how did most of them get it so wrong and how many other stocks out there have been incorrectly labelled ??

-

Darren Sinden posted an update

1 month, 2 weeks agoThe UK is often criticised for lack of technology and growth stocks and much of that criticism is justified.

However, there are growth stocks in the UK top flight and one of those is Airtel Africa AAF LN .

The stock is up +167.0%over the year to date, and by +206.0% over the last 52 weeks .

It’s posted 74 new highs in 2025 and has a…[Read more]

-

Darren Sinden posted an update

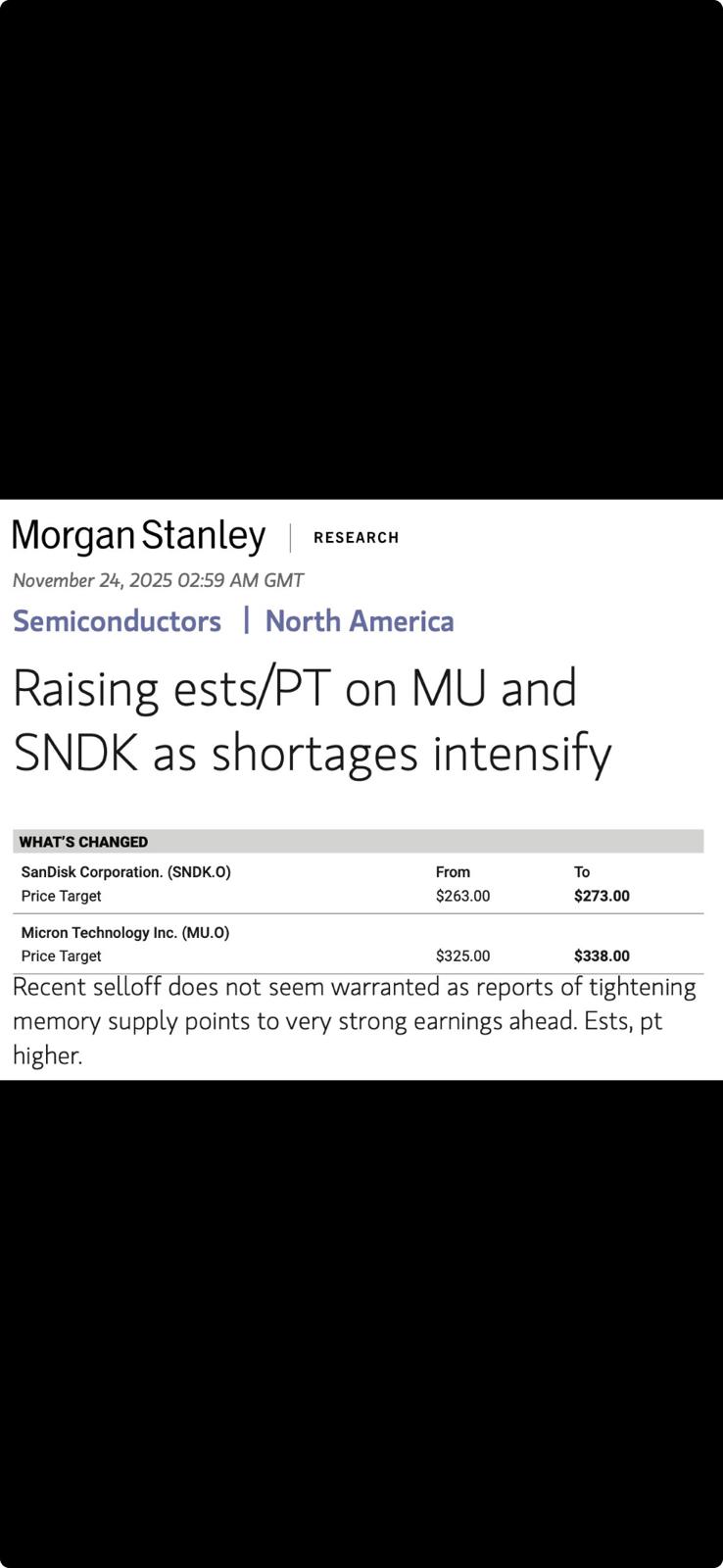

1 month, 2 weeks agoMemory stocks have rebounded today with Sandisk SNDK up by + 12.0% , Western Digital WDC up +8.0% and Micron MU by +7.0%. this comment from Morgan Stanley is likely behind some of those gains .

-

Darren Sinden posted an update

1 month, 2 weeks agoGood Morning all,

The mood in the market this morning seems to be one of cautious optimism. I will be watching the Nasdaq 100 index for clues and in particular how it performs around old support and resistance circa 24446/50 and 25536/40 above that .

In Europe the Dax has opened up by +1.0% and the Stoxx 600 by +0.57%.

-

Darren Sinden posted an update

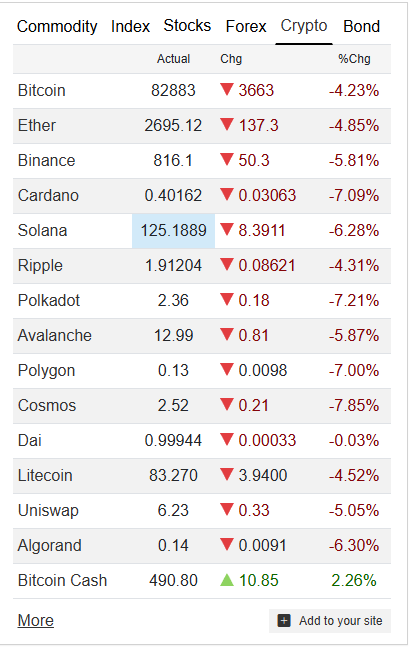

1 month, 3 weeks agoLooking at how Bitcoin is performing today it looks like it’s risk-off into the weekend .

And on that note I wish you a good one .

-

Darren Sinden posted an update

1 month, 3 weeks agoAlmost an hour into the US trading day and the Nasdaq 100 index is once gain struggling to post and retain gains on the day.

Markets are effectively a continuous auction between buyers and sellers, who are trying to establish an equilibrium price, at which business can be transacted .

An imbalance in the supply or demand, of either buyers…[Read more]

-

Good Money Guide posted an update

1 month, 3 weeks agoAs the UK budget looms, is the gloom overstated?

In this week’s podcast, Michael Brown (Senior Market Strategist from Pepperstone) and Michael Hewson discuss this week’s UK CPI data and whether it makes a December rate cut more or less likely. They also look at the latest Q3 numbers from Nvidia as well as looking ahead to next week’s budge…[Read more] -

Darren Sinden posted an update

1 month, 3 weeks agoIts very easy to focus on silicon valley and the hyperscalers when thinking about data entre capex and buildout .

However ,there are real world winners too .

For example Finnish engine and turbine maker Wartsila WRT1V the stock is up 9.26% today on deal to supply 27 engines to a US datacentre.( see…[Read more]

-

Darren Sinden posted an update

1 month, 3 weeks agoThis is what Swiss bank UBS has to say about those Nvidia earnings:

Summary Thoughts

Consistent w/our preview, NVDA’s guidance was very solid (even better than our $63-64B) with demand commentary delivering another full throated message that the market is too concerned about any “bubble” that may be forming.

While still probably prudent to…[Read more]

-

Darren Sinden posted an update

1 month, 3 weeks agoLooking at Nasdaq 100 CFDs today its pretty clear where the resistance has been in the morning session. Nvidia earnings last night may have provided the markets with a tonic, but that will only matter, if the wider market can build on that, make gains and hold on to them into the US close.

What are you thoughts?

-

Richard Berryreplied 1 month, 3 weeks ago

I’m probably more likely to buy puts rather than calls at those levels… short to medium term anyway.

like like

like dislikeReacted by Darren Sinden

dislikeReacted by Darren Sinden-

Darren Sindenreplied 1 month, 3 weeks ago

I will remain sceptical until the price action shows me otherwise as to options I am told that the recent up tick in volatility has made short term/ ODTE options too dear for many to sensibly trade.

like like

like dislike

dislike

-

-

-

Darren Sinden posted an update

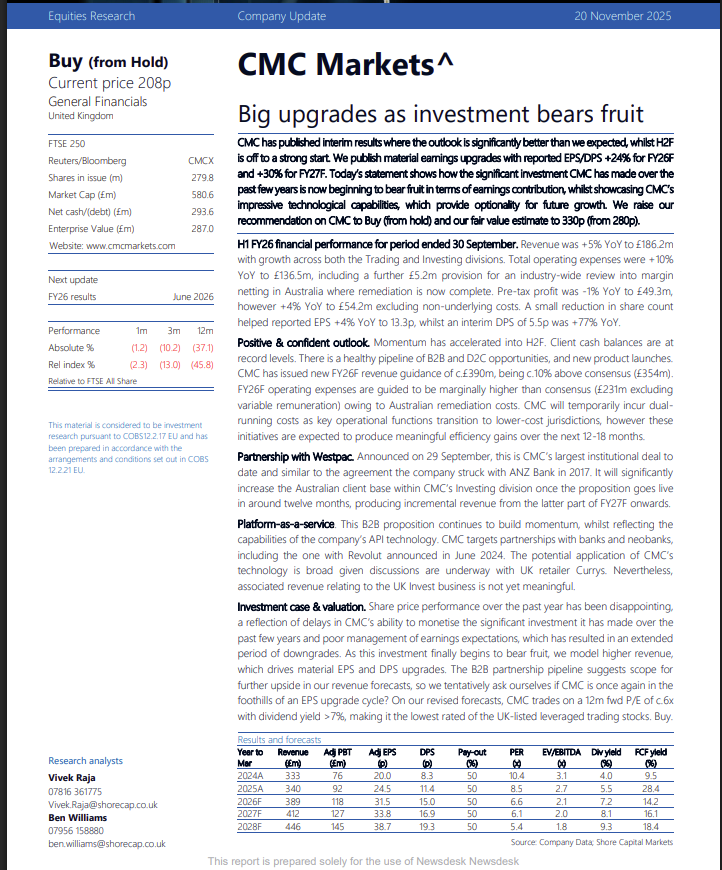

1 month, 3 weeks agoCMC Markets CMCX LN reported their interim results today:

This is what brokers Shore Capital had to say about them ( see below)

The market likes what they see and the stock has rallied by +29.00% ( second image)

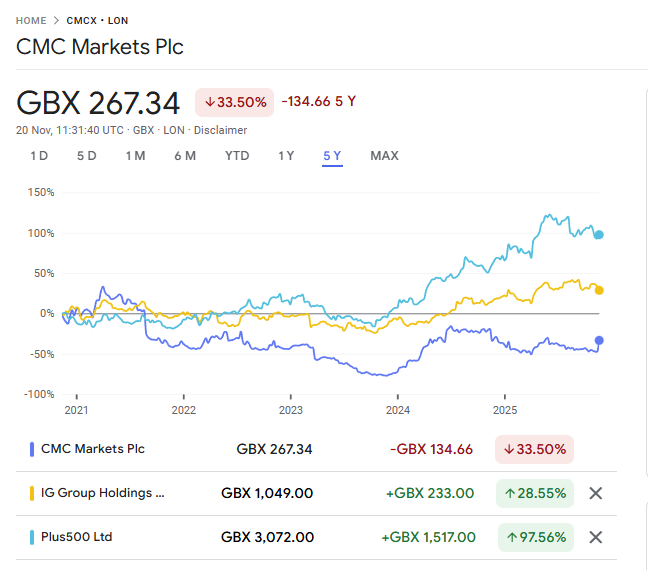

Despite that V impressive gain. they still have plenty of room to play catchup versus IG Group and Plus 500.(image 3)

IG Group…[Read more]

3 CommentsReacted by Richard Berry-

Richard Berryreplied 1 month, 3 weeks ago

There’s got to be a divergence trade there somewhere… I would’nt be short any of those atm

like like

like dislikeReacted by Darren Sinden

dislikeReacted by Darren Sinden-

Darren Sindenreplied 1 month, 3 weeks ago

Agreed, not least because Kraken or another player could take a run at IG Group again

like like

like dislike

dislike

-

-

-

Darren Sinden posted an update

1 month, 3 weeks agoHas Danish wind farm builder Orsted ORSTE DC, spent too much time on the “Naughty Step “?

The charts below suggest that could be the case. And as you can see the candle chart is full of unfilled gaps above .

For the price to move into, and fill some of those gaps, we will need a catalyst and demonstrative performance from the share…[Read more]

-

Edward Sheldon replied to the topic Can The FTSE 100 Reach 10,000? in the forum Indices

1 month, 3 weeks agoI wouldn’t be surprised to see the FTSE 100 hit 10,000 in 2026. Here are five reasons why:

* We’re in the midst of a powerful bull market in global equities right now. I think there’s a decent chance this bull market will continue in 2026 as economic growth is solid and corporate earnings are rising.

* The Footsie’s valuation isn’t that high…[Read more]